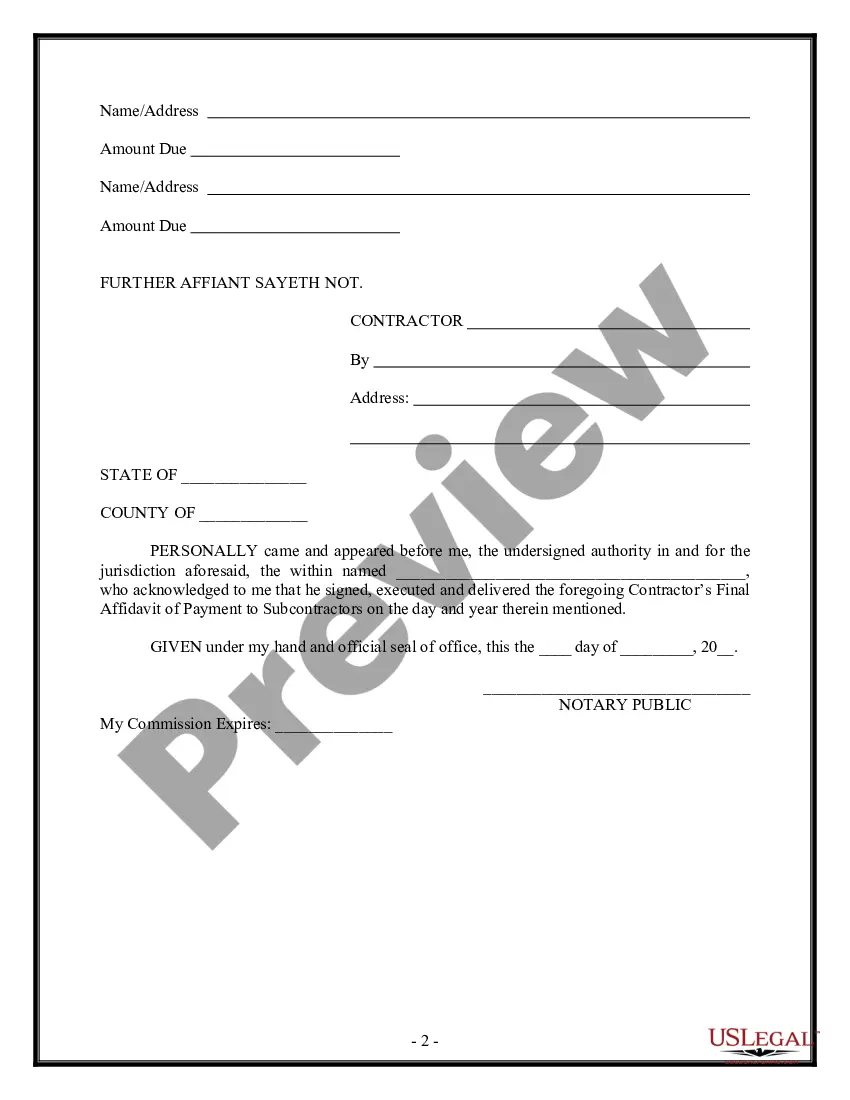

Montana Contractor's Final Affidavit of Payment to Subcontractors

Description

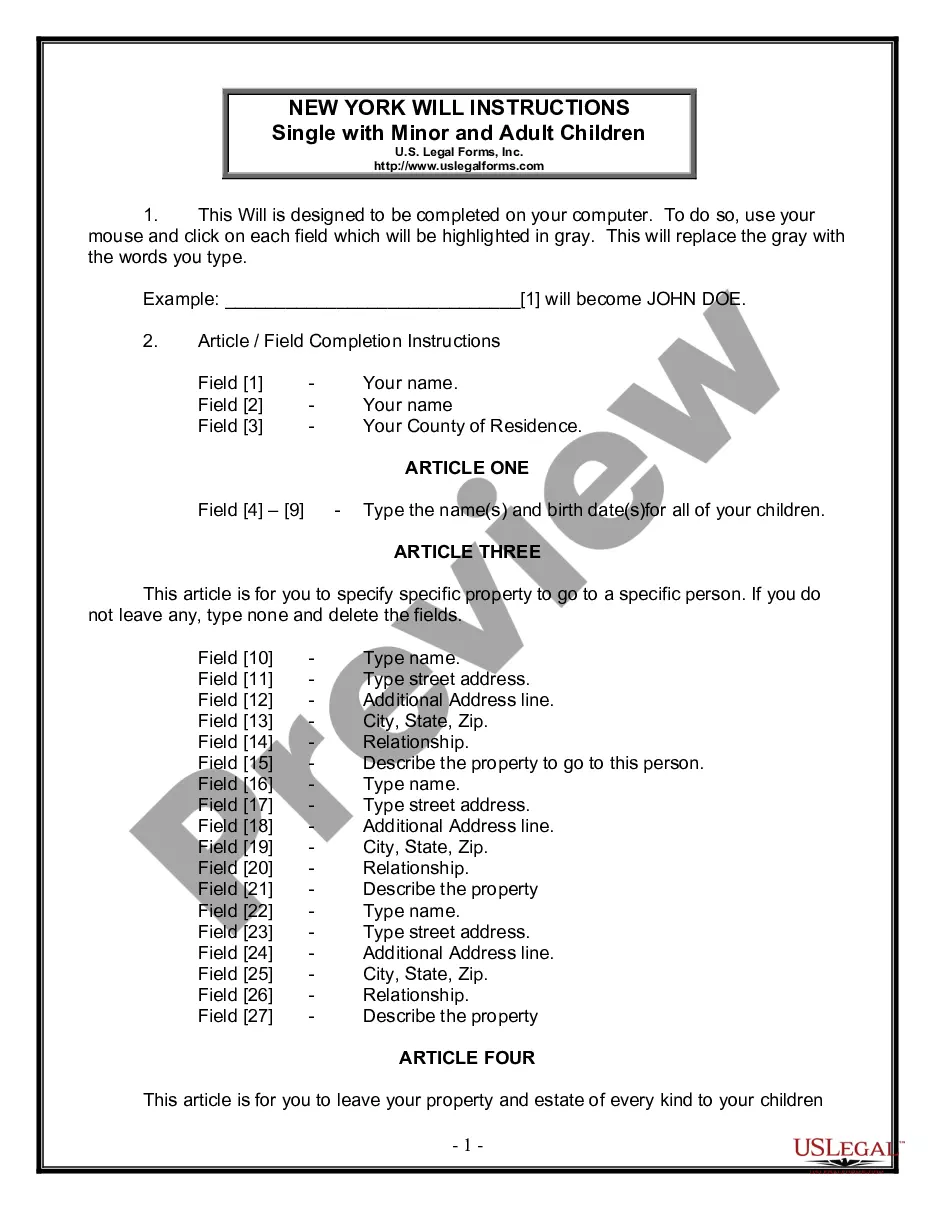

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the site, you can access thousands of templates for business and personal needs, organized by categories, states, or keywords. You can receive the latest templates such as the Montana Contractor's Final Affidavit of Payment to Subcontractors in moments.

If you already have an account, Log In to download the Montana Contractor's Final Affidavit of Payment to Subcontractors from your US Legal Forms collection. The Download button will appear on every template you view. You can access all previously downloaded templates from the My documents section of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Choose the file format and download the form to your device. Edit, fill out, print, and sign the downloaded Montana Contractor's Final Affidavit of Payment to Subcontractors.

Each template you add to your account does not expire and is yours forever. So, if you need to download or print another copy, simply visit the My documents section and click on the form you need. Access the Montana Contractor's Final Affidavit of Payment to Subcontractors with US Legal Forms, the most extensive library of legal document formats. Utilize a wide array of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct template for your city/county.

- Click the Preview button to review the details of the form.

- Check the description of the template to confirm you have chosen the right one.

- If the template does not fulfill your requirements, use the Search box at the top of the screen to find a suitable one.

- Once you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select your preferred pricing plan and provide your details to register for the account.

Form popularity

FAQ

The following steps can help contractors get the payments they are owed.Create Solid Contracts. A solid contract is the strongest weapon in your arsenal.Optimize Your Contracts.Send Invoices for Progress Payments.Use Preliminary Notices & Conditional Lien Waivers.5 Seek Payment After the Project is Completed.

