It is essential to a contract that there be an offer and, while the offer is still in existence, it must be accepted without qualification. An offer expresses the willingness of the offeror to enter into a contract agreement regarding a particular subject. An invitation to negotiate is not an offer. An invitation to negotiate is merely a preliminary discussion or an invitation by one party to the other to negotiate or make an offer. This form is an invitation to negotiate.

The Mississippi Business Purchase Proposal is a comprehensive document that outlines the terms and conditions involved in acquiring an existing business in the state of Mississippi. This proposal plays a crucial role in facilitating the purchase negotiation process and aims to provide a detailed overview of the intended transaction. Keywords: Mississippi, business purchase proposal, acquisition, existing business, negotiation, terms and conditions, transaction. There are various types of Mississippi Business Purchase Proposals, each with its unique characteristics and specifications. These include: 1. Small Business Purchase Proposal: This type of proposal targets small-scale businesses in Mississippi. It outlines the financials, assets, liabilities, and operational aspects of the business, ensuring potential buyers have a clear understanding of what they are acquiring. 2. Franchise Purchase Proposal: Franchising is a popular business model in Mississippi. Franchise Purchase Proposals focus on acquiring an established franchise within the state. These proposals highlight the franchise's track record, brand value, franchise fees, and support provided by the franchisor. 3. Corporate Merger or Acquisition Proposal: In this type of proposal, the focus is on corporate-level transactions involving larger companies in Mississippi. These proposals outline the strategic rationale behind the merger or acquisition, the financial terms, and the anticipated outcome of the transaction. 4. Distressed Business Purchase Proposal: When a business in Mississippi is facing financial difficulties or is in a distressed state, interested buyers can submit a Distressed Business Purchase Proposal. This type of proposal includes a detailed analysis of the business's current financial situation, a restructuring plan, and an offer to acquire the business at a reduced price. 5. Partnership or Joint Venture Purchase Proposal: Partnerships and joint ventures are common in Mississippi businesses. This proposal type focuses on acquiring an ownership stake in an existing partnership or forming a new joint venture. It outlines the contributions, profit-sharing arrangements, governance structure, and expected outcomes of the partnership or joint venture. 6. Asset Purchase Proposal: In certain situations, buyers might only be interested in acquiring specific assets of a Mississippi business rather than the entire business itself. This type of proposal outlines the assets to be acquired, their value, and any liabilities to be assumed by the buyer. A well-crafted Mississippi Business Purchase Proposal should address the unique aspects of the intended transaction, allowing both the buyer and the seller to make informed decisions. It typically includes financial statements, legal and operational due diligence, a purchase price offer, terms of payment, contingencies, and any other relevant details needed to proceed with the acquisition process.The Mississippi Business Purchase Proposal is a comprehensive document that outlines the terms and conditions involved in acquiring an existing business in the state of Mississippi. This proposal plays a crucial role in facilitating the purchase negotiation process and aims to provide a detailed overview of the intended transaction. Keywords: Mississippi, business purchase proposal, acquisition, existing business, negotiation, terms and conditions, transaction. There are various types of Mississippi Business Purchase Proposals, each with its unique characteristics and specifications. These include: 1. Small Business Purchase Proposal: This type of proposal targets small-scale businesses in Mississippi. It outlines the financials, assets, liabilities, and operational aspects of the business, ensuring potential buyers have a clear understanding of what they are acquiring. 2. Franchise Purchase Proposal: Franchising is a popular business model in Mississippi. Franchise Purchase Proposals focus on acquiring an established franchise within the state. These proposals highlight the franchise's track record, brand value, franchise fees, and support provided by the franchisor. 3. Corporate Merger or Acquisition Proposal: In this type of proposal, the focus is on corporate-level transactions involving larger companies in Mississippi. These proposals outline the strategic rationale behind the merger or acquisition, the financial terms, and the anticipated outcome of the transaction. 4. Distressed Business Purchase Proposal: When a business in Mississippi is facing financial difficulties or is in a distressed state, interested buyers can submit a Distressed Business Purchase Proposal. This type of proposal includes a detailed analysis of the business's current financial situation, a restructuring plan, and an offer to acquire the business at a reduced price. 5. Partnership or Joint Venture Purchase Proposal: Partnerships and joint ventures are common in Mississippi businesses. This proposal type focuses on acquiring an ownership stake in an existing partnership or forming a new joint venture. It outlines the contributions, profit-sharing arrangements, governance structure, and expected outcomes of the partnership or joint venture. 6. Asset Purchase Proposal: In certain situations, buyers might only be interested in acquiring specific assets of a Mississippi business rather than the entire business itself. This type of proposal outlines the assets to be acquired, their value, and any liabilities to be assumed by the buyer. A well-crafted Mississippi Business Purchase Proposal should address the unique aspects of the intended transaction, allowing both the buyer and the seller to make informed decisions. It typically includes financial statements, legal and operational due diligence, a purchase price offer, terms of payment, contingencies, and any other relevant details needed to proceed with the acquisition process.

