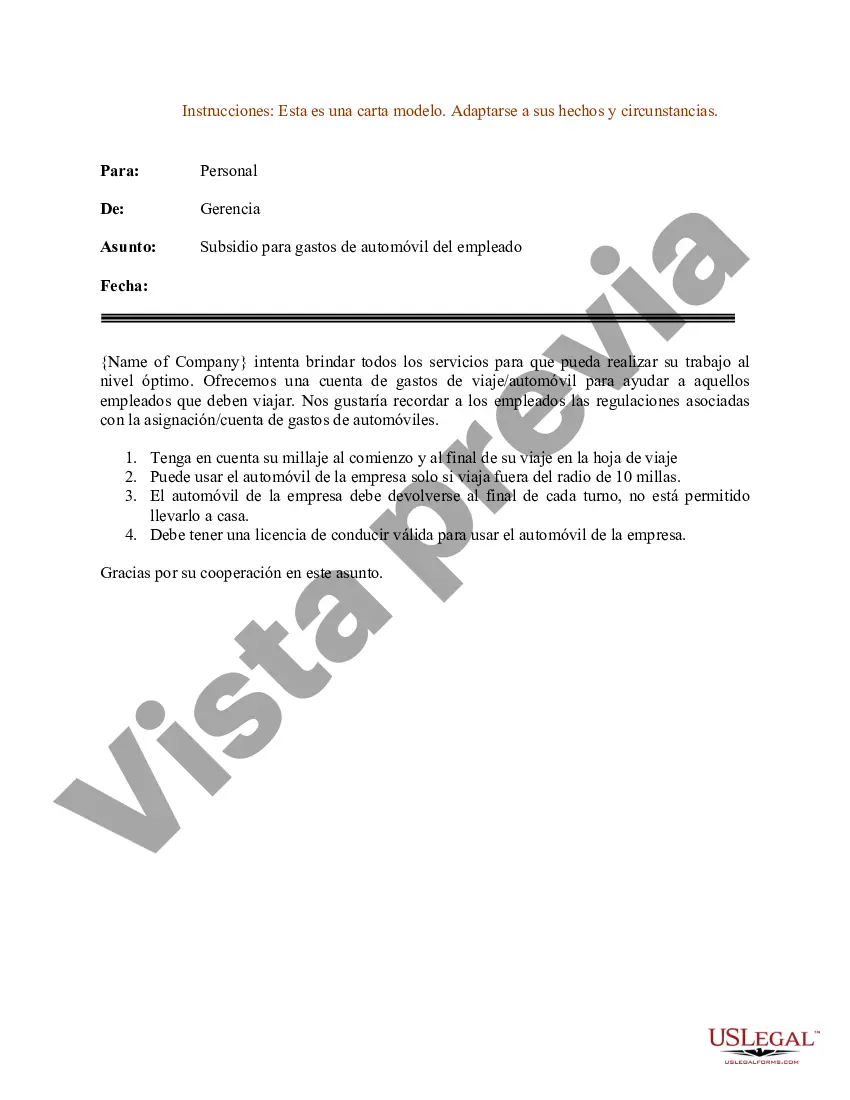

Dear [Employee], I hope this letter finds you well. I am writing to provide you with important information regarding the Mississippi Sample Letter for Employee Automobile Expense Allowance. This allowance aims to assist you in covering the costs associated with using your personal vehicle for work-related purposes. The state of Mississippi recognizes the expenses incurred by employees who regularly use their vehicles for work-related activities. This Sample Letter serves as an official document that confirms the agreement between the employer and the employee regarding the automobile expense allowance. We understand that using your own vehicle for work-related tasks incurs various costs such as fuel, maintenance, insurance, and other associated expenses. The purpose of providing this allowance is to support our employees in meeting these financial burdens and to ensure that their work-related transportation needs are adequately covered. Different types of Mississippi Sample Letters for Employee Automobile Expense Allowance exist, including: 1. Initial Allowance Agreement: This letter is to be provided to the employee when they first start utilizing their personal vehicle for work purposes. It outlines the terms and conditions of the allowance, including eligible expenses, reimbursement procedures, and reporting requirements. 2. Allowance Adjustment Letter: In cases where there are changes to the employee's work-related driving requirements or reimbursement rates, this letter serves as an official notification of any adjustments made to the existing allowance agreement. 3. Termination/Alteration Letter: This letter notifies the employee of any modifications or termination of the allowance agreement due to changes in their job responsibilities, relocation, or other factors that may affect their work-related transportation needs. By offering this allowance, we aim to provide our employees with financial assistance and acknowledge the value of their personal vehicles in carrying out their job responsibilities effectively. However, it is important to note that the allowance is subject to IRS regulations and should be used solely for legitimate business purposes. To claim reimbursement under this allowance, you will be required to maintain accurate records of mileage, fuel receipts, maintenance bills, and any other eligible expenses incurred while using your personal vehicle for work. Our company will provide specific guidelines on the documentation needed and the process for reimbursement. Please review the attached Mississippi Sample Letter for Employee Automobile Expense Allowance carefully, as it outlines your rights and responsibilities in regard to this benefit. If you have any questions or concerns, please do not hesitate to reach out to the Human Resources department. We appreciate your dedication and commitment to your role within our organization. It is our priority to ensure that you are supported in your work-related transportation needs. We believe that this allowance will contribute to your overall satisfaction and productivity. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Title/Organization]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mississippi Modelo de carta para asignación de gastos de automóvil para empleados - Sample Letter for Employee Automobile Expense Allowance

Description

How to fill out Mississippi Modelo De Carta Para Asignación De Gastos De Automóvil Para Empleados?

