In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

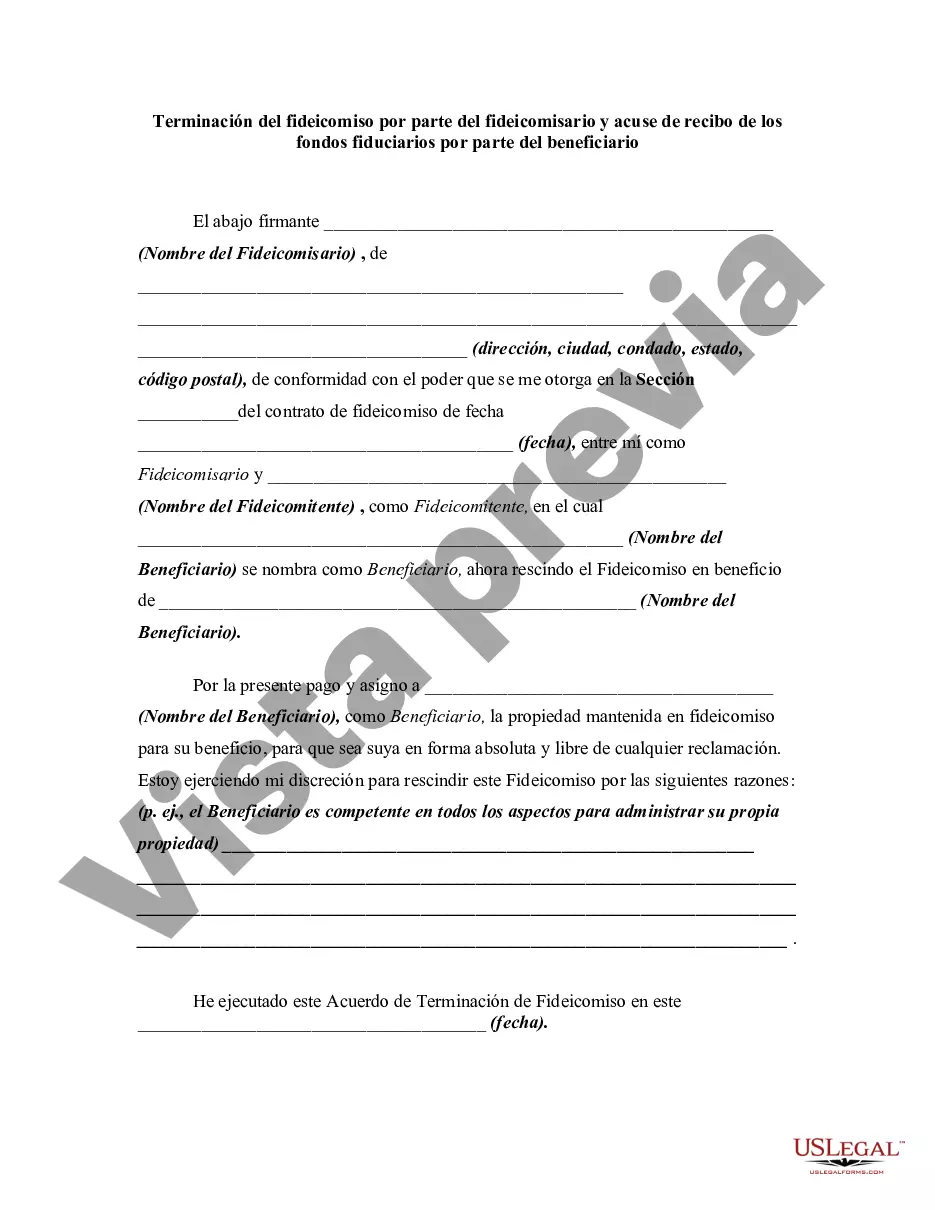

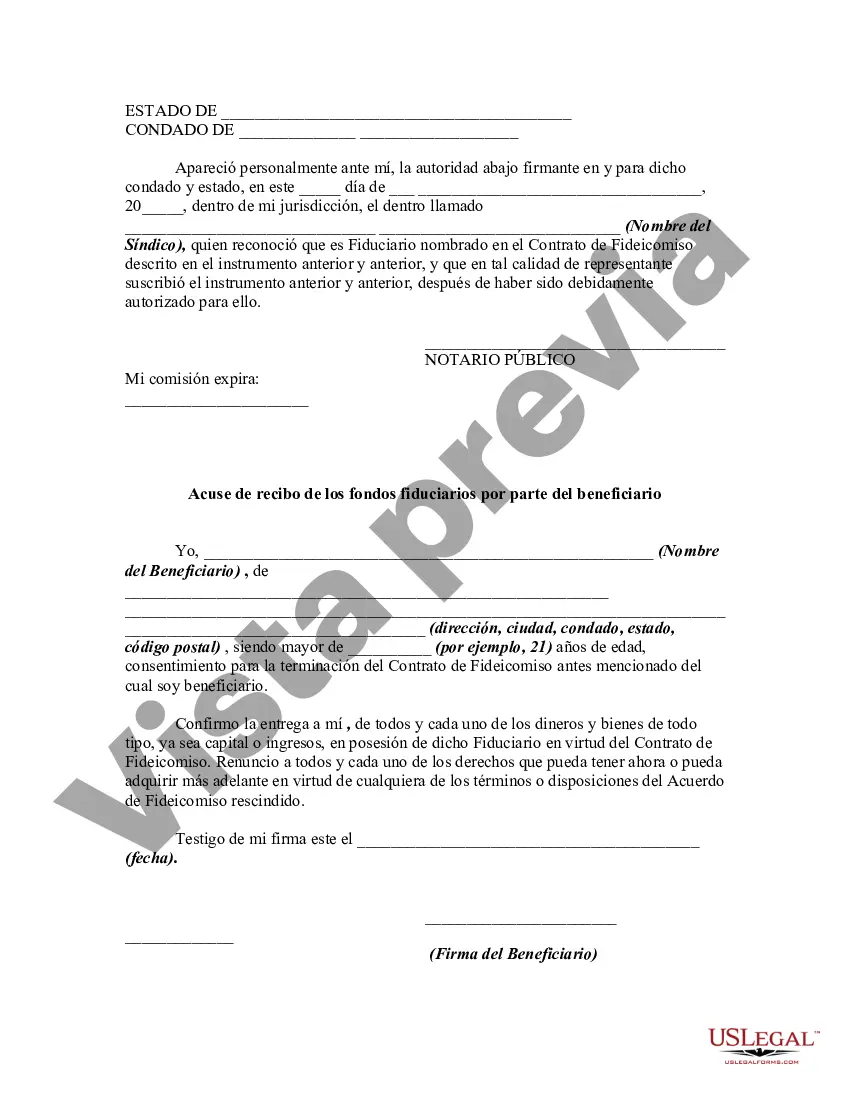

Mississippi Termination of Trust By Trustee In the state of Mississippi, a trust can be terminated by the trustee under certain circumstances. Termination of a trust refers to the formal process of putting an end to the trust agreement and distributing the trust assets to the designated beneficiaries. This action can occur for various reasons such as fulfillment of the trust's purpose, expiration of the trust period, or upon the occurrence of certain events specified in the trust document. One type of Mississippi Termination of Trust By Trustee is when the trust's purpose has been achieved. In this case, the trustee must carefully review the terms of the trust agreement and determine if the conditions or objectives set forth by the granter have been met. If the purpose of the trust has been accomplished, the trustee may file the necessary documents with the court to terminate the trust, ensuring compliance with all legal requirements. Another type of Mississippi Termination of Trust By Trustee occurs when the trust period has expired. Some trusts are established for a specific duration, and once the established time frame elapses, the trustee is responsible for initiating the termination process. It is important for the trustee to thoroughly review the trust document, determining the exact termination date and any other provisions related to the termination process. Additionally, a Mississippi Termination of Trust By Trustee may be sought when certain events outlined in the trust document occur, triggering termination. For instance, the trust agreement might specify that the trust will terminate if all the named beneficiaries die before a certain age or upon the sale of a particular property. In such cases, the trustee is obligated to follow the instructions laid out in the trust document and initiate the necessary legal procedures to conclude the trust. Accompanying the termination of trust, there is the Acknowledgment of Receipt of Trust Funds By Beneficiary. Once the trust has been terminated, and the assets have been distributed, beneficiaries are typically required to acknowledge in writing that they have received their respective shares. This acknowledgment serves as evidence that the beneficiaries have