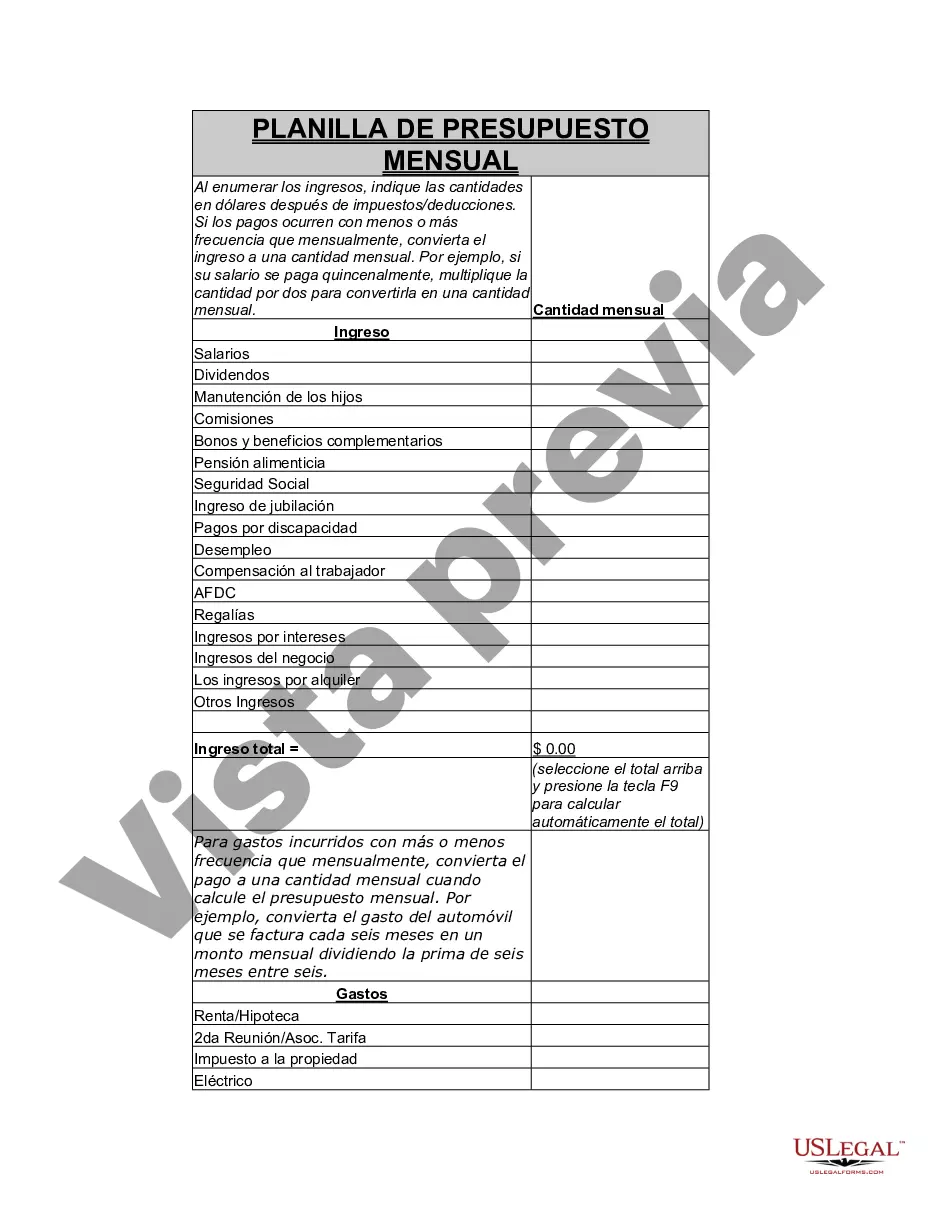

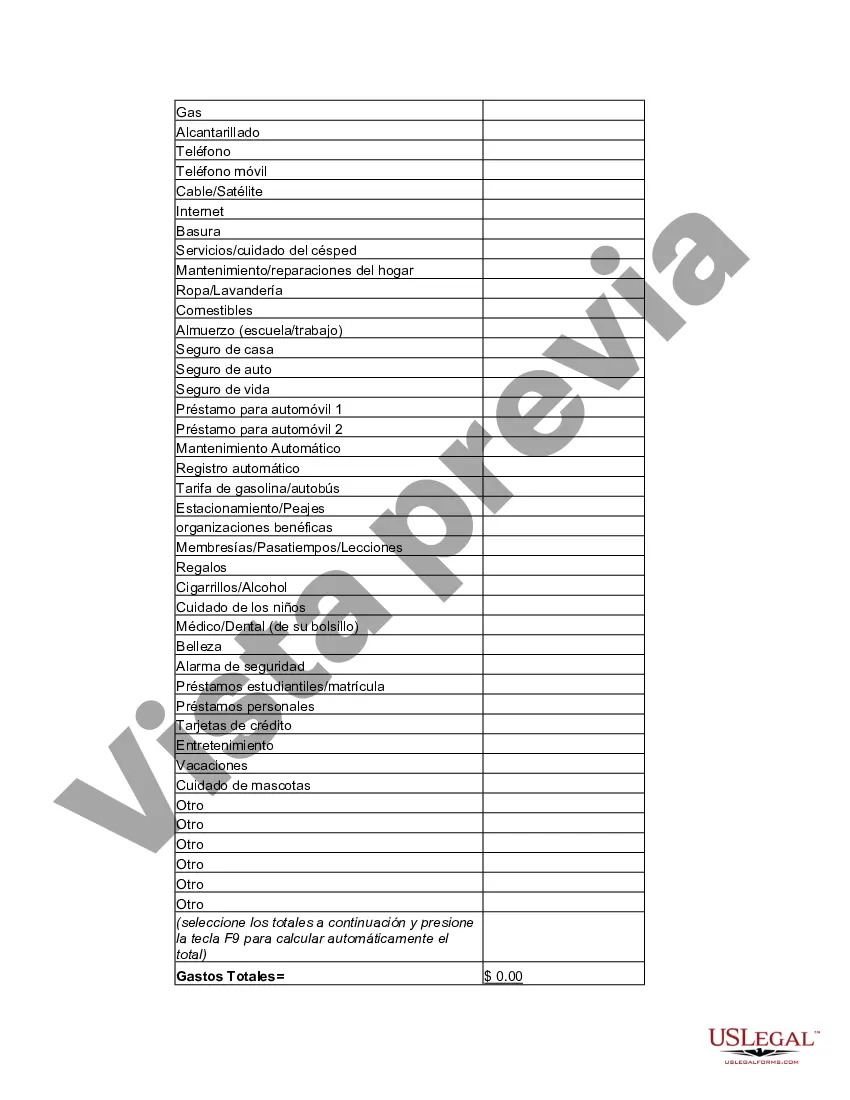

Mississippi Personal Monthly Budget Worksheet is an essential tool designed to help individuals and families manage their finances effectively. This comprehensive budgeting worksheet enables users to control expenses, track income, and gain a clear overview of their financial situation. By using this worksheet, Mississippi residents can maintain a balanced budget, save money, and reach their financial goals. The Mississippi Personal Monthly Budget Worksheet encompasses various categories, such as income, housing, transportation, groceries, healthcare, entertainment, debt payments, savings, and miscellaneous expenses. It allows individuals to input their monthly income from various sources, including salaries, wages, investments, and other additional sources. This initial step ensures an accurate representation of available funds. Furthermore, this budget worksheet offers comprehensive sections to record expenses for each category. Under housing, users can input data regarding mortgage or rent payments, property taxes, insurance, utilities, and maintenance costs. Similarly, the transportation section covers expenses related to car payments, fuel, insurance, maintenance, and parking fees. Groceries, which include food expenses, can also be closely monitored using this worksheet. Moreover, the Mississippi Personal Monthly Budget Worksheet assists in tracking healthcare expenses, covering insurance premiums, co-pays, medication, and any other medical costs. For entertainment purposes, users can record expenses for dining out, movies, concerts, and recreational activities. Additionally, individuals can track their debt payments, including credit card bills, student loans, or other loans, in order to reduce outstanding debts efficiently. The worksheet also emphasizes savings, enabling users to monitor and allocate funds towards emergency savings, retirement accounts, or specific short-term savings goals. Incorporating a separate section for miscellaneous expenses, this budgeting tool allows for additional customization as per individuals' specific needs. While the Mississippi Personal Monthly Budget Worksheet provides a comprehensive overview of an individual's finances, there may also be variations or specialized versions of this worksheet. Some potential variants may include versions tailored specifically for college students, couples, families with children, or individuals with specific financial goals, such as paying off debt or saving for a down payment on a house. In summary, the Mississippi Personal