This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Mississippi Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a legal document that outlines the transfer of ownership of personal property and the assumptions of debts by the buyer. This document is used to protect the interests of both parties involved in the transaction and ensure a smooth transfer of ownership. The Mississippi Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased typically includes the following details: 1. Parties involved: The document identifies the buyer and the seller, including their full names, contact information, and legal addresses. It is crucial to accurately identify all parties to ensure the document is legally binding. 2. Description of property: The bill of sale provides a detailed description of the personal property being sold, including its make, model, year, serial number, and any other relevant identifying information. This helps to avoid any confusion or disputes regarding the specific item being transferred. 3. Purchase price: The document specifies the agreed-upon purchase price for the personal property. It also includes any additional terms, such as down payment amounts, installment plans, or interest rates if applicable. 4. Assumption of debt: In cases where the personal property being purchased is still under a debt or loan, the bill of sale includes provisions for the buyer to assume responsibility for paying off the outstanding debt. This ensures that the seller is relieved of their financial obligations related to the property, and the buyer understands and agrees to take on the debt as part of the transaction. 5. Security agreement: If the debt being assumed is secured by the personal property being purchased (such as a car loan or a mortgage), the bill of sale may include a security agreement. This agreement outlines the terms and conditions related to the collateral being used to secure the debt, ensuring that the lender's interests are protected. Different types of Mississippi Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased may exist depending on the specific nature of the transaction or the type of personal property involved. Some examples could include: 1. Vehicle Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased: This type of bill of sale and assumption of debt is specific to the sale and transfer of ownership of motor vehicles such as cars, motorcycles, or boats. 2. Real Estate Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased: This document is used when personal property (such as appliances or furniture) is being sold along with real estate, and the buyer assumes any outstanding debts secured by the property. 3. Equipment Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased: This type of bill of sale is used in transactions involving the sale of equipment, machinery, or other similar assets, where the buyer assumes any debts or liens secured by the personal property. In conclusion, the Mississippi Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a legally binding document that protects the rights and interests of both the buyer and the seller. It outlines the transfer of ownership of personal property and the assumption of any outstanding debts secured by the property. Different types of bills of sale and assumptions of debt may exist depending on the nature of the transaction or the type of personal property involved.The Mississippi Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a legal document that outlines the transfer of ownership of personal property and the assumptions of debts by the buyer. This document is used to protect the interests of both parties involved in the transaction and ensure a smooth transfer of ownership. The Mississippi Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased typically includes the following details: 1. Parties involved: The document identifies the buyer and the seller, including their full names, contact information, and legal addresses. It is crucial to accurately identify all parties to ensure the document is legally binding. 2. Description of property: The bill of sale provides a detailed description of the personal property being sold, including its make, model, year, serial number, and any other relevant identifying information. This helps to avoid any confusion or disputes regarding the specific item being transferred. 3. Purchase price: The document specifies the agreed-upon purchase price for the personal property. It also includes any additional terms, such as down payment amounts, installment plans, or interest rates if applicable. 4. Assumption of debt: In cases where the personal property being purchased is still under a debt or loan, the bill of sale includes provisions for the buyer to assume responsibility for paying off the outstanding debt. This ensures that the seller is relieved of their financial obligations related to the property, and the buyer understands and agrees to take on the debt as part of the transaction. 5. Security agreement: If the debt being assumed is secured by the personal property being purchased (such as a car loan or a mortgage), the bill of sale may include a security agreement. This agreement outlines the terms and conditions related to the collateral being used to secure the debt, ensuring that the lender's interests are protected. Different types of Mississippi Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased may exist depending on the specific nature of the transaction or the type of personal property involved. Some examples could include: 1. Vehicle Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased: This type of bill of sale and assumption of debt is specific to the sale and transfer of ownership of motor vehicles such as cars, motorcycles, or boats. 2. Real Estate Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased: This document is used when personal property (such as appliances or furniture) is being sold along with real estate, and the buyer assumes any outstanding debts secured by the property. 3. Equipment Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased: This type of bill of sale is used in transactions involving the sale of equipment, machinery, or other similar assets, where the buyer assumes any debts or liens secured by the personal property. In conclusion, the Mississippi Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a legally binding document that protects the rights and interests of both the buyer and the seller. It outlines the transfer of ownership of personal property and the assumption of any outstanding debts secured by the property. Different types of bills of sale and assumptions of debt may exist depending on the nature of the transaction or the type of personal property involved.

