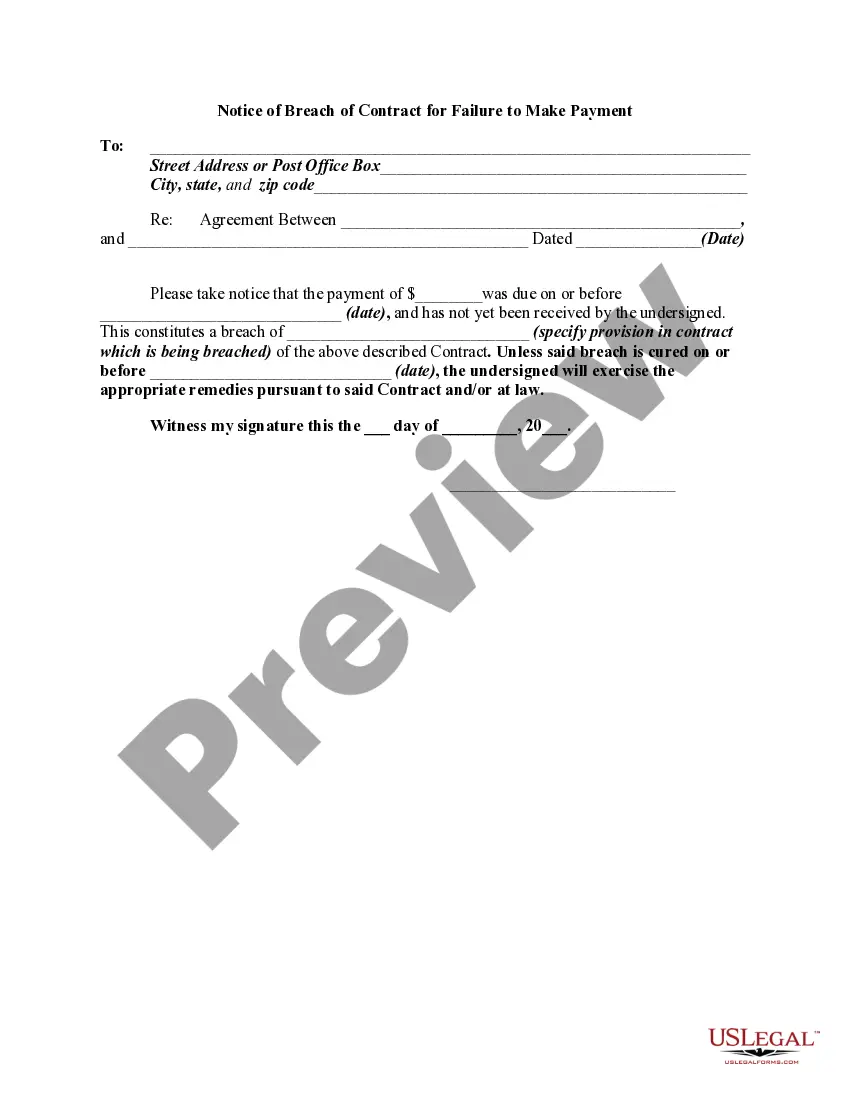

This notice is not from a debt collector but from the party to whom the debt is owed.

Mississippi Notice by Mail to Debtor of Action if Payment not Made

Description

How to fill out Notice By Mail To Debtor Of Action If Payment Not Made?

Discovering the right authorized file format can be quite a have a problem. Naturally, there are a lot of templates available on the Internet, but how do you get the authorized kind you want? Utilize the US Legal Forms website. The support gives thousands of templates, like the Mississippi Notice by Mail to Debtor of Action if Payment not Made, that can be used for company and private requirements. Each of the types are inspected by specialists and meet federal and state requirements.

Should you be previously authorized, log in for your bank account and then click the Acquire option to have the Mississippi Notice by Mail to Debtor of Action if Payment not Made. Make use of your bank account to search with the authorized types you might have acquired earlier. Check out the My Forms tab of your bank account and obtain one more backup in the file you want.

Should you be a fresh customer of US Legal Forms, allow me to share simple directions for you to comply with:

- Initial, ensure you have selected the right kind to your metropolis/state. You are able to check out the form utilizing the Preview option and read the form explanation to guarantee it is the right one for you.

- In the event the kind fails to meet your needs, utilize the Seach area to find the appropriate kind.

