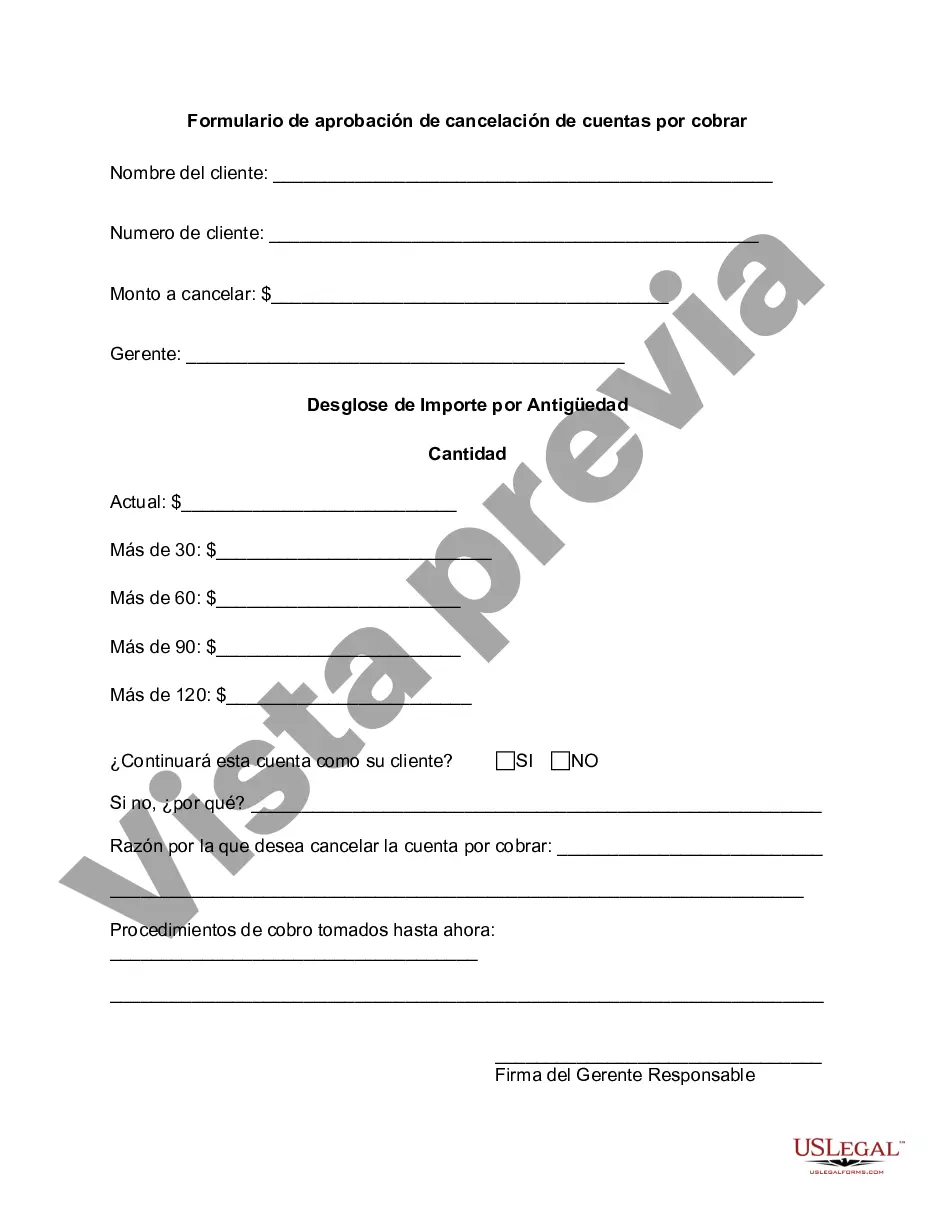

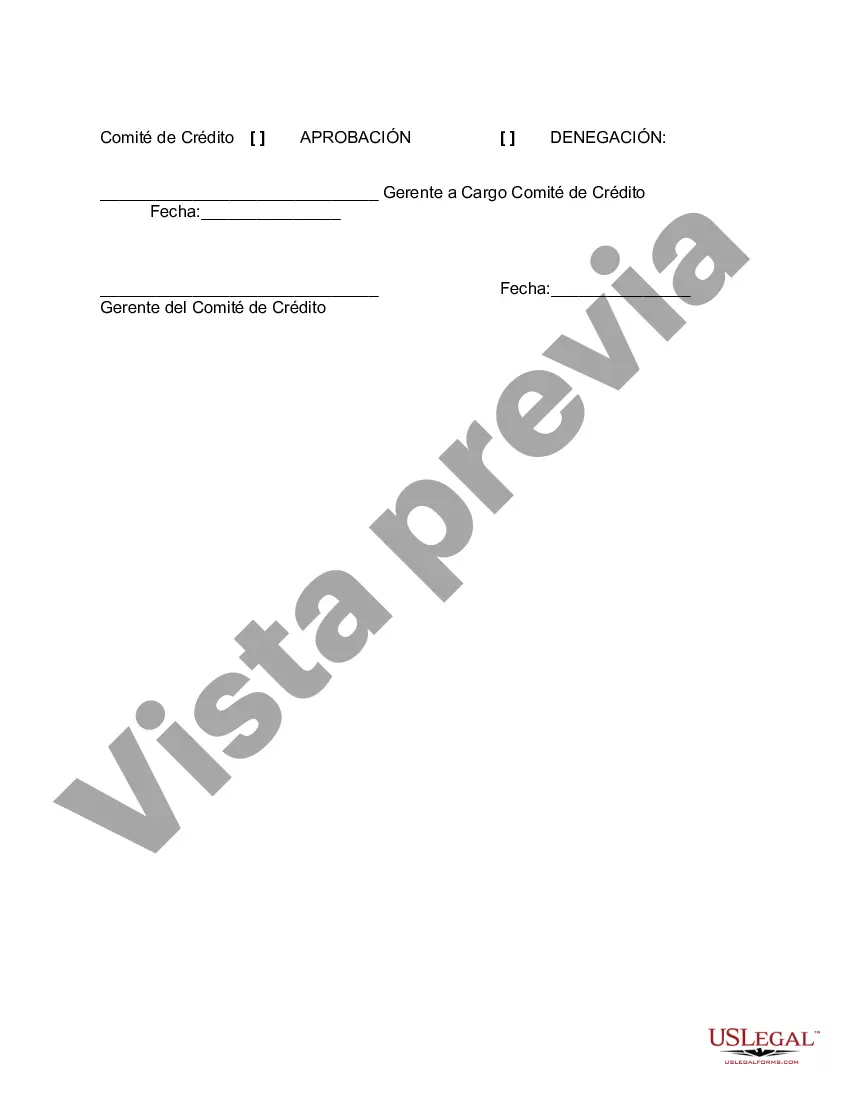

The Mississippi Accounts Receivable Write-Off Approval Form is a document used by businesses in Mississippi to seek approval for writing off unpaid accounts receivable. This detailed form outlines the necessary information and justification required for the write-off of a specific account. Keywords: Mississippi, accounts receivable, write-off, approval form, unpaid, justification This form serves as a crucial tool for businesses operating in Mississippi that need to clear outstanding receivables from their financial records. It ensures that the write-off process is structured, documented, and in compliance with relevant regulatory guidelines. By utilizing the Mississippi Accounts Receivable Write-Off Approval Form, businesses can properly track and reconcile their financial records, mitigate potential losses, and maintain accurate reporting. This form also ensures that the write-off decision adheres to established internal controls and policies. It is important to note that there may be different types of Mississippi Accounts Receivable Write-Off Approval Forms based on the specific circumstances and requirements of the business. Depending on the nature of the unpaid accounts, some common variations may include: 1. Bad Debt Write-Off Approval Form: This form is used when a customer's debt is considered unrecoverable due to bankruptcy, insolvency, or prolonged delinquency, and it requires the approval of relevant stakeholders. 2. Uncollectible Account Write-Off Approval Form: This form is used to request permission for writing off accounts where numerous attempts to collect payment have failed, and the debtor is untraceable or refuses to respond. 3. Small Balance Write-Off Approval Form: Businesses often encounter accounts receivable with small balances that are not economically feasible to pursue. This form allows businesses to write off such small and insignificant balances efficiently. 4. Doubtful Account Write-Off Approval Form: In cases where there is uncertainty regarding the collect ability of an account, the Doubtful Account Write-Off Approval Form is used. It requires a thorough investigation and justification to assess the likelihood of successful recovery. By using these specific variations of the Mississippi Accounts Receivable Write-Off Approval Form, businesses can tailor their requests based on the unique circumstances of each unpaid account. In conclusion, the Mississippi Accounts Receivable Write-Off Approval Form is a