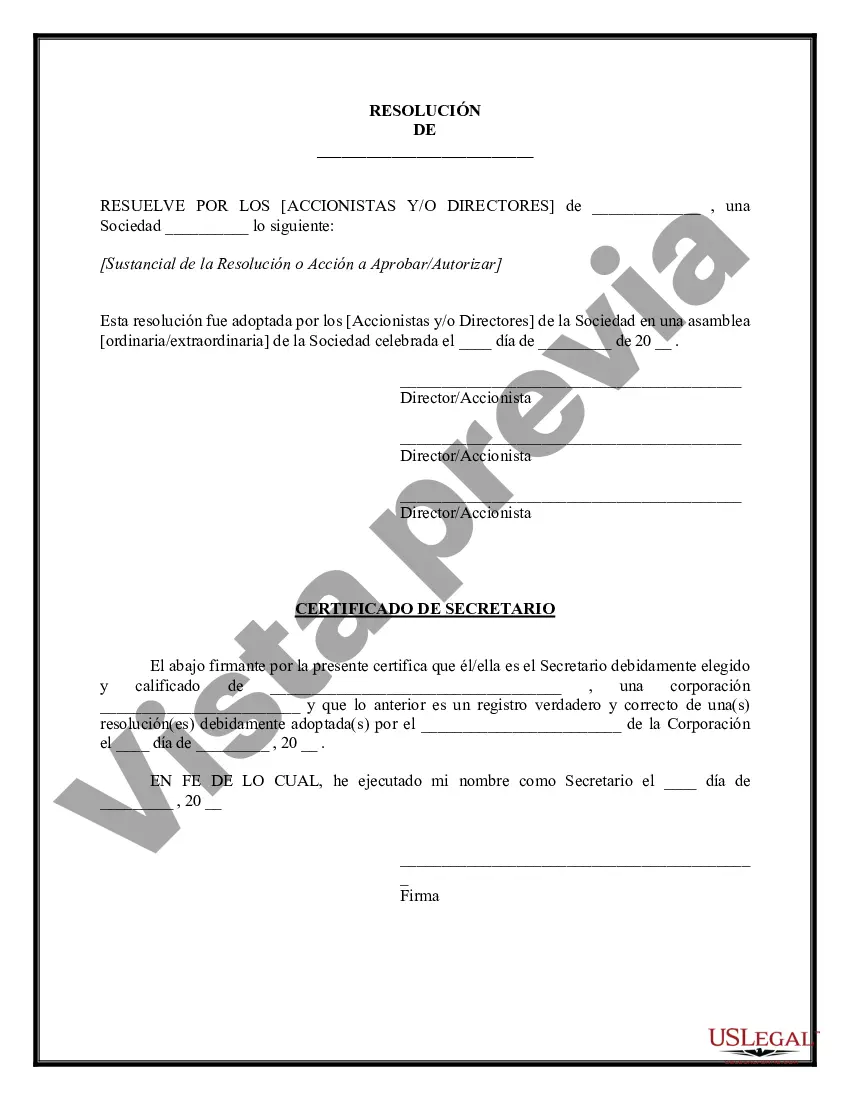

A Montana Corporate Resolution for Single Member LLC is a legal document that serves as a written record of important decisions and actions made by the sole member of a limited liability company (LLC) in the state of Montana. It is also known as a resolution for a single-member LLC or a member resolution for a single-member LLC. In Montana, a single-member LLC is an LLC with only one owner or member. While single-member LCS enjoy certain flexibility and simplicity in their structure and operation, it is still necessary for the member to have documentation to show that decisions were made in the best interests of the company and to protect the liability protection provided by the LLC structure. The Montana Corporate Resolution for Single Member LLC outlines various resolutions taken by the single member. It may include the authority to enter into contracts, borrow money, open bank accounts, appoint managers or officers, issue membership interests, or make decisions related to significant business transactions. The resolutions must be clearly stated in writing to establish the intent and consent of the single member, preventing any ambiguity or misunderstanding. Different types of Montana Corporate Resolutions for Single Member LLC may include resolutions related to: 1. Operating Agreement: The member can adopt, modify, or amend the LLC's operating agreement, which is a vital document governing the rights, powers, and responsibilities of the single member and the LLC. 2. Business Transactions: Resolutions related to significant business transactions, such as purchasing or selling assets, entering into leases or contracts, acquiring or disposing of real estate, or entering into partnerships or joint ventures. 3. Financial Matters: Resolutions related to financial matters, including authorizing loans, guarantees, mortgages, or investments on behalf of the LLC, or approving the LLC's annual budget or financial statements. 4. Taxation: Resolutions authorizing the filing of tax returns, designating a tax professional or accountant, or making elections for tax purposes. 5. Employment Matters: Resolutions authorizing the hiring or termination of employees, setting employee compensation, or granting certain benefits or incentives. 6. Dissolution or Transfer: Resolutions related to the dissolution of the LLC, admitting additional members, or transferring membership interests. The Montana Corporate Resolution for Single Member LLC should be signed and dated by the single member and kept as part of the LLC's official records. It is important to note that while the single member has the sole authority to make decisions, it is recommended to consult an attorney or a qualified professional while creating or executing these resolutions to ensure compliance with Montana state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Resolución corporativa para un solo miembro LLC - Corporate Resolution for Single Member LLC

Description

How to fill out Montana Resolución Corporativa Para Un Solo Miembro LLC?

You may spend several hours online searching for the lawful document design that meets the state and federal needs you will need. US Legal Forms offers thousands of lawful forms which are analyzed by specialists. It is possible to obtain or produce the Montana Corporate Resolution for Single Member LLC from our services.

If you already possess a US Legal Forms profile, you are able to log in and then click the Acquire switch. After that, you are able to full, modify, produce, or sign the Montana Corporate Resolution for Single Member LLC. Every lawful document design you acquire is the one you have forever. To acquire an additional duplicate of the purchased type, go to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms internet site for the first time, adhere to the straightforward guidelines beneath:

- Initial, make sure that you have chosen the right document design for the region/city of your choosing. Read the type outline to ensure you have picked the proper type. If available, make use of the Review switch to appear from the document design too.

- In order to get an additional edition of the type, make use of the Research area to find the design that suits you and needs.

- Upon having located the design you need, simply click Buy now to carry on.

- Pick the rates strategy you need, enter your credentials, and sign up for a free account on US Legal Forms.

- Full the transaction. You should use your charge card or PayPal profile to purchase the lawful type.

- Pick the formatting of the document and obtain it to your gadget.

- Make modifications to your document if required. You may full, modify and sign and produce Montana Corporate Resolution for Single Member LLC.

Acquire and produce thousands of document templates while using US Legal Forms web site, that offers the most important selection of lawful forms. Use professional and state-specific templates to handle your company or person requirements.