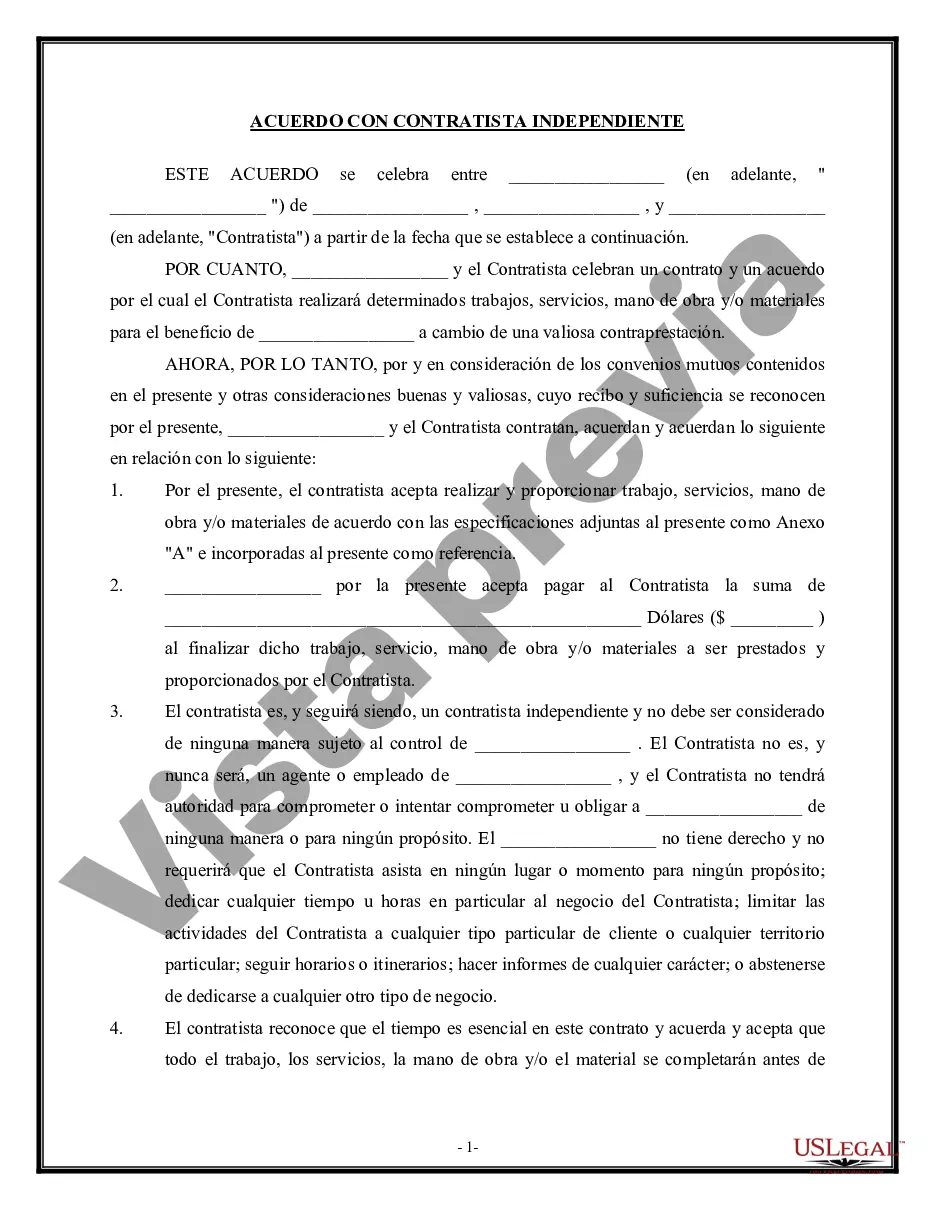

The Missouri Self-Employed Independent Contractor Employment Agreement is a legal document that outlines the terms and conditions of a working relationship between a self-employed individual and the hiring party. This agreement covers various aspects related to the provision of work, services, and/or materials by the independent contractor. In Missouri, there are different types of Self-Employed Independent Contractor Employment Agreements that can be categorized based on the nature of work, services, and/or materials involved. Here are a few examples: 1. General Work Agreement: This type of agreement is used when the self-employed individual is engaged in providing general services, such as house cleaning, landscaping, or general labor. 2. Professional Services Agreement: This agreement is applicable when the independent contractor provides specialized professional services, such as accounting, legal advice, consulting, or IT services. 3. Materials Provision Agreement: In cases where the self-employed contractor is hired to supply materials or goods, such as construction materials, merchandise, or equipment, a materials provision agreement is used. 4. Artistic Services Agreement: This type of agreement applies to self-employed individuals in the creative field, such as artists, musicians, photographers, or writers, who provide artistic services for events, projects or commissions. 5. Non-Disclosure Agreement (NDA): Sometimes a separate NDA is included in the employment agreement to protect the hiring party's confidential information or trade secrets that the self-employed individual may come in contact with during the course of their work. The Missouri Self-Employed Independent Contractor Employment Agreement typically includes key sections such as: 1. Parties Involved: Identifies the contracting parties, including their names, addresses, and contact information. 2. Scope of Work: Clearly defines the tasks, services, and/or materials to be provided by the independent contractor and any specific requirements or specifications related to the project. 3. Compensation: Outlines the payment structure, including the method, frequency, and amount of compensation. It may also cover any additional expenses or reimbursements that the contractor is entitled to. 4. Term and Termination: Specifies the length of the agreement, whether it is ongoing or for a specific duration, and outlines the conditions under which either party can terminate the agreement. 5. Intellectual Property Rights: Addresses who will retain ownership of any intellectual property or creative work produced by the self-employed contractor during the engagement. 6. Confidentiality and Non-Disclosure: Stipulates the obligations of both parties to maintain the confidentiality of any proprietary information or trade secrets they may come across during the performance of services. 