Discovering the right lawful document design can be quite a have difficulties. Obviously, there are a variety of layouts available on the Internet, but how can you discover the lawful form you will need? Make use of the US Legal Forms site. The service gives a large number of layouts, including the Mississippi Sample Letter for Employee Automobile Expense Allowance, which can be used for business and private demands. Every one of the types are inspected by experts and meet up with state and federal requirements.

In case you are already authorized, log in in your bank account and then click the Download option to get the Mississippi Sample Letter for Employee Automobile Expense Allowance. Use your bank account to look with the lawful types you might have bought formerly. Proceed to the My Forms tab of your bank account and have an additional copy in the document you will need.

In case you are a whole new end user of US Legal Forms, allow me to share easy recommendations that you should comply with:

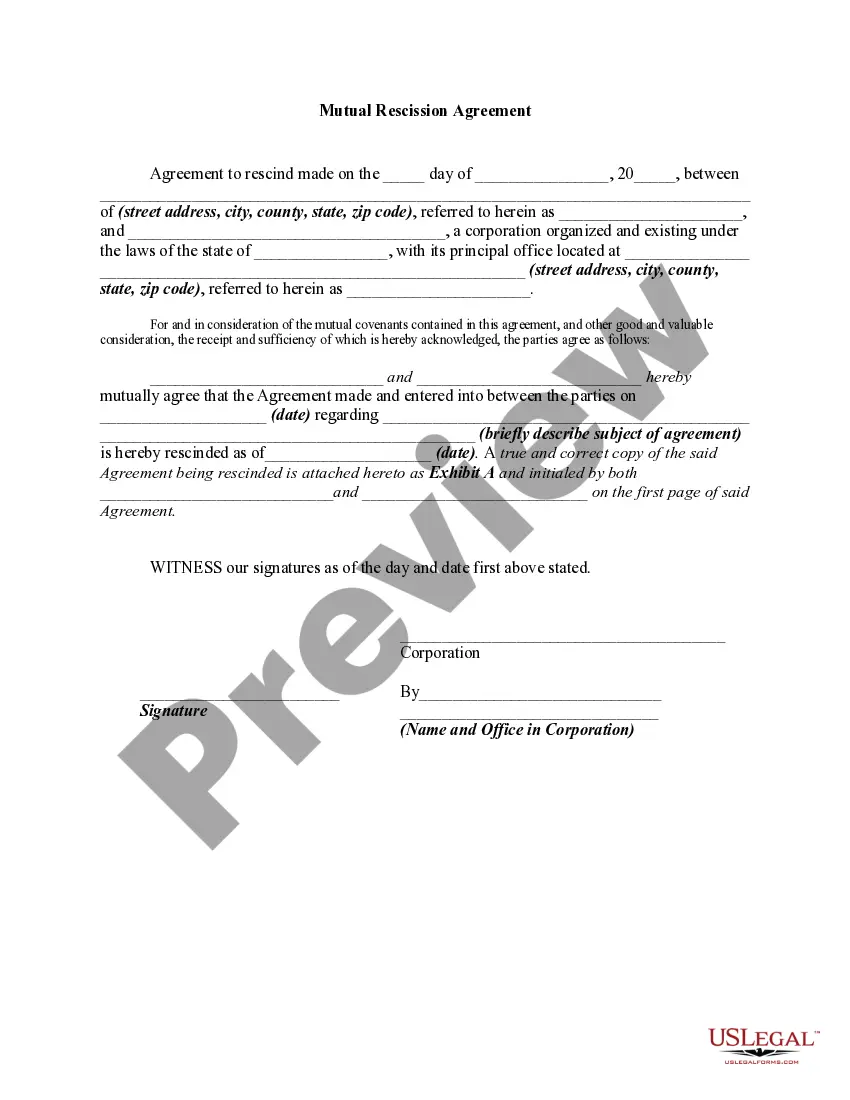

- Initially, ensure you have chosen the correct form for the metropolis/state. It is possible to check out the form while using Review option and study the form explanation to make certain this is the best for you.

- If the form fails to meet up with your expectations, take advantage of the Seach industry to get the right form.

- When you are sure that the form is proper, click on the Get now option to get the form.

- Opt for the pricing prepare you need and enter the required information. Design your bank account and pay money for the order utilizing your PayPal bank account or bank card.

- Select the document formatting and download the lawful document design in your product.

- Total, modify and print out and sign the acquired Mississippi Sample Letter for Employee Automobile Expense Allowance.

US Legal Forms is the biggest local library of lawful types for which you can see various document layouts. Make use of the company to download appropriately-made paperwork that comply with status requirements.