- When you are certain the form is proper, go through the Purchase now option to have the kind.

- Select the rates prepare you would like and enter the necessary information. Design your bank account and pay for your order utilizing your PayPal bank account or charge card.

- Opt for the submit format and download the authorized file format for your gadget.

- Total, edit and print and sign the received Mississippi Notice by Mail to Debtor of Action if Payment not Made.

US Legal Forms is definitely the biggest library of authorized types for which you can find different file templates. Utilize the company to download appropriately-made documents that comply with state requirements.

Form popularity

FAQ

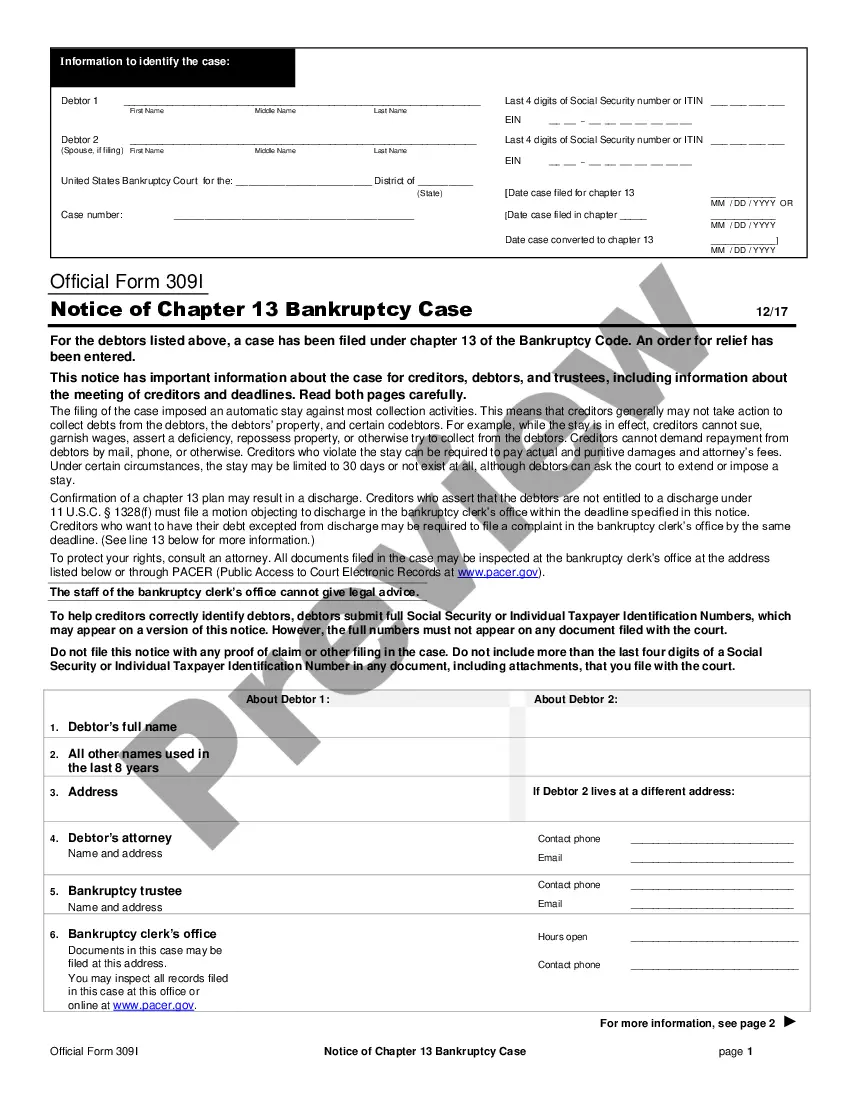

Statutes of Limitations in Mississippi Injury to PersonThree years (Miss. Code § 15-1-49)Collection of Debt on AccountThree years (Miss. Code § 15-1-29 and Miss. Code § 15-1-31)JudgmentsSeven years for domestic and foreign judgments (Miss. Code § 15-1-43)7 more rows

A Judgement (a lawsuit that was filed against you and was ruled in favor of the company/person that filed against you) is covered under Mississippi Code 15-1-43 and states a 7 year period.