received their designated portion and releases the trustee from any further liability regarding the distribution of trust funds. The Acknowledgment of Receipt of Trust Funds By Beneficiary is a crucial step in the trust termination process, ensuring transparency and accountability in the final distribution. Beneficiaries should carefully review the acknowledgment document, providing accurate information regarding the receipt of their share, the date of receipt, and their agreement that they have no further claims or demands against the trustee. This acknowledgment is essentially both for the beneficiaries and the trustee, as it serves as a legal record of the final distribution and protects the interests of all parties involved. In summary, Mississippi Termination of Trust By Trustee involves the legal process of bringing an end to a trust agreement. This termination can occur when the trust's purpose is fulfilled, the trust period expires, or specified events outlined in the trust document take place. Simultaneously, the Acknowledgment of Receipt of Trust Funds By Beneficiary is a vital document that beneficiaries must complete, confirming the receipt of their designated assets and finalizing the trust termination process.Mississippi Termination of Trust By Trustee In the state of Mississippi, a trust can be terminated by the trustee under certain circumstances. Termination of a trust refers to the formal process of putting an end to the trust agreement and distributing the trust assets to the designated beneficiaries. This action can occur for various reasons such as fulfillment of the trust's purpose, expiration of the trust period, or upon the occurrence of certain events specified in the trust document. One type of Mississippi Termination of Trust By Trustee is when the trust's purpose has been achieved. In this case, the trustee must carefully review the terms of the trust agreement and determine if the conditions or objectives set forth by the granter have been met. If the purpose of the trust has been accomplished, the trustee may file the necessary documents with the court to terminate the trust, ensuring compliance with all legal requirements. Another type of Mississippi Termination of Trust By Trustee occurs when the trust period has expired. Some trusts are established for a specific duration, and once the established time frame elapses, the