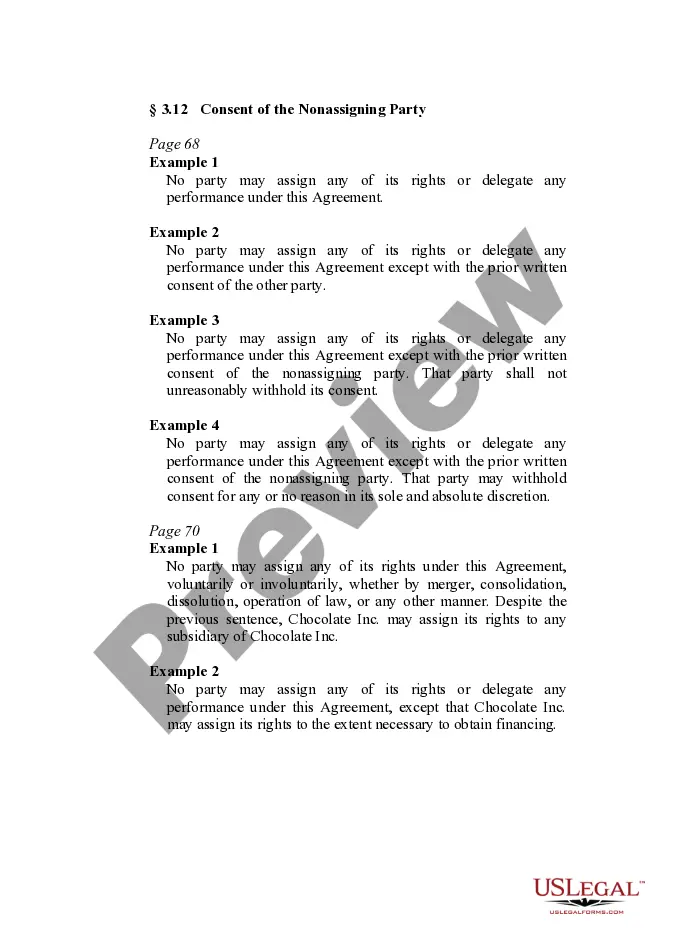

A Mississippi Simple Promissory Note for Family Loan is a legal document that outlines the terms and conditions under which an individual borrows money from a family member. It serves as a formal agreement and provides security for both parties involved in the loan. The Mississippi Simple Promissory Note for Family Loan includes essential information such as the names and addresses of the borrower and lender, the loan amount, interest rate (if any), repayment schedule, and any collateral put forth as security. This document ensures clarity and helps prevent any misunderstandings or disputes that may arise in the future. In Mississippi, there are various types of Simple Promissory Notes for Family Loans available, each serving a specific purpose: 1. Secured Promissory Note: This type of promissory note includes additional provisions that put a specific asset, such as a house or car, as collateral for the loan. If the borrower fails to repay the loan, the lender can claim ownership of the collateral. 2. Unsecured Promissory Note: Unlike the secured promissory note, this type does not require any collateral. It relies solely on the borrower's promise to repay the loan as agreed upon in the document. However, the lender might charge a higher interest rate to compensate for the increased risk. 3. Demand Promissory Note: This type of promissory note allows the lender to request immediate repayment of the loan at any time they desire, without providing a designated repayment schedule beforehand. The borrower must then repay the loan promptly upon receiving the demand. 4. Installment Promissory Note: This type of promissory note establishes a structured repayment plan. The borrower agrees to repay the loan in fixed amounts over a specified period, typically including both principal and interest. The terms of repayment are clearly defined to provide a clear understanding for both parties. Using a Mississippi Simple Promissory Note for Family Loan is essential for maintaining transparency and managing expectations between the borrower and the lender. It helps ensure that both parties are aware of their rights, obligations, and the consequences in case of default or breach of the agreement. It is highly recommended consulting with a legal professional to draft or review the promissory note to ensure it complies with Mississippi state laws and addresses the specific needs of the loan agreement.