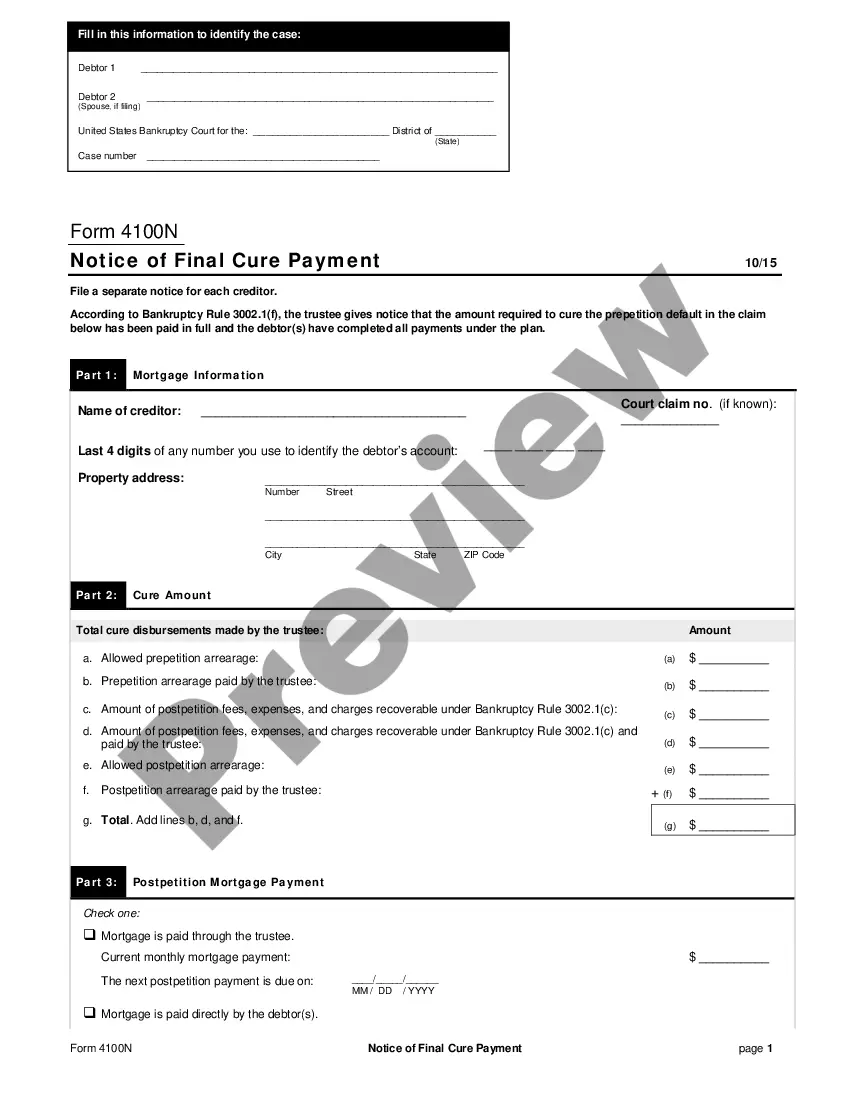

A tax lien is valid for seven years unless a continuation is filed before it expires. The continuation extends the lien another seven years. Mississippi law allows continuations on state liens until they're paid in full; so continuations can be filed repeatedly making a tax lien valid indefinitely.

For example, in Mississippi, there is a three-year statute of limitations for credit card debt. The three years is from the date you last used the card or the last time you made payment. If the collector sues you after three years from this date, you will have the defense that the statute of limitations has run.

A Judgement (a lawsuit that was filed against you and was ruled in favor of the company/person that filed against you) is covered under Mississippi Code 15-1-43 and states a 7 year period. The courts have these limitations in order to create as much fairness and predictability as possible.

Another example is the statute of repose, which is the date the victim must file a civil action by, even if the injury has not yet been discovered. In Mississippi, the statute of repose is seven years from the date of the malpractice.

Limitations of Actions and Prevention of Frauds § 15-1-43. All actions founded on any judgment or decree rendered by any court of record in this state, shall be brought within seven (7) years next after the rendition of such judgment or decree, or last renewal of judgment or decree, whichever is later.

How to File a Mississippi Mechanics Lien Prepare the lien document, taking care to include all the necessary information set forth above ? including the required statements. Sign the document. Deliver the lien must the office of the clerk of the chancery court of the county where the property is located.