A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

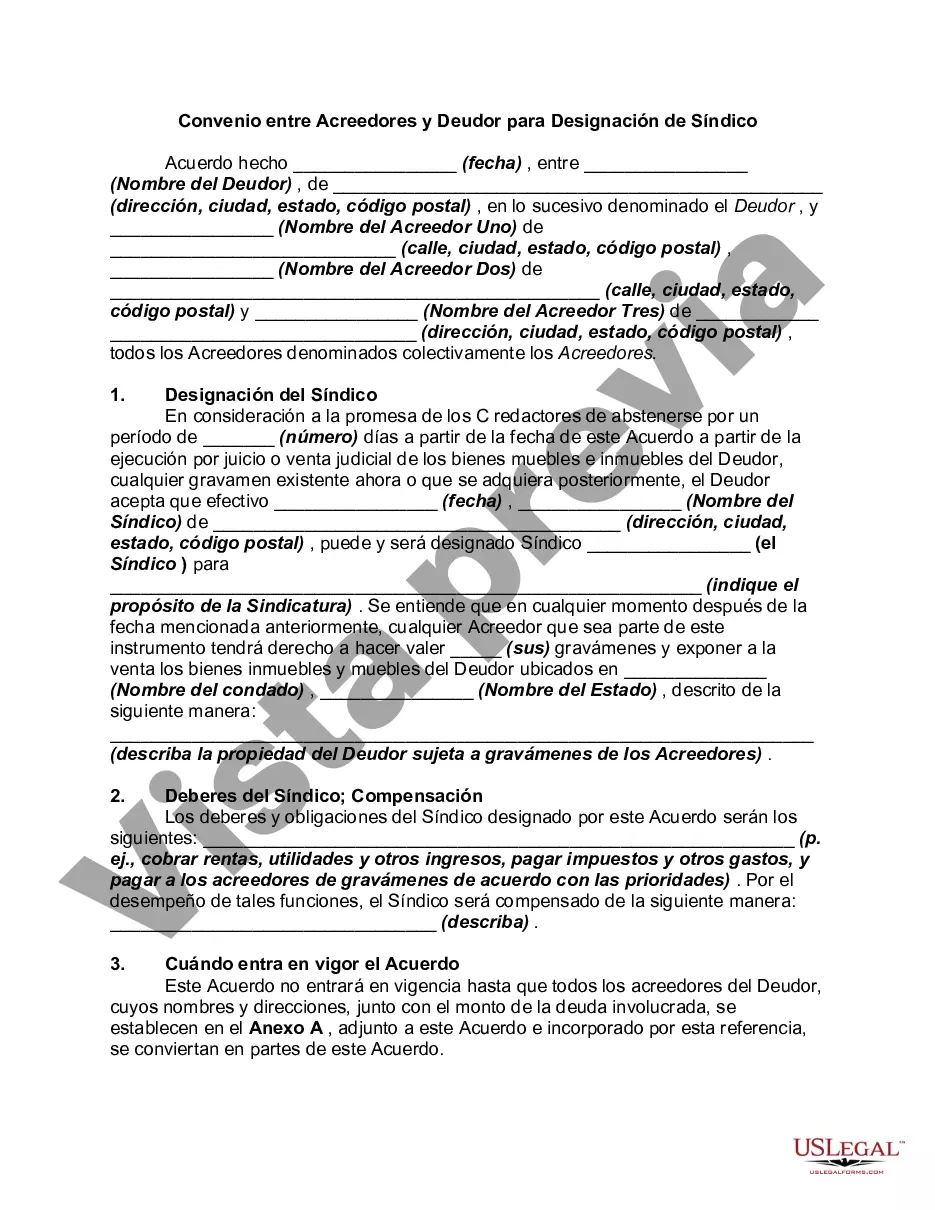

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Mississippi Agreement between Creditors and Debtor for Appointment of Receiver is a legally binding document that outlines the terms and conditions agreed upon by the parties involved in the appointment of a receiver. This agreement is crucial in cases where a debtor is struggling to fulfill their financial obligations to creditors, and it serves as a mechanism to protect the interests of the creditors while providing an opportunity for the debtor to reorganize their financial affairs. The agreement establishes the authority and responsibilities of a receiver, who acts as an impartial third party appointed by the court to take over the debtor's assets and manage them for the benefit of the creditors. The receiver's role includes collecting and distributing income from the debtor's assets, negotiating with creditors, and implementing a plan to repay the debts owed. Keywords: — Mississippi Agreement between Creditors and Debtor — Appointment of Receive— - Creditors' rights — Debtor's financial obligation— - Financial reorganization — Court-Appointed Receive— - Asset management — Debt repayment pla— - Creditor protection Different types of Mississippi Agreement between Creditors and Debtor for Appointment of Receiver may include variations based on the specific circumstances or goals of the parties involved. Here are some potential variations: 1. Voluntary Agreement between Creditors and Debtor for Appointment of Receiver: This type of agreement is entered into willingly by both the debtor and the creditors, with the intention of resolving their financial issues through the appointment of a receiver. It can be seen as a proactive approach to financial reorganization. 2. Involuntary Agreement between Creditors and Debtor for Appointment of Receiver: In some cases, creditors may initiate legal proceedings to force the appointment of a receiver when the debtor is failing to meet their financial obligations. This type of agreement may arise from a creditor's desire to secure their debts and protect their rights. 3. Restructuring Agreement between Creditors and Debtor for Appointment of Receiver: This type of agreement focuses on the reorganization of the debtor's financial affairs and proposes a specific plan to repay the outstanding debts. It may involve negotiations with creditors to establish revised terms and conditions for debt repayment. 4. Liquidation Agreement between Creditors and Debtor for Appointment of Receiver: In situations where the debtor's financial situation is deemed irreparable, a liquidation agreement may be reached. This agreement outlines the process by which the receiver will sell the debtor's assets and distribute the proceeds among the creditors to satisfy their debts. 5. Specific Industry Agreement between Creditors and Debtor for Appointment of Receiver: In certain cases, industry-specific agreements may be required, such as in the healthcare or real estate sector. These agreements may include additional provisions tailored to the unique characteristics or regulations governing the respective industry. Ultimately, the Mississippi Agreement between Creditors and Debtor for Appointment of Receiver provides a legal framework for resolving financial disputes and establishing an orderly process for creditors to recover their debts