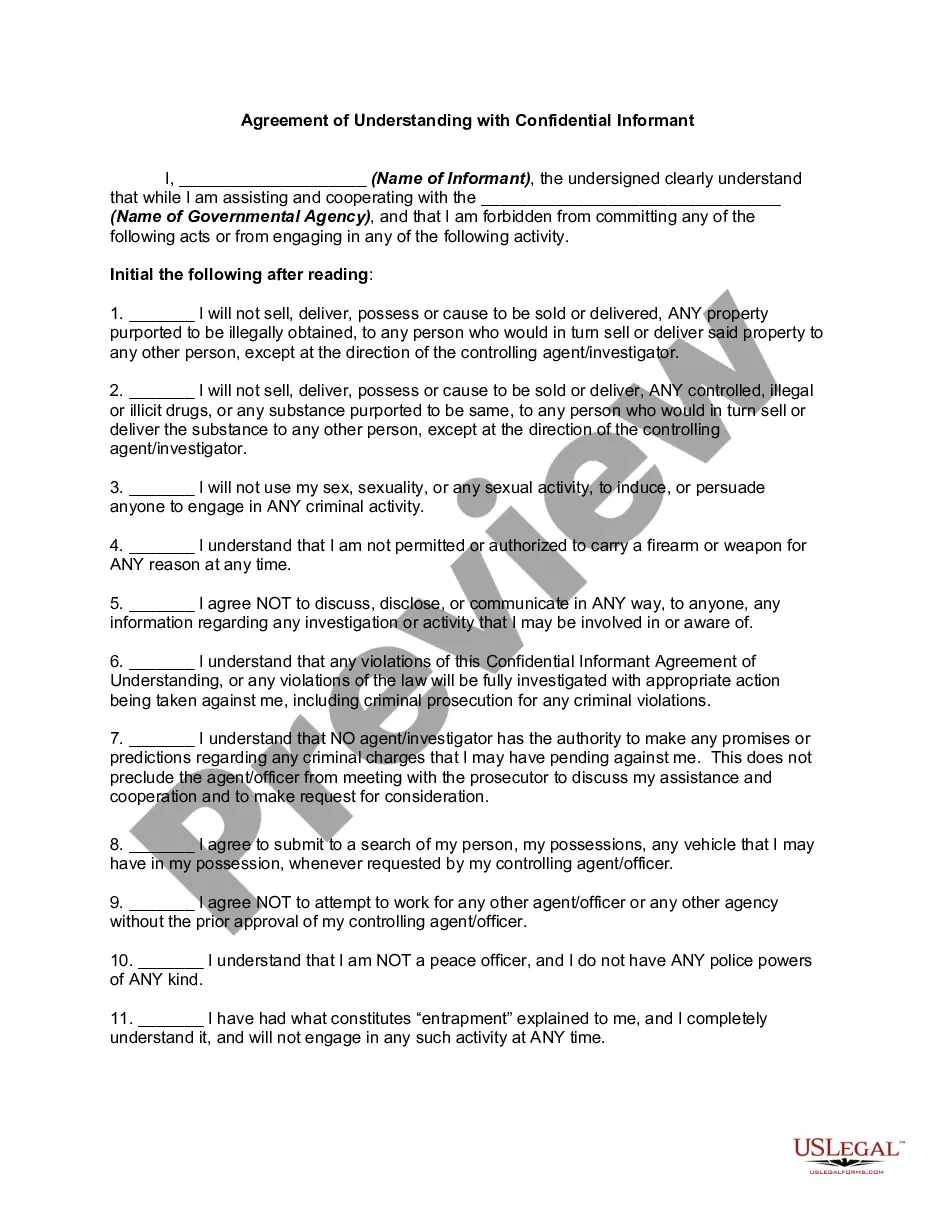

Montana Donation or Gift to Charity of Personal Property refers to the act of donating or gifting personal property to a charitable organization or non-profit in the state of Montana, United States. This process involves transferring ownership of personal property (such as furniture, artwork, vehicles, electronics, etc.) from the donor to the charitable organization without any monetary compensation. Donating personal property to charity in Montana can offer several benefits to both the donor and the charitable organization. Firstly, it allows donors to support causes they believe in while potentially gaining tax deductions for the fair market value of the donated property. This can provide a financial incentive for individuals looking to reduce their taxable income. Montana offers different types of donation or gift options when it comes to personal property. These include: 1. General Donations: This involves donating personal property of any kind to a charitable organization without any specific designation or restriction on its use. The donor may have the option to specify how the proceeds from the sale of the donated property should be used by the charity. 2. Restricted Donations: Here, the donor can specify how their personal property should be utilized by the charitable organization. For example, if a donor wants their donated furniture to be used specifically for a women's shelter, they can place restrictions on its usage. 3. Vehicle Donations: Montana also allows individuals to donate vehicles (such as cars, boats, motorcycles, etc.) to charitable organizations. The charitable organization can either keep and utilize the vehicle for its own purposes or sell it to generate funds for their programs. To make a donation or gift of personal property in Montana, individuals should follow certain steps. Firstly, they need to identify a reputable and qualified charitable organization registered under the Internal Revenue Service (IRS) guidelines. It is important to research the organization's mission, reputation, and financial transparency before making a donation. To complete the donation process, individuals must provide a detailed description of the donated personal property, including its condition, estimated fair market value, and any accompanying documentation (such as appraisals). Appraisals may be required for higher value donations in order to qualify for tax deductions. After obtaining all necessary documentation, the donor should contact the chosen charitable organization to arrange a drop-off or pick-up. It is crucial to obtain a receipt from the organization acknowledging the donation, which includes the donor's name, description of the property, date, and estimated fair market value. Finally, when