Missouri Telecommuting Policy

Description

How to fill out Telecommuting Policy?

If you desire to be thorough, obtain, or create official document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Employ the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the purchase. You can use your Visa, Mastercard, or PayPal account to finalize the transaction.

- Use US Legal Forms to acquire the Missouri Telecommuting Policy with just a couple of clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to retrieve the Missouri Telecommuting Policy.

- You can also access forms you have previously obtained from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct town/state.

- Step 2. Use the Preview option to review the form's details. Don't forget to read the information.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form format.

Form popularity

FAQ

Filling out the instructions for form MO-a involves closely following the guidelines provided on the form itself. Begin by gathering all necessary documents, such as W-2s or 1099s, that outline your income. Familiarizing yourself with the Missouri Telecommuting Policy can also guide you in claiming any relevant deductions associated with your remote work. Carefully completing this form helps ensure your tax return is accurate and submitted on time.

You should file the MO W-3 with the Missouri Department of Revenue. This form is essential for reporting annual wages and withholding information for your employees. If you manage a remote workforce under the Missouri Telecommuting Policy, ensure you include all telecommuting employees in your filing. US Legal Forms offers convenient resources to assist in completing and submitting your W-3 accurately.

Though often away from the office, a teleworker is different from a remote employee because there occasionally some in-person office attendance required though this is not always the case. Another key difference is that a teleworker is often geographically closer to the main office location than a remote worker.

Yes. Any time an employee is performing services for an employer in exchange for wages in Missouri, those wages are subject to Missouri withholding. This rule also applies when an employee is located in Missouri and performs services for the employer within Missouri on a remote basis.

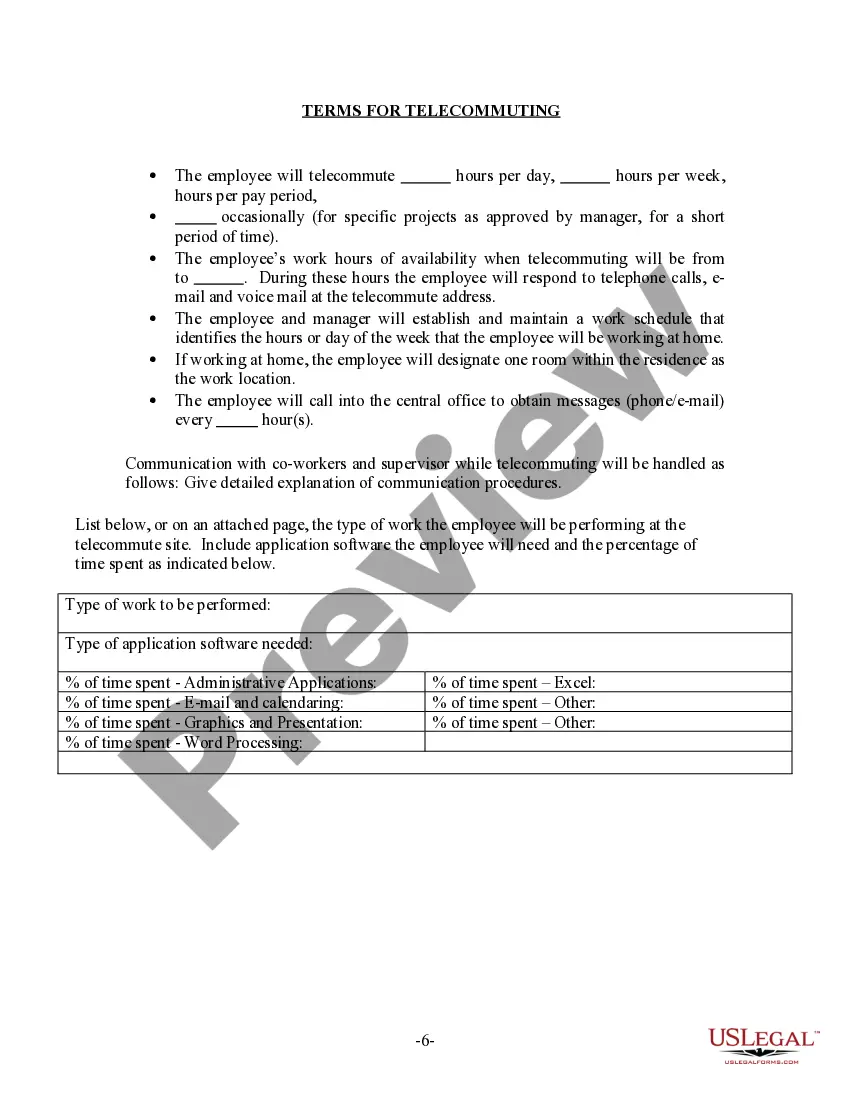

Telecommuting is an employment arrangement in which the employee works outside of the employer's office. Often this means working from home or at a location close to home, such as a coffee shop, library, or co-working space.

Though often away from the office, a teleworker is different from a remote employee because there occasionally some in-person office attendance required though this is not always the case. Another key difference is that a teleworker is often geographically closer to the main office location than a remote worker.

Telecommuting is the ability for an employee to complete work assignments from outside the traditional workplace by using telecommunications tools such as email, phone, chat and video apps.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

You are a resident and have less than $1,200 of Missouri adjusted gross income; You are a nonresident with less than $600 of Missouri income; OR. Your Missouri adjusted gross income is less than the amount of your standard deduction plus your exemption amount.

Remote work is the practice of employees doing their jobs from a location other than a central office operated by the employer. Such locations could include an employee's home, a co-working or other shared space, a private office, or any other place outside of the traditional corporate office building or campus.