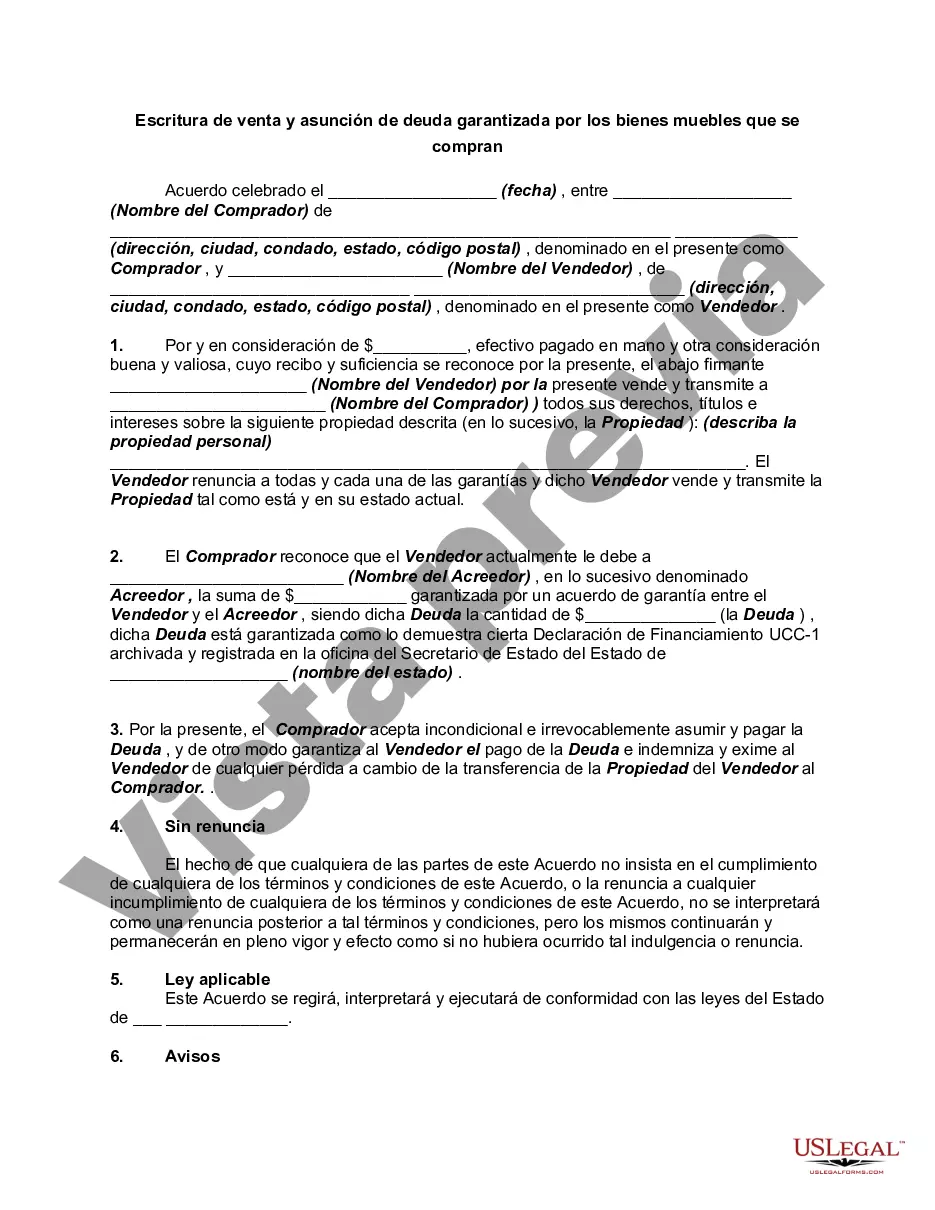

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.