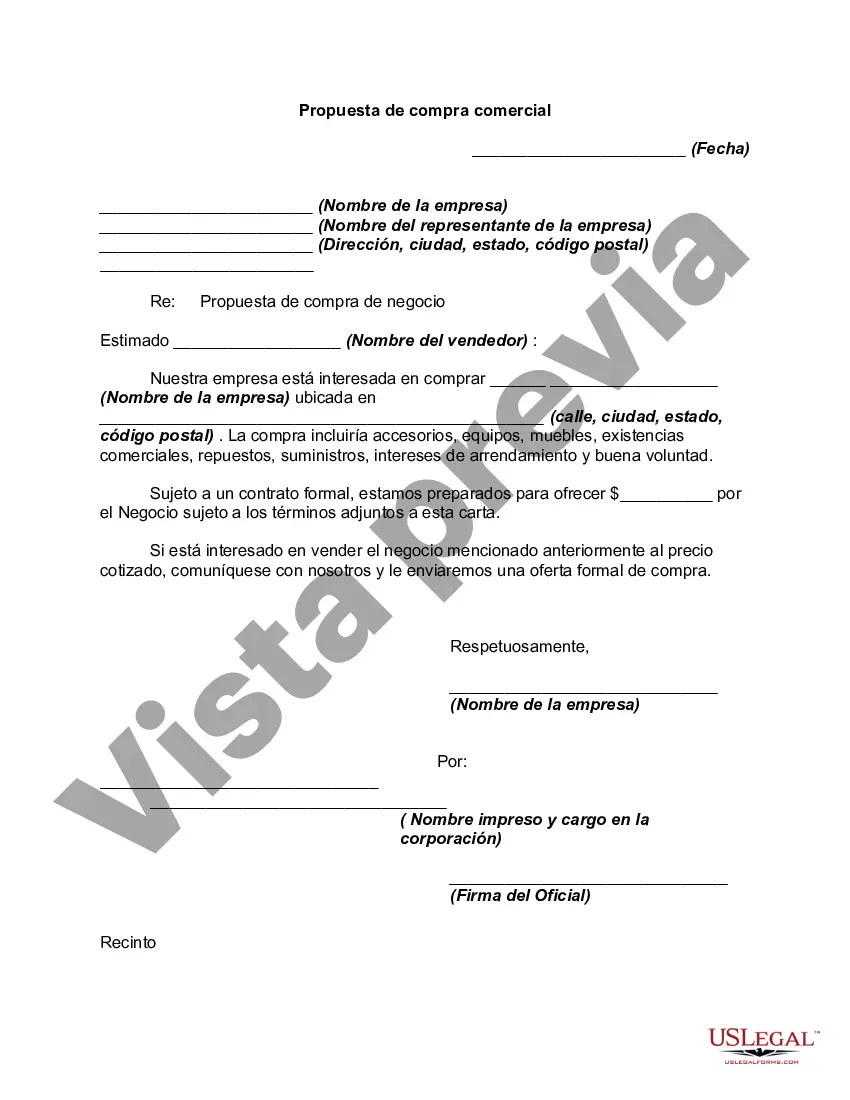

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.