trustee is responsible for initiating the termination process. It is important for the trustee to thoroughly review the trust document, determining the exact termination date and any other provisions related to the termination process. Additionally, a Mississippi Termination of Trust By Trustee may be sought when certain events outlined in the trust document occur, triggering termination. For instance, the trust agreement might specify that the trust will terminate if all the named beneficiaries die before a certain age or upon the sale of a particular property. In such cases, the trustee is obligated to follow the instructions laid out in the trust document and initiate the necessary legal procedures to conclude the trust. Accompanying the termination of trust, there is the Acknowledgment of Receipt of Trust Funds By Beneficiary. Once the trust has been terminated, and the assets have been distributed, beneficiaries are typically required to acknowledge in writing that they have received their respective shares. This acknowledgment serves as evidence that the beneficiaries have received their designated portion and releases the trustee from any further liability regarding the distribution of trust funds. The Acknowledgment of Receipt of Trust Funds By Beneficiary is a crucial step in the trust termination process, ensuring transparency and accountability in the final distribution. Beneficiaries should carefully review the acknowledgment document, providing accurate information regarding the receipt of their share, the date of receipt, and their agreement that they have no further claims or demands against the trustee. This acknowledgment is essentially both for the beneficiaries and the trustee, as it serves as a legal record of the final distribution and protects the interests of all parties involved. In summary, Mississippi Termination of Trust By Trustee involves the legal process of bringing an end to a trust agreement. This termination can occur when the trust's purpose is fulfilled, the trust period expires, or specified events outlined in the trust document take place. Simultaneously, the Acknowledgment of Receipt of Trust Funds By Beneficiary is a vital document that beneficiaries must complete, confirming the receipt of their designated assets and finalizing the trust termination process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.