Consulting services you have provided. interest on overdue progress payments. your losses and additional costs due to work being deleted from your contract while you suspended work. cash security and retention money.

Your losses and additional expenses due to work being deleted from your contract while you suspended work under the protection of the Act; cash security and retention money; and. at the end of the contract, a claim under the Act can be made for the final payment.

A subcontractor is a person who works for a contractor. A contractor is a person or company who works with businesses on a contract basis and is paid for completing projects. Like contractors, subcontractors are self-employed, and they can help contractors on projects that require additional help or skills to complete.

AIA Document G706A21221994 supports AIA Document G70621221994 in the event that the owner requires a sworn statement of the contractor stating that all releases or waivers of liens have been received.

It must:be served by or on behalf of a claimant; and.identify the respondent and the construction work performed or related goods and services; and.indicate the amount. A claim for $10,000 + GST should be described as $11,000 including GST; and.relate to work performed on or prior to a reference date.

Independent subcontractors regularly purchase materials and equipment related to their specific projects. Expenses for materials necessary for completion of a job may be directly deducted from taxable income on your tax return.

Subcontractor Costs means all costs incurred by subcontractors for the project, including labor and non-labor costs.

You can claim:Fuel costs.Repairs and servicing costs.Maintenance costs.Interest owed on the vehicle loan.Insurance premiums related to the vehicle.Payments on any lease agreements for the vehicle.Registration costs.Depreciation.

Typically, a contractor works under a contractual agreement to provide services, labor or materials to complete a project. Subcontractors are businesses or individuals that carry out work for a contractor as part of the larger contracted project.