7. Indemnification and Liability: Allocates responsibility for any damages, losses, or claims arising from the work, services, and/or materials provided by the independent contractor. It is important for both the self-employed individual and the hiring party to carefully review and understand the terms and provisions of the Missouri Self-Employed Independent Contractor Employment Agreement before entering into the agreement. Consulting with a legal professional familiar with Missouri employment laws can ensure that the agreement is suitable and compliant with relevant regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Contrato de Trabajo de Contratista Independiente para Trabajadores por Cuenta Propia - trabajo, servicios y/o materiales - Self-Employed Independent Contractor Employment Agreement - work, services and / or materials

Description

How to fill out Missouri Contrato De Trabajo De Contratista Independiente Para Trabajadores Por Cuenta Propia - Trabajo, Servicios Y/o Materiales?

Are you presently within a situation in which you need papers for both enterprise or individual purposes just about every working day? There are tons of legal file layouts available online, but discovering types you can depend on isn`t effortless. US Legal Forms provides 1000s of kind layouts, such as the Missouri Self-Employed Independent Contractor Employment Agreement - work, services and / or materials, which can be written to fulfill federal and state requirements.

In case you are currently informed about US Legal Forms site and also have an account, just log in. After that, you are able to download the Missouri Self-Employed Independent Contractor Employment Agreement - work, services and / or materials format.

Unless you offer an account and would like to start using US Legal Forms, follow these steps:

- Find the kind you require and ensure it is for that proper town/county.

- Use the Review key to examine the shape.

- See the information to actually have selected the right kind.

- In the event the kind isn`t what you are searching for, utilize the Look for industry to get the kind that meets your needs and requirements.

- Whenever you find the proper kind, simply click Buy now.

- Opt for the rates strategy you would like, fill out the desired information and facts to create your money, and purchase the transaction with your PayPal or bank card.

- Decide on a practical data file file format and download your backup.

Locate all of the file layouts you might have bought in the My Forms menu. You can obtain a further backup of Missouri Self-Employed Independent Contractor Employment Agreement - work, services and / or materials whenever, if necessary. Just go through the required kind to download or print out the file format.

Use US Legal Forms, by far the most extensive collection of legal varieties, to conserve time as well as stay away from blunders. The services provides appropriately made legal file layouts which you can use for an array of purposes. Create an account on US Legal Forms and commence creating your life easier.