while allowing the debtor to regain financial stability.The Mississippi Agreement between Creditors and Debtor for Appointment of Receiver is a legally binding document that outlines the terms and conditions agreed upon by the parties involved in the appointment of a receiver. This agreement is crucial in cases where a debtor is struggling to fulfill their financial obligations to creditors, and it serves as a mechanism to protect the interests of the creditors while providing an opportunity for the debtor to reorganize their financial affairs. The agreement establishes the authority and responsibilities of a receiver, who acts as an impartial third party appointed by the court to take over the debtor's assets and manage them for the benefit of the creditors. The receiver's role includes collecting and distributing income from the debtor's assets, negotiating with creditors, and implementing a plan to repay the debts owed. Keywords: — Mississippi Agreement between Creditors and Debtor — Appointment of Receive— - Creditors' rights — Debtor's financial obligation— - Financial reorganization — Court-Appointed Receive— - Asset management — Debt repayment pla— - Creditor protection Different types of Mississippi Agreement between Creditors and Debtor for Appointment of Receiver may include variations based on the specific circumstances or goals of the parties involved. Here are some potential variations: 1. Voluntary Agreement between Creditors and Debtor for Appointment of Receiver: This type of agreement is entered into willingly by both the debtor and the creditors, with the intention of resolving their financial issues through the appointment of a receiver. It can be seen as a proactive approach to financial reorganization. 2. Involuntary Agreement between Creditors and Debtor for Appointment of Receiver: In some cases, creditors may initiate legal proceedings to force the appointment of a receiver when the debtor is failing to meet their financial obligations. This type of agreement may arise from a creditor's desire to secure their debts and protect their rights. 3. Restructuring Agreement between Creditors and Debtor for Appointment of Receiver: This type of agreement focuses on the reorganization of the debtor's financial affairs and proposes a specific plan to repay the outstanding debts. It may involve negotiations with creditors to establish revised terms and conditions for debt repayment. 4. Liquidation Agreement between Creditors and Debtor for Appointment of Receiver: In situations where the debtor's financial situation is deemed irreparable, a liquidation agreement may be reached. This agreement outlines the process by which the receiver will sell the debtor's assets and distribute the proceeds among the creditors to satisfy their debts. 5. Specific Industry Agreement between Creditors and Debtor for Appointment of Receiver: In certain cases, industry-specific agreements may be required, such as in the healthcare or real estate sector. These agreements may include additional provisions tailored to the unique characteristics or regulations governing the respective industry. Ultimately, the Mississippi Agreement between Creditors and Debtor for Appointment of Receiver provides a legal framework for resolving financial disputes and establishing an orderly process for creditors to recover their debts while allowing the debtor to regain financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.