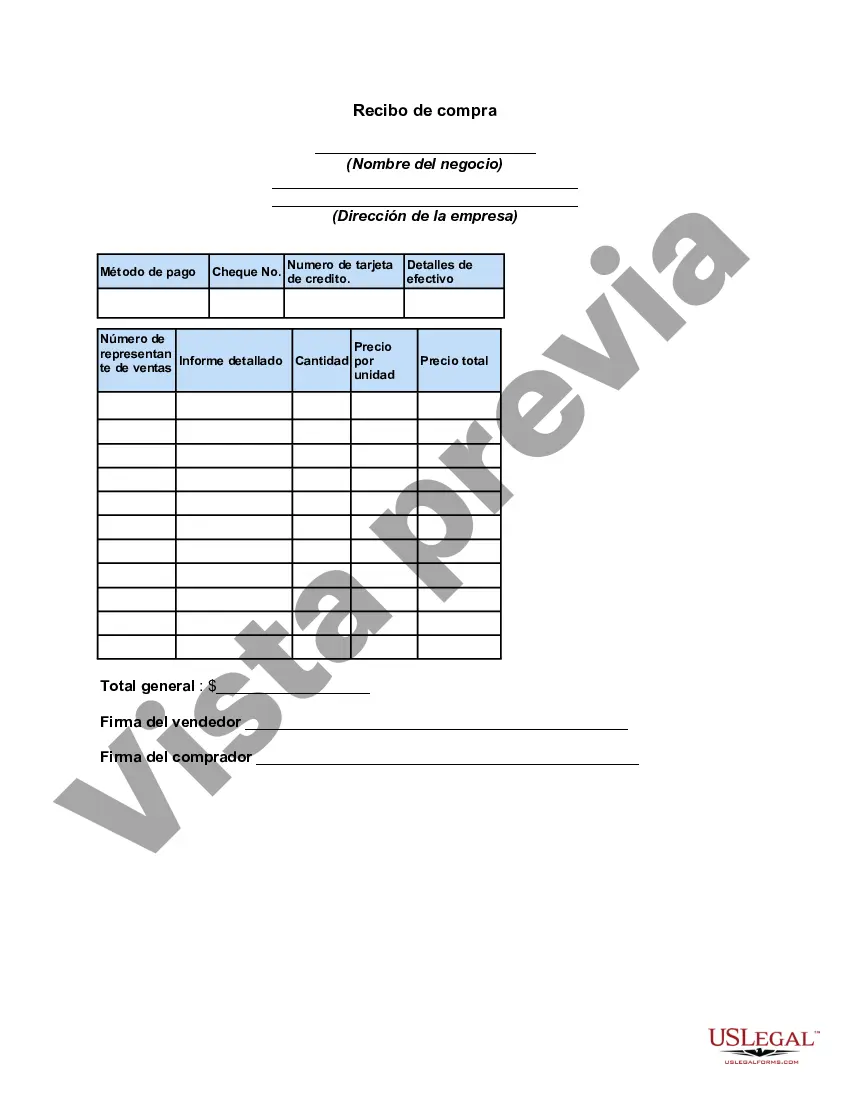

A Mississippi sales receipt is a legal document provided to customers after purchasing goods or services in the state of Mississippi. It serves as proof of purchase and includes important information regarding the transaction. The receipt typically contains the following details: 1. Business Information: The name, address, and contact details of the business issuing the receipt are mentioned at the top. This ensures that customers can easily identify and reach out to the seller if required. 2. Transaction Details: The receipt includes the date and time of the purchase, allowing the customer to track the timeline of the transaction. Additionally, it mentions the unique receipt number, which comes in handy while referencing the purchase at a later stage. 3. Itemized List: A Mississippi sales receipt comprises a detailed breakdown of the items or services purchased. Each item is listed separately, accompanied by its name, quantity, unit price, and total price. This helps the customer verify the accuracy of the purchase and detect any discrepancies. 4. Taxes and Charges: Any applicable taxes, such as sales tax, are clearly stated in the receipt. This allows customers to identify the tax amount included in their purchase and understand the breakdown of the total cost. Additionally, other charges, such as shipping fees or service charges, if applicable, may also be itemized separately. 5. Payment Method: The receipt specifies the mode of payment used for the transaction, such as cash, credit card, or check. In case of card payments, the last digits of the card number may be mentioned for reference. This information helps customers track their preferred method of payment and ensure accuracy. 6. Return Policy: Depending on the business's policies, the receipt may contain information about the return or exchange policy. It may state the timeframe within which a return or exchange is accepted, any conditions or fees associated with it, and contact information for the business's customer service. Types of Mississippi Sales Receipts: 1. Retail Sales Receipt: This type of receipt is issued by retail establishments when customers purchase merchandise, clothing, electronics, or any other tangible goods. 2. Service Sales Receipt: When customers avail services such as repairs, maintenance, consulting, or any other intangible services, a service sales receipt is generated. 3. Restaurant Sales Receipt: Restaurants and food establishments issue this type of receipt after customers dine in or order takeout/delivery. It itemizes food and beverage charges along with any applicable taxes and tips. 4. Online Sales Receipt: With the rise of e-commerce, online sales receipts have become increasingly common. These receipts are generated for purchases made through online platforms, including websites or mobile apps. In conclusion, a Mississippi sales receipt is a crucial document that provides a detailed summary of a purchase made in the state. Whether it's a retail, service, restaurant, or online sales receipt, it acts as evidence of the transaction and facilitates customer satisfaction by transparently outlining the associated costs and essential information.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mississippi Recibo de compra - Sales Receipt

Description

How to fill out Mississippi Recibo De Compra?

US Legal Forms - among the largest libraries of lawful types in the United States - provides a variety of lawful papers web templates you can acquire or print. Using the website, you will get a huge number of types for company and person uses, sorted by classes, states, or keywords and phrases.You will find the newest types of types such as the Mississippi Sales Receipt in seconds.

If you currently have a registration, log in and acquire Mississippi Sales Receipt from your US Legal Forms library. The Down load button can look on each and every kind you perspective. You get access to all earlier saved types in the My Forms tab of your profile.

If you would like use US Legal Forms for the first time, here are straightforward instructions to help you get started out:

- Make sure you have chosen the proper kind for the city/area. Go through the Review button to check the form`s articles. See the kind information to ensure that you have selected the proper kind.

- In case the kind doesn`t satisfy your specifications, take advantage of the Look for area towards the top of the display screen to discover the one which does.

- Should you be pleased with the form, affirm your choice by clicking on the Purchase now button. Then, pick the rates prepare you want and give your qualifications to sign up for an profile.

- Method the transaction. Use your charge card or PayPal profile to finish the transaction.

- Find the structure and acquire the form on the product.

- Make changes. Fill out, change and print and signal the saved Mississippi Sales Receipt.

Every design you added to your bank account lacks an expiry particular date and is your own for a long time. So, in order to acquire or print yet another backup, just go to the My Forms section and click about the kind you require.

Obtain access to the Mississippi Sales Receipt with US Legal Forms, the most substantial library of lawful papers web templates. Use a huge number of professional and status-particular web templates that fulfill your company or person requires and specifications.