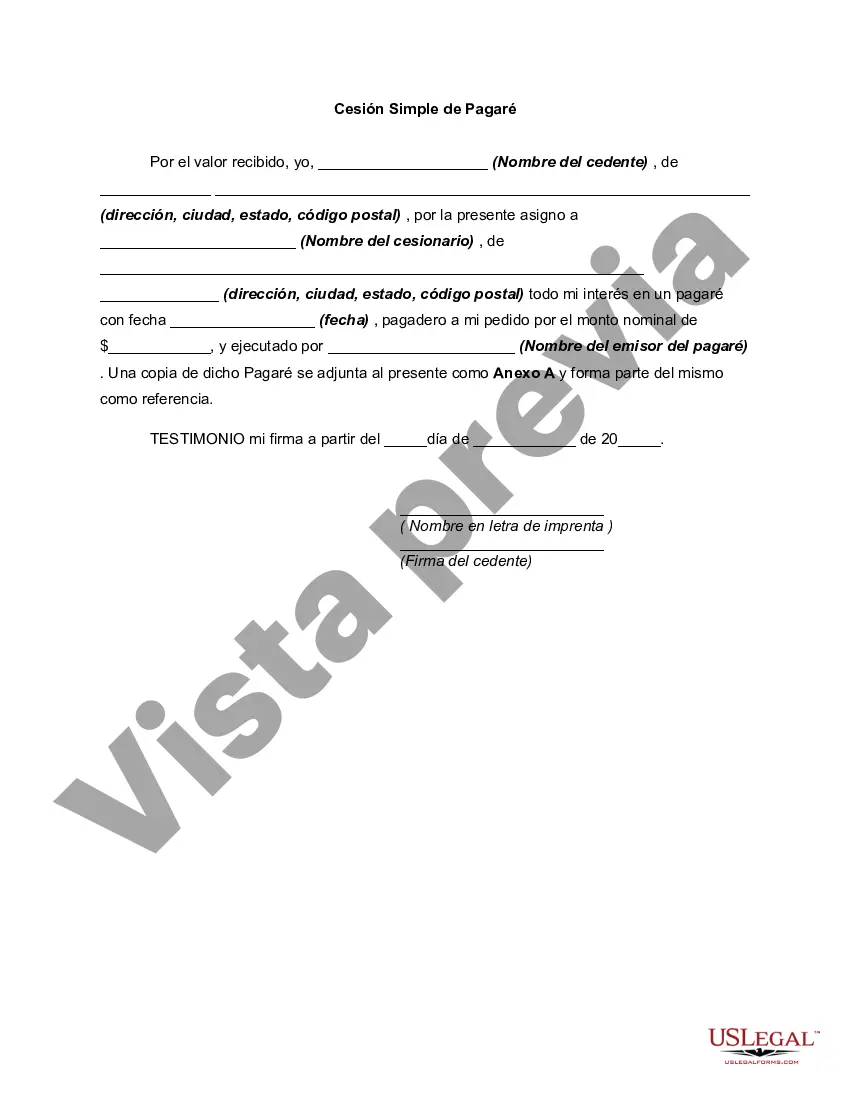

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mississippi Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Mississippi Pagaré Simple Para Préstamo Familiar?

US Legal Forms - one of the greatest libraries of legal varieties in the United States - offers a wide array of legal papers themes it is possible to acquire or printing. Making use of the web site, you can find 1000s of varieties for organization and personal uses, sorted by classes, states, or keywords.You will find the newest types of varieties such as the Mississippi Simple Promissory Note for Family Loan within minutes.

If you have a monthly subscription, log in and acquire Mississippi Simple Promissory Note for Family Loan in the US Legal Forms catalogue. The Down load option will show up on every form you view. You have access to all in the past saved varieties in the My Forms tab of the bank account.

If you want to use US Legal Forms initially, listed below are basic instructions to get you started off:

- Ensure you have picked out the correct form for your area/state. Select the Preview option to analyze the form`s content. Read the form description to actually have selected the correct form.

- If the form does not satisfy your needs, use the Look for industry on top of the screen to get the one who does.

- If you are content with the form, validate your option by clicking the Purchase now option. Then, opt for the prices prepare you prefer and offer your references to register for the bank account.

- Method the financial transaction. Make use of your Visa or Mastercard or PayPal bank account to finish the financial transaction.

- Find the file format and acquire the form on the gadget.

- Make adjustments. Complete, modify and printing and sign the saved Mississippi Simple Promissory Note for Family Loan.

Each and every format you included in your account lacks an expiry day and it is yours eternally. So, if you wish to acquire or printing an additional duplicate, just visit the My Forms segment and then click on the form you will need.

Gain access to the Mississippi Simple Promissory Note for Family Loan with US Legal Forms, the most considerable catalogue of legal papers themes. Use 1000s of skilled and state-particular themes that meet your business or personal needs and needs.