Monthly Budget Worksheet is a valuable resource allowing individuals in Mississippi to take control of their finances. It provides a systematic approach to budgeting, enabling users to track their income and expenses across various categories. By utilizing this tool effectively, residents can make informed financial decisions, manage their money efficiently, and work towards achieving their financial objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mississippi Hoja de trabajo de presupuesto mensual personal - Personal Monthly Budget Worksheet

Description

How to fill out Mississippi Hoja De Trabajo De Presupuesto Mensual Personal?

You can devote several hours on-line trying to find the legitimate record web template that meets the state and federal needs you need. US Legal Forms offers thousands of legitimate kinds that are reviewed by professionals. It is possible to obtain or produce the Mississippi Personal Monthly Budget Worksheet from our service.

If you already have a US Legal Forms profile, you can log in and click on the Acquire option. Afterward, you can complete, revise, produce, or indication the Mississippi Personal Monthly Budget Worksheet. Every legitimate record web template you purchase is your own eternally. To get an additional duplicate for any purchased develop, check out the My Forms tab and click on the related option.

If you are using the US Legal Forms website initially, keep to the basic directions listed below:

- First, make certain you have chosen the best record web template to the area/town of your choosing. Read the develop information to ensure you have picked the correct develop. If offered, take advantage of the Review option to look through the record web template as well.

- If you wish to locate an additional version in the develop, take advantage of the Look for discipline to get the web template that meets your needs and needs.

- Once you have located the web template you desire, click on Get now to carry on.

- Pick the rates plan you desire, type your credentials, and register for your account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal profile to fund the legitimate develop.

- Pick the format in the record and obtain it to the gadget.

- Make alterations to the record if required. You can complete, revise and indication and produce Mississippi Personal Monthly Budget Worksheet.

Acquire and produce thousands of record templates while using US Legal Forms site, which offers the greatest assortment of legitimate kinds. Use professional and status-certain templates to take on your business or personal requirements.