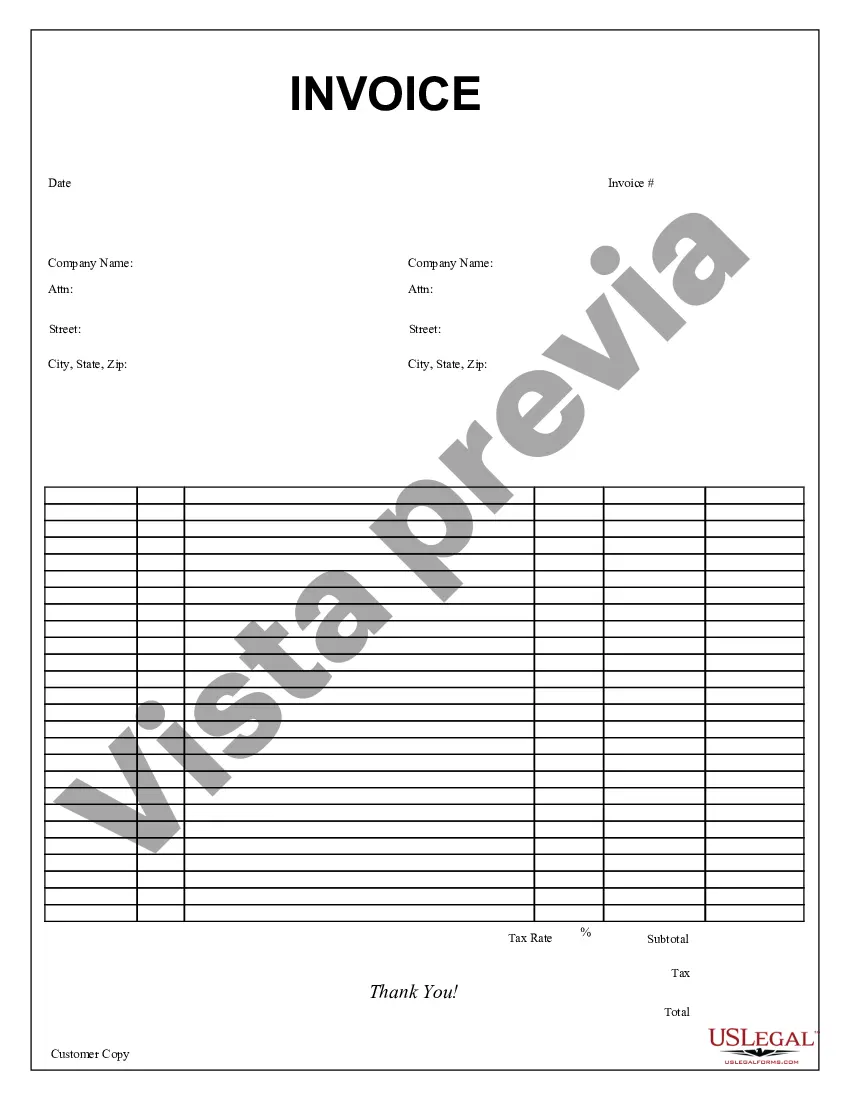

Title: Understanding Mississippi Purchase Invoices: Types and Detailed Description Keywords: Mississippi Purchase Invoice, Definition, Types, Purpose, Components, Important Details, Legal Document, Documentation, Invoice Pads, Online Invoicing, Types of Mississippi Purchase Invoices. Introduction: In the business world, accurate and comprehensive documentation plays a pivotal role. One such crucial document is the Mississippi Purchase Invoice. Known for its importance in recording transactions and serving as proof of purchase, the Mississippi Purchase Invoice is essential for businesses in Mississippi. In this article, we will provide a detailed description of what the Mississippi Purchase Invoice entails, its purpose, and highlight different types of such invoices. Definition and Purpose: A Mississippi Purchase Invoice is a legal document that enables businesses in Mississippi to record sales transactions between a buyer and a seller. Also known as a sales invoice or sales receipt, it primarily serves two purposes: facilitating the sale of goods or services and providing legal documentation for financial and tax obligations. Components of a Mississippi Purchase Invoice: A Mississippi Purchase Invoice typically comprises several vital components, ensuring the transaction details are accurately recorded. The main elements of a purchase invoice include: 1. Header: The header contains the business name, logo, contact information, and invoice number, enabling easy identification for both buyer and seller. 2. Seller Information: The invoice includes the seller's contact details, such as name, address, phone number, and email, ensuring clear communication channels. 3. Buyer Information: The buyer's details, such as name, address, and contact information, are essential for record-keeping and future references. 4. Itemized Description: This section lists the goods or services purchased, including a comprehensive description, quantity, unit price, and total amount, ensuring transparency in the transaction. 5. Taxes and Discounts: Mississippi Purchase Invoices often include applicable taxes, such as sales tax, and any applicable discounts to reflect the total amount payable accurately. 6. Payment Terms: Invoices specify the agreed-upon payment terms, such as due date, payment methods, and any penalties or late fees for delayed payments. 7. Total Amount Due: The invoice provides the final calculation of the total amount payable by the buyer, including all charges, taxes, and discounts. Types of Mississippi Purchase Invoices: 1. Paper-based Purchase Invoice: Traditional invoices printed on invoice pads or predesigned stationary that can be filled manually with a pen or typewriter. 2. Online Purchase Invoice: With technological advancements, businesses now have the option to generate invoices electronically using dedicated invoicing software or online platforms. Conclusion: The Mississippi Purchase Invoice is a critical document for businesses in Mississippi, serving as official proof of transactions, facilitating financial and tax obligations. This comprehensive invoice effectively records essential details such as the buyer's and seller's information, goods or services purchased, taxes, discounts, and payment terms. Businesses can choose between paper-based or online invoicing methods, depending on their preferences and requirements. Understanding and utilizing the Mississippi Purchase Invoice is crucial for seamless business operations and maintaining accurate financial records in compliance with legal regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mississippi Factura de compra - Purchase Invoice

Description

How to fill out Mississippi Factura De Compra?

It is possible to invest hrs on the Internet looking for the lawful document design that fits the state and federal specifications you need. US Legal Forms supplies 1000s of lawful varieties which are analyzed by pros. You can actually download or printing the Mississippi Purchase Invoice from the service.

If you have a US Legal Forms bank account, you are able to log in and then click the Down load option. Following that, you are able to complete, revise, printing, or indication the Mississippi Purchase Invoice. Each lawful document design you get is the one you have permanently. To have one more backup of any purchased kind, proceed to the My Forms tab and then click the related option.

If you are using the US Legal Forms web site the first time, adhere to the straightforward directions under:

- Initial, make certain you have selected the proper document design for your county/area of your choosing. Read the kind information to ensure you have picked out the proper kind. If available, utilize the Review option to search throughout the document design too.

- If you wish to locate one more version of your kind, utilize the Look for area to get the design that meets your requirements and specifications.

- Once you have identified the design you need, click on Acquire now to move forward.

- Choose the prices plan you need, type your accreditations, and sign up for a free account on US Legal Forms.

- Complete the purchase. You may use your Visa or Mastercard or PayPal bank account to pay for the lawful kind.

- Choose the file format of your document and download it to your device.

- Make changes to your document if necessary. It is possible to complete, revise and indication and printing Mississippi Purchase Invoice.

Down load and printing 1000s of document web templates making use of the US Legal Forms web site, which provides the largest variety of lawful varieties. Use expert and status-specific web templates to deal with your organization or individual requires.