tax season arrives, donors can claim the fair market value of their donated personal property as a deduction on their federal income tax return (subject to IRS regulations) if they choose to itemize deductions instead of opting for the standard deduction. It is advisable to consult with a tax professional to ensure compliance with relevant tax laws and regulations. Overall, Montana Donation or Gift to Charity of Personal Property serves as a way for individuals to support charitable causes, receive potential tax benefits, and make a meaningful impact in their community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Donación o regalo a la caridad de propiedad personal - Donation or Gift to Charity of Personal Property

Description

How to fill out Montana Donación O Regalo A La Caridad De Propiedad Personal?

Choosing the right legal papers template might be a have difficulties. Naturally, there are a variety of web templates available on the Internet, but how can you discover the legal type you require? Make use of the US Legal Forms web site. The assistance gives thousands of web templates, like the Montana Donation or Gift to Charity of Personal Property, which can be used for enterprise and personal demands. Each of the kinds are inspected by specialists and satisfy federal and state needs.

If you are previously listed, log in to the profile and then click the Down load key to get the Montana Donation or Gift to Charity of Personal Property. Utilize your profile to check throughout the legal kinds you possess purchased in the past. Check out the My Forms tab of the profile and have one more copy from the papers you require.

If you are a new customer of US Legal Forms, allow me to share simple instructions for you to comply with:

- Initial, be sure you have chosen the appropriate type for your city/state. You are able to look through the form using the Preview key and study the form explanation to guarantee it will be the right one for you.

- In the event the type does not satisfy your requirements, take advantage of the Seach area to discover the right type.

- When you are certain that the form would work, click on the Buy now key to get the type.

- Select the pricing prepare you need and enter the essential information and facts. Design your profile and purchase your order with your PayPal profile or credit card.

- Select the data file format and down load the legal papers template to the gadget.

- Comprehensive, change and print out and indication the received Montana Donation or Gift to Charity of Personal Property.

US Legal Forms is definitely the greatest collection of legal kinds in which you can find a variety of papers web templates. Make use of the company to down load skillfully-produced paperwork that comply with express needs.