vital tool for businesses to manage their unpaid accounts and maintain accurate financial records. By adhering to the guidelines and utilizing the appropriate variations of this form, businesses can efficiently write off uncollectible debts and ensure compliance with internal controls and regulatory requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mississippi Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Mississippi Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

If you need to comprehensive, obtain, or print out legitimate document templates, use US Legal Forms, the biggest selection of legitimate forms, which can be found on the Internet. Utilize the site`s basic and handy look for to get the files you want. Various templates for enterprise and personal reasons are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to get the Mississippi Accounts Receivable Write-Off Approval Form in a number of mouse clicks.

When you are previously a US Legal Forms client, log in for your bank account and click on the Acquire key to have the Mississippi Accounts Receivable Write-Off Approval Form. You can also entry forms you previously delivered electronically in the My Forms tab of your own bank account.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for your correct town/nation.

- Step 2. Use the Preview option to look over the form`s content material. Do not neglect to read through the information.

- Step 3. When you are unsatisfied together with the type, use the Search discipline towards the top of the display screen to discover other versions in the legitimate type design.

- Step 4. When you have found the form you want, select the Buy now key. Opt for the prices program you choose and put your accreditations to register on an bank account.

- Step 5. Procedure the purchase. You can use your bank card or PayPal bank account to complete the purchase.

- Step 6. Pick the structure in the legitimate type and obtain it on your own product.

- Step 7. Complete, modify and print out or signal the Mississippi Accounts Receivable Write-Off Approval Form.

Each and every legitimate document design you buy is the one you have eternally. You possess acces to each type you delivered electronically in your acccount. Click the My Forms area and pick a type to print out or obtain once again.

Compete and obtain, and print out the Mississippi Accounts Receivable Write-Off Approval Form with US Legal Forms. There are many professional and condition-distinct forms you may use for the enterprise or personal demands.