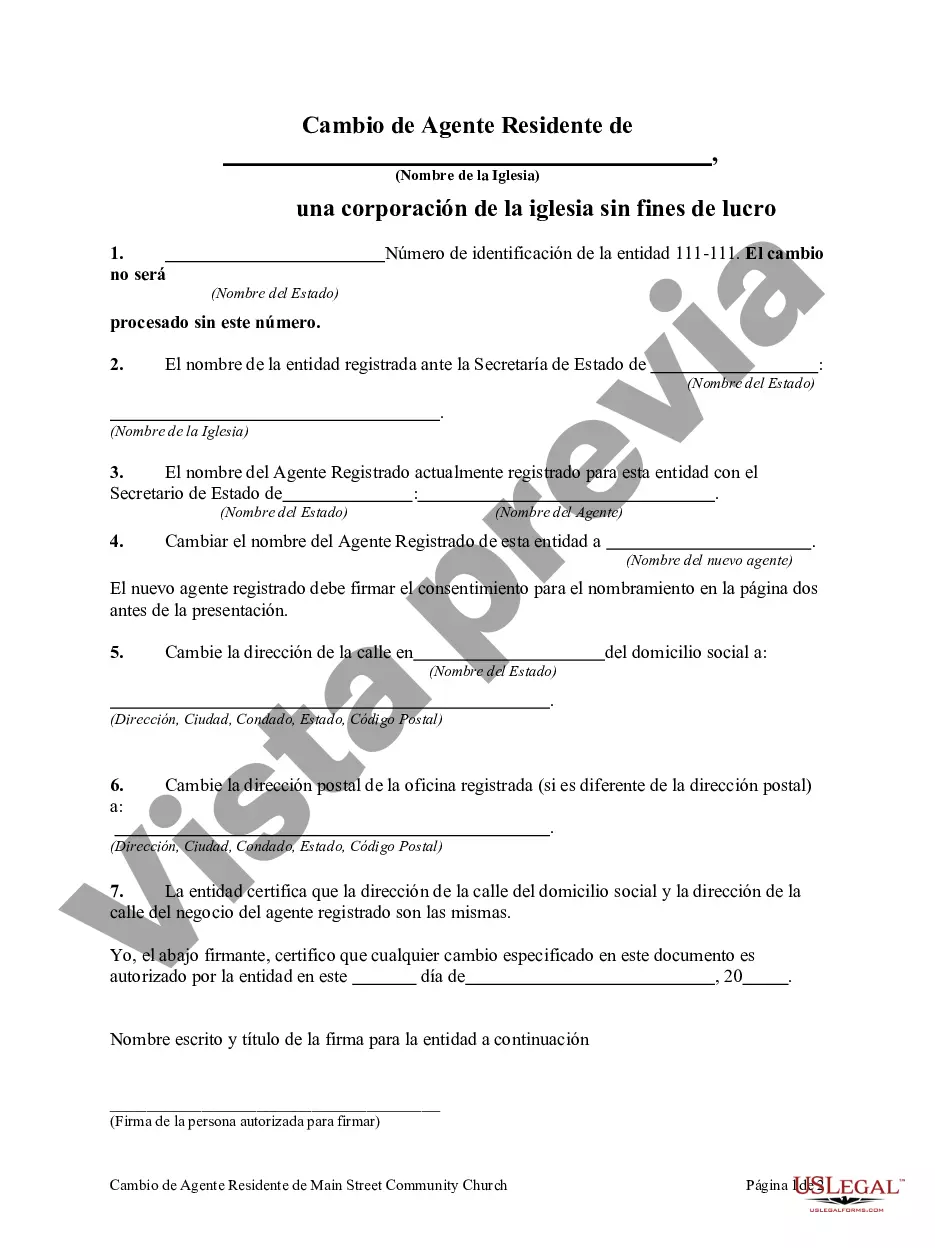

Mississippi Change of Resident Agent of Non-Profit Church Corporation Description: A Mississippi Change of Resident Agent of Non-Profit Church Corporation refers to the process of updating the registered agent information for a non-profit church corporation in the state of Mississippi. Every non-profit church corporation in Mississippi is required to have a registered agent who acts as the official point of contact for legal and administrative matters. Keywords: Mississippi, Change, Resident Agent, Non-Profit, Church Corporation, Registered Agent, Legal, Administrative. In Mississippi, a non-profit church corporation needs to have a registered agent who is a legal resident of the state and has a physical address within Mississippi. The registered agent is responsible for receiving legal documents, tax notices, and other official communications on behalf of the church corporation. When there is a change in the resident agent, it is essential for the corporation to update this information with the Mississippi Secretary of State's office. This process is known as the Change of Resident Agent of Non-Profit Church Corporation. By completing this change, the church corporation ensures that its legal and administrative communications are properly handled and received by the appointed resident agent. There are different types of Mississippi Change of Resident Agent of Non-Profit Church Corporation: 1. Voluntary Change of Resident Agent: This type of change occurs when the church corporation voluntarily chooses to update their registered agent information. It may be necessary due to various reasons such as the resignation or relocation of the existing resident agent, or a decision to appoint a new individual who better suits the needs of the corporation. 2. Involuntary Change of Resident Agent: This type of change may occur when the registered agent is no longer able or eligible to fulfill their role. It can happen due to the death of the registered agent, their incapacity, or disqualification from holding the position. In such cases, the church corporation is required to appoint a new resident agent to ensure continuity in legal and administrative matters. 3. Change of Resident Agent during Annual Report Filing: In Mississippi, non-profit church corporations are required to file an annual report with the Secretary of State's office. During this regular filing process, if there has been a change in the resident agent, the church corporation can update this information along with the annual report. To complete the Mississippi Change of Resident Agent of Non-Profit Church Corporation, the church corporation needs to submit the necessary form to the Mississippi Secretary of State's office. The form typically requires detailed information about the corporation, the outgoing resident agent, and the incoming resident agent. Additionally, a filing fee may be applicable. It is crucial for