Mississippi Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc.

Description

How to fill out Agreement And Plan Of Merger By Filtertek, Inc., Filtertek De Puerto Rico, And Filtertek USA, Inc.?

US Legal Forms - one of many greatest libraries of lawful varieties in the United States - offers a wide array of lawful record web templates it is possible to acquire or printing. Utilizing the internet site, you can find a large number of varieties for enterprise and person uses, categorized by groups, claims, or keywords.You can find the latest types of varieties just like the Mississippi Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc. within minutes.

If you have a registration, log in and acquire Mississippi Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc. from the US Legal Forms catalogue. The Obtain option can look on each type you see. You get access to all in the past delivered electronically varieties within the My Forms tab of your own profile.

In order to use US Legal Forms the very first time, allow me to share easy recommendations to help you began:

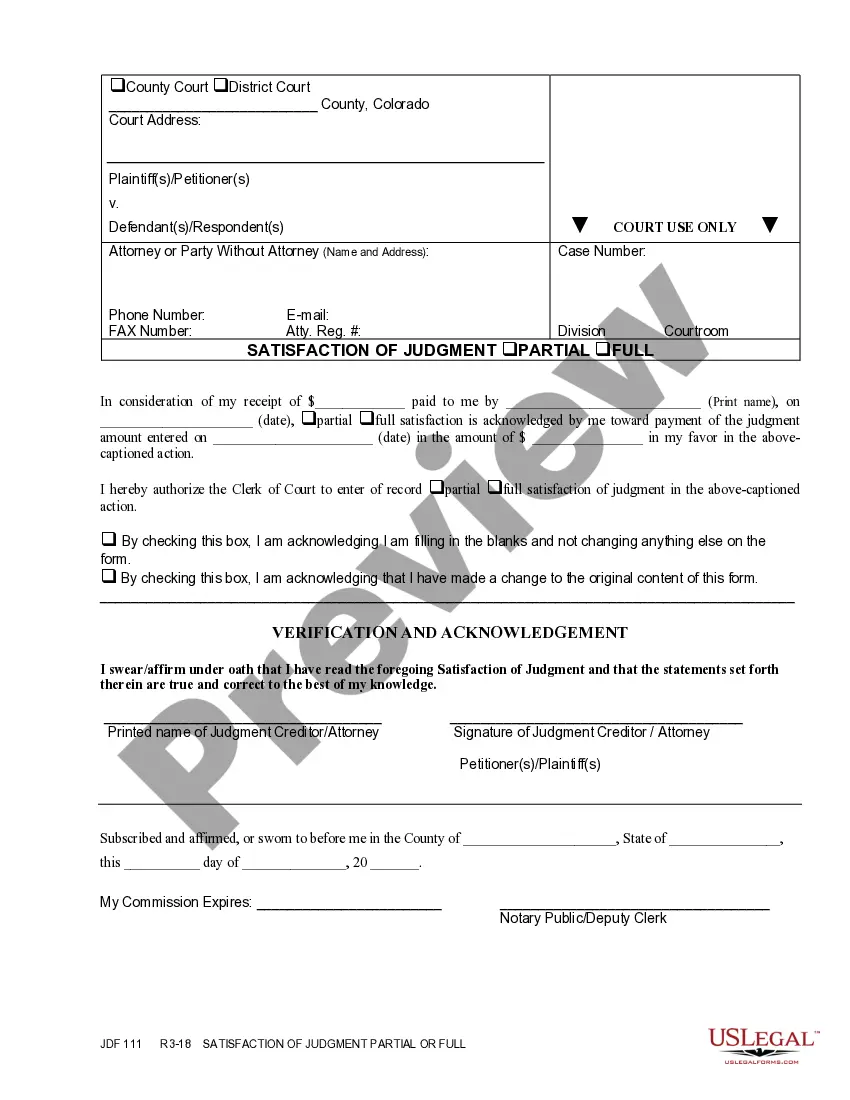

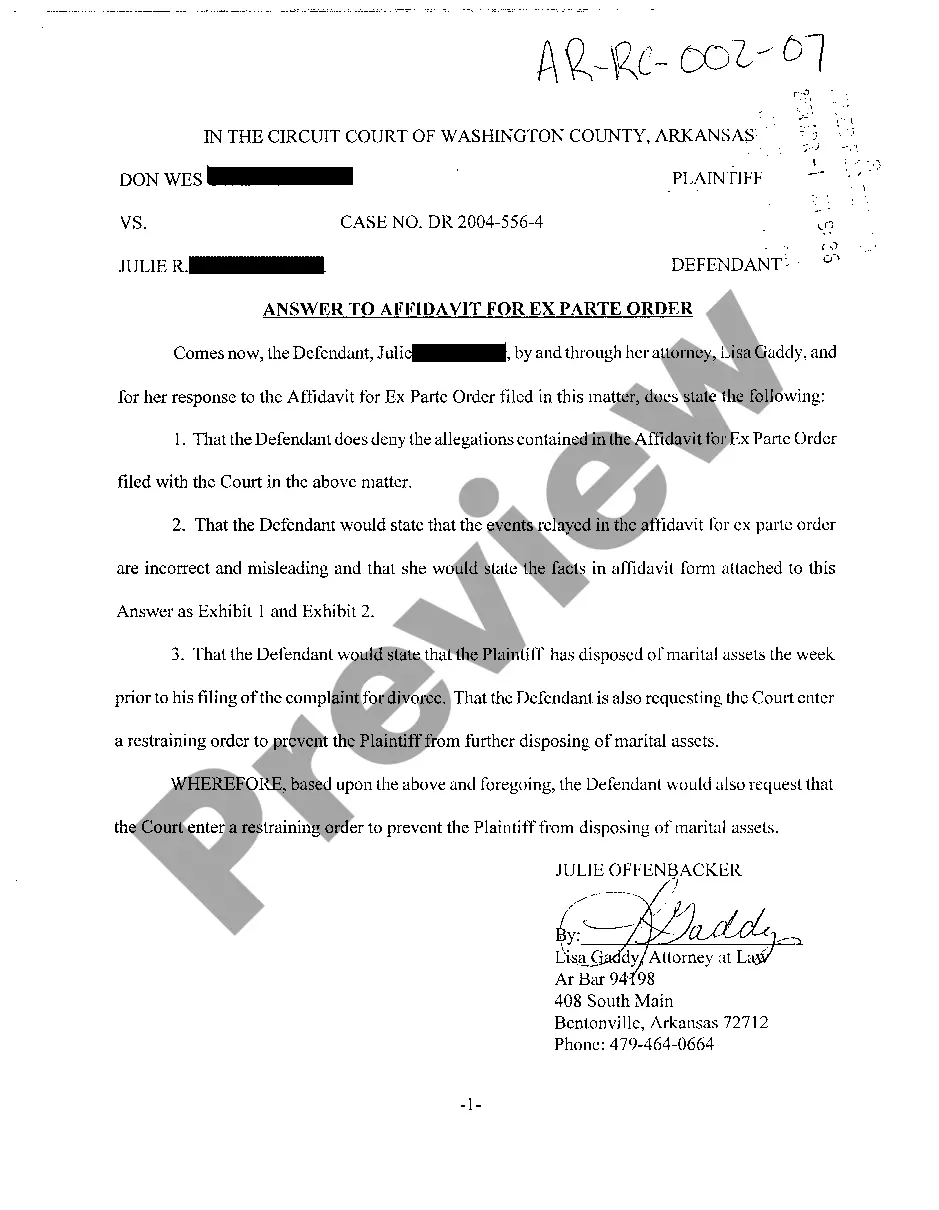

- Make sure you have chosen the proper type for your area/area. Click the Preview option to check the form`s information. See the type description to actually have chosen the right type.

- In the event the type doesn`t match your needs, utilize the Lookup discipline towards the top of the monitor to find the one who does.

- If you are happy with the form, confirm your choice by clicking the Buy now option. Then, pick the pricing program you favor and supply your accreditations to sign up for the profile.

- Process the financial transaction. Make use of charge card or PayPal profile to accomplish the financial transaction.

- Select the structure and acquire the form on your own device.

- Make alterations. Fill out, edit and printing and indication the delivered electronically Mississippi Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc..

Each and every format you added to your money lacks an expiration date which is yours forever. So, if you want to acquire or printing an additional copy, just proceed to the My Forms area and then click in the type you want.

Gain access to the Mississippi Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc. with US Legal Forms, the most comprehensive catalogue of lawful record web templates. Use a large number of professional and status-particular web templates that meet your organization or person requirements and needs.