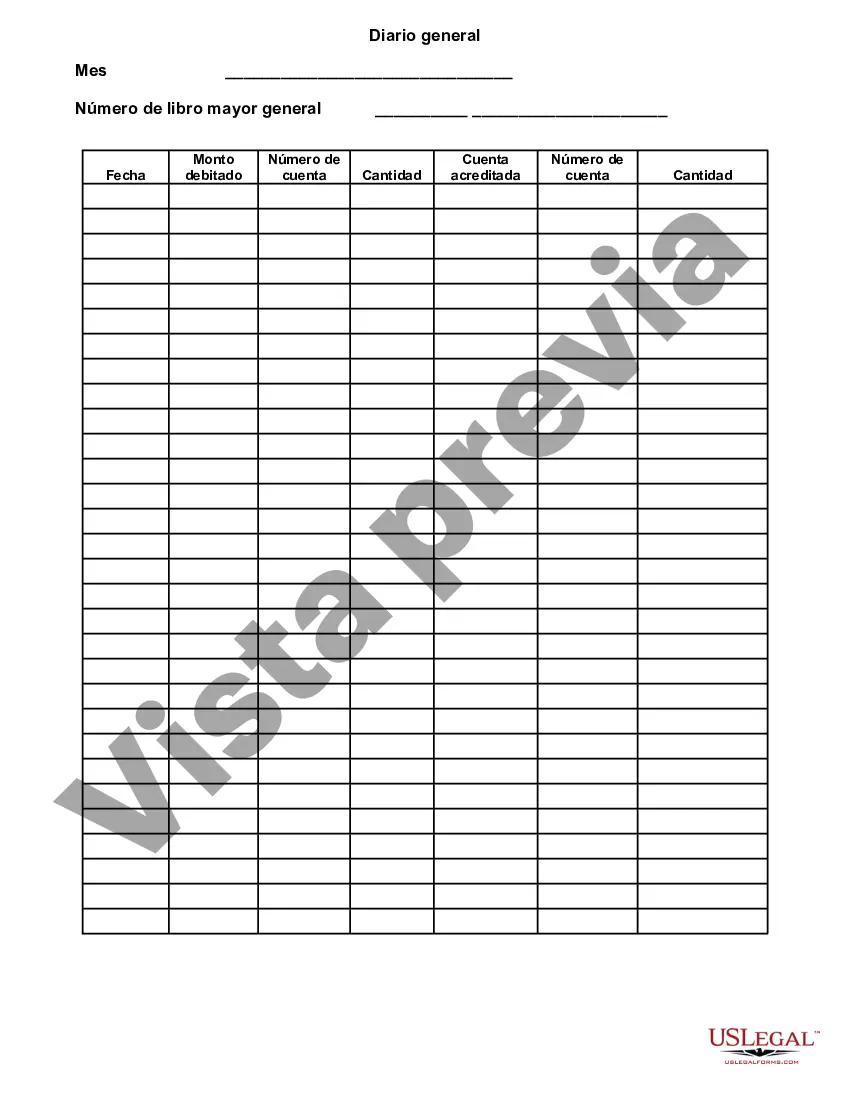

Mississippi General Journal is a type of financial journal used for recording and tracking a company's transactions and business activities. It serves as a comprehensive record of all the company's financial entries, ensuring accurate and organized documentation. The Mississippi General Journal follows the double-entry bookkeeping system, where every transaction is recorded twice — once as a debit and once as a credit. This method ensures that the accounting equation, Assets = Liabilities + Equity, is always maintained. This essential accounting tool includes various key components, such as the date of the transaction, a description of the transaction, debit and credit columns, and the account and amount involved. By meticulously recording each transaction, the Mississippi General Journal provides a detailed overview of a company's financial health and assists in producing accurate financial statements. Different types of Mississippi General Journals can include: 1. Sales Journal: This sub-journal specifically records all sales transactions made by a company. It typically includes information such as customer names, invoice numbers, and monetary amounts received. 2. Purchase Journal: The Purchase Journal is used to record all purchases made by a company. It includes details such as supplier names, invoice numbers, and the amounts paid for goods or services. 3. Cash Receipts Journal: This journal tracks all cash inflows received by the company. It records details of payments received in cash, including customer names, invoice numbers, and the amounts paid. 4. Cash Disbursements Journal: The Cash Disbursements Journal records all cash payments made by the company. It includes information on expenses paid in cash, such as vendor names, invoice numbers, and the amounts paid. 5. General Journal: The General Journal is the primary journal that records any transactions not recorded in the specialized sub-journals mentioned earlier. It includes entries like adjustments, corrections, or any other non-routine transactions. 6. Payroll Journal: In cases where employee salaries and wages need to be recorded separately, companies may utilize a Payroll Journal. It documents all payroll-related payments, including employee names, salary details, and deductions. In conclusion, the Mississippi General Journal is an essential tool in accounting, enabling businesses to accurately record and track their financial transactions. Its various sub-journals cater to specific types of transactions, ensuring comprehensive and organized financial documentation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mississippi Diario general - General Journal

Description

How to fill out Mississippi Diario General?

If you want to total, down load, or print out legal papers themes, use US Legal Forms, the largest collection of legal kinds, which can be found on the web. Utilize the site`s basic and practical search to get the files you want. A variety of themes for organization and person functions are categorized by types and says, or keywords and phrases. Use US Legal Forms to get the Mississippi General Journal within a couple of mouse clicks.

In case you are currently a US Legal Forms consumer, log in for your accounts and then click the Down load button to obtain the Mississippi General Journal. Also you can accessibility kinds you formerly saved inside the My Forms tab of your respective accounts.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the form for that correct town/land.

- Step 2. Utilize the Review method to examine the form`s information. Don`t forget about to read the explanation.

- Step 3. In case you are unsatisfied with the kind, take advantage of the Look for discipline on top of the screen to find other variations in the legal kind design.

- Step 4. After you have identified the form you want, click on the Buy now button. Choose the pricing prepare you like and include your qualifications to register on an accounts.

- Step 5. Procedure the transaction. You can use your charge card or PayPal accounts to perform the transaction.

- Step 6. Pick the formatting in the legal kind and down load it on your own gadget.

- Step 7. Comprehensive, revise and print out or indication the Mississippi General Journal.

Each and every legal papers design you buy is your own eternally. You have acces to each kind you saved inside your acccount. Select the My Forms area and choose a kind to print out or down load yet again.

Remain competitive and down load, and print out the Mississippi General Journal with US Legal Forms. There are many professional and express-particular kinds you can utilize for the organization or person requires.