non-profit church corporations to ensure that their registered agent information is up to date with the Mississippi Secretary of State's office. Failure to comply with this requirement may lead to missed legal notices, administrative issues, or potential penalties. In conclusion, the Mississippi Change of Resident Agent of Non-Profit Church Corporation is an important process that allows non-profit church corporations to maintain accurate and updated information on their registered agent. By completing this change, they ensure smooth handling of legal and administrative matters, while fulfilling the state's requirements for maintaining an active and compliant status.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mississippi Cambio de Agente Residente de Non-Profit Church Corporation - Change of Resident Agent of Non-Profit Church Corporation

Description

How to fill out Mississippi Cambio De Agente Residente De Non-Profit Church Corporation?

Choosing the best legitimate papers design can be a struggle. Naturally, there are tons of layouts available on the Internet, but how do you find the legitimate develop you need? Make use of the US Legal Forms site. The assistance delivers thousands of layouts, like the Mississippi Change of Resident Agent of Non-Profit Church Corporation, that can be used for organization and personal requires. Every one of the types are checked out by experts and meet federal and state specifications.

In case you are presently registered, log in in your account and then click the Acquire option to have the Mississippi Change of Resident Agent of Non-Profit Church Corporation. Use your account to check throughout the legitimate types you may have purchased in the past. Visit the My Forms tab of your account and acquire one more duplicate in the papers you need.

In case you are a fresh consumer of US Legal Forms, allow me to share straightforward guidelines that you should comply with:

- Initially, make certain you have selected the correct develop to your metropolis/region. You are able to look through the shape using the Review option and study the shape outline to guarantee it is the right one for you.

- If the develop is not going to meet your expectations, take advantage of the Seach area to discover the right develop.

- When you are certain the shape is proper, click the Purchase now option to have the develop.

- Pick the rates plan you desire and enter the needed info. Create your account and pay money for the order using your PayPal account or Visa or Mastercard.

- Select the submit file format and acquire the legitimate papers design in your product.

- Total, change and printing and sign the attained Mississippi Change of Resident Agent of Non-Profit Church Corporation.

US Legal Forms is the largest library of legitimate types that you will find different papers layouts. Make use of the service to acquire expertly-manufactured documents that comply with express specifications.