Title: Understanding the Mississippi Investment Letter Promising not to Violate Exemption of Intrastate Offering Description: In the realm of investment opportunities, Mississippi offers a specific type of investment letter: the Mississippi Investment Letter Promising not to Violate Exemption of Intrastate Offering. This detailed description aims to shed light on this investment tool, its purpose, and potential variants available in the state. Keywords: Mississippi, investment letter, Promising not to Violate Exemption, Intrastate Offering, variants 1. What is the Mississippi Investment Letter Promising not to Violate Exemption of Intrastate Offering? The Mississippi Investment Letter Promising not to Violate Exemption of Intrastate Offering is a legal document or notice issued to potential investors within Mississippi. Its primary objective is to alert investors to the fact that the issuer will strictly adhere to the state's exemption requirements for intrastate offerings. By following these guidelines, the issuer ensures compliance with Mississippi's securities laws. 2. Importance of the Exemption of Intrastate Offering: The exemption of intrastate offering allows businesses or entities based in Mississippi to raise capital locally without undergoing the complexities of federal securities' registration. This exemption enables local offerings within the state's boundaries and facilitates economic growth by fostering investment opportunities within Mississippi. 3. Types of Mississippi Investment Letter Promising not to Violate Exemption of Intrastate Offering: While there may not be specific named variants of the Mississippi Investment Letter, the content can vary depending on the type of offering or the investment instrument involved. Some common types of investment letters promising not to violate the exemption might include: a) Equity-based Offerings: This type of offering involves the sale of ownership stakes or shares in a Mississippi-based company. The investment letter will detail the terms, conditions, and risks associated with the purchase of these equity securities. b) Debt-based Offerings: In this scenario, companies may issue debt instruments, such as bonds or notes, to raise capital. The investment letter will outline the terms, interest rates, repayment structure, and other pertinent information related to the debt offering. c) Real Estate Investment Offerings: Real estate investment opportunities within Mississippi may also utilize the investment letter, providing details pertaining to the property, return on investment, risks, and other related factors. 4. Compliance with Mississippi Securities Laws: The Mississippi Investment Letter is a crucial tool for issuers to demonstrate their commitment to adhering to Mississippi securities regulations, particularly those governing exempt intrastate offerings. By explicitly promising not to violate these laws, issuers aim to protect both the integrity of their offering and the interests of potential investors. Conclusion: The Mississippi Investment Letter Promising not to Violate Exemption of Intrastate Offering acts as a safeguard for investors and a commitment from issuers to comply with state securities laws. Understanding the purpose and various types of investment letters ensures informed decision-making when considering investment opportunities within Mississippi's boundaries.

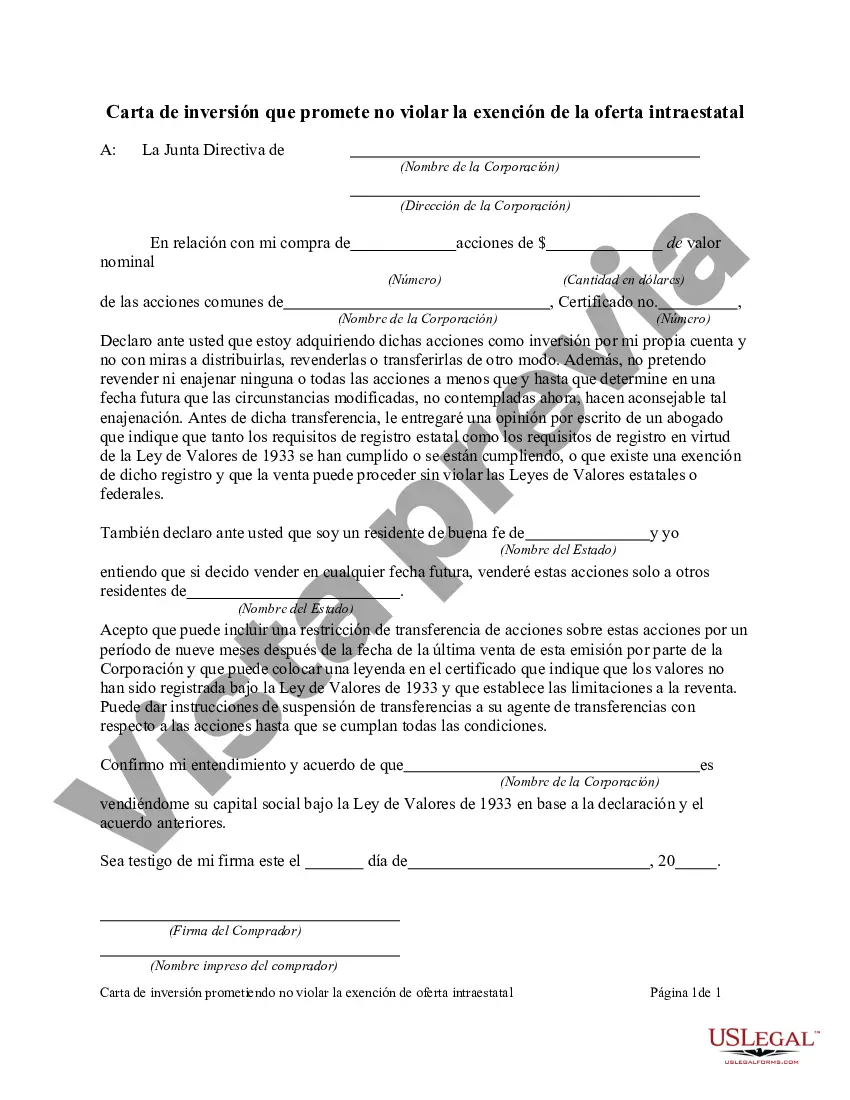

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mississippi Carta de inversión que promete no violar la exención de la oferta intraestatal - Investment Letter Promising not to Violate Exemption of Intrastate Offering

Description

How to fill out Mississippi Carta De Inversión Que Promete No Violar La Exención De La Oferta Intraestatal?

It is possible to spend hrs on the Internet trying to find the lawful file web template which fits the state and federal demands you will need. US Legal Forms provides thousands of lawful varieties that happen to be analyzed by professionals. You can actually acquire or produce the Mississippi Investment Letter Promising not to Violate Exemption of Intrastate Offering from your services.

If you already possess a US Legal Forms account, you can log in and click the Obtain key. Afterward, you can full, modify, produce, or indication the Mississippi Investment Letter Promising not to Violate Exemption of Intrastate Offering. Each and every lawful file web template you buy is your own property forever. To acquire yet another backup for any acquired form, visit the My Forms tab and click the corresponding key.

Should you use the US Legal Forms web site for the first time, stick to the straightforward recommendations under:

- First, make certain you have selected the right file web template for the state/metropolis of your choice. Look at the form outline to make sure you have picked the correct form. If available, make use of the Preview key to appear throughout the file web template as well.

- In order to locate yet another edition from the form, make use of the Search area to find the web template that meets your needs and demands.

- When you have located the web template you would like, just click Get now to continue.

- Find the prices strategy you would like, type in your references, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You may use your credit card or PayPal account to cover the lawful form.

- Find the file format from the file and acquire it to the system.

- Make alterations to the file if required. It is possible to full, modify and indication and produce Mississippi Investment Letter Promising not to Violate Exemption of Intrastate Offering.

Obtain and produce thousands of file themes utilizing the US Legal Forms web site, that provides the biggest variety of lawful varieties. Use specialist and condition-particular themes to tackle your company or individual needs.