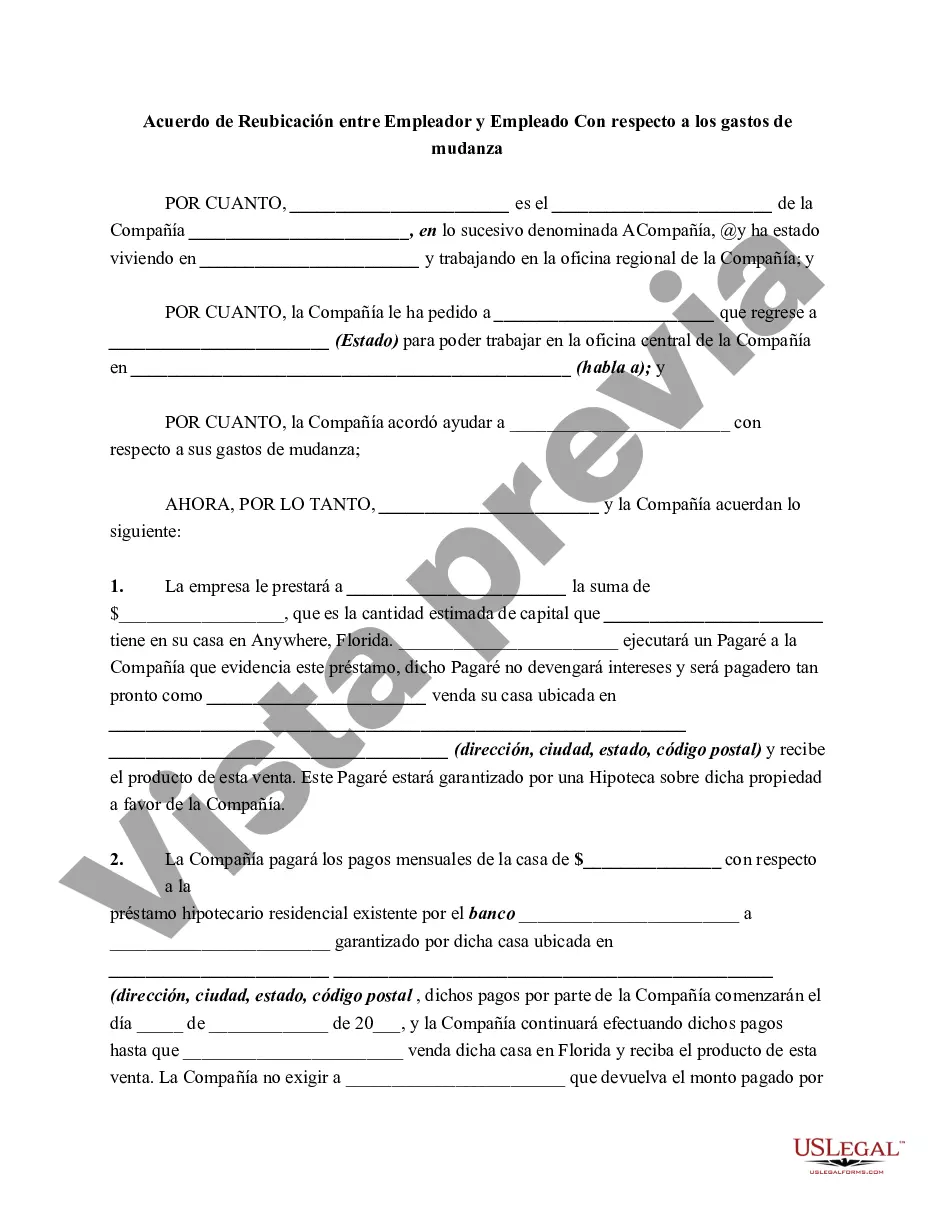

Montana Relocation Agreement between Employer and Employee Regarding Moving Expenses is a legally binding document that outlines the terms and conditions related to an employee's relocation to Montana and the expenses incurred during the move. This agreement seeks to protect the interests of both the employer and the employee, ensuring a smooth transition and fair reimbursement for moving costs. In this agreement, various types of expenses may be addressed, including transportation costs, temporary lodging, meals, packing and shipping, storage, and other related expenses. The agreement allows for flexibility in determining which expenses will be covered and reimbursed by the employer. Different types of Montana Relocation Agreements between Employer and Employee Regarding Moving Expenses can be categorized based on the reimbursement methods, such as: 1. Lump Sum Relocation Agreement: Under this arrangement, the employer provides the employee with a fixed amount of money to cover all eligible moving expenses. It is the employee's responsibility to manage the funds throughout the relocation process. 2. Direct Payment Agreement: In this type of agreement, the employer directly pays the relocation service providers on behalf of the employee. The employee is relieved of the financial burden of paying for the moving expenses upfront, as the employer settles the bills directly. 3. Reimbursement Agreement: This agreement requires the employee to pay for all the eligible moving expenses upfront. Once the employee submits valid receipts and expense reports, the employer will reimburse the employee for the approved expenses. This type of agreement ensures that the employee retains control over the relocation process while receiving reimbursement. To ensure clarity and avoid misunderstandings, a Montana Relocation Agreement between Employer and Employee Regarding Moving Expenses should include specific provisions, such as: 1. Eligible Expenses: Clearly define which expenses are considered eligible for reimbursement, such as transportation costs, hotel stays, storage fees, packing materials, and temporary lodging. 2. Expense Limits: Set limitations on reimbursement amounts for each type of expense to avoid excessive costs and provide a clear budget for the employee. 3. Documentation Requirements: Specify the necessary documents, such as receipts, invoices, and expense reports, that the employee must provide to claim reimbursement. This helps maintain transparency and ensures accurate record-keeping. 4. Timeframe for Submission: Establish a deadline for the employee to submit expense claims and outline the timeframe within which the employer will process reimbursements. 5. Repayment Obligations: Clarify any circumstances in which the employee may be required to repay relocation expenses, such as if they voluntarily leave the company within a specified period after the move. Overall, a Montana Relocation Agreement between Employer and Employee Regarding Moving Expenses serves as a crucial tool in managing a smooth and well-organized relocation process. It provides clarity on the financial aspects of the move while protecting the interests of both the employer and the employee.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Acuerdo de reubicación entre el empleador y el empleado con respecto a los gastos de mudanza - Relocation Agreement between Employer and Employee Regarding Moving Expenses

Description

How to fill out Montana Acuerdo De Reubicación Entre El Empleador Y El Empleado Con Respecto A Los Gastos De Mudanza?

Choosing the right legal record template can be quite a struggle. Obviously, there are plenty of layouts available on the net, but how would you get the legal type you will need? Make use of the US Legal Forms website. The services offers 1000s of layouts, such as the Montana Relocation Agreement between Employer and Employee Regarding Moving Expenses, which can be used for organization and private requires. Each of the forms are examined by experts and meet up with federal and state requirements.

Should you be currently authorized, log in to your profile and click on the Acquire button to find the Montana Relocation Agreement between Employer and Employee Regarding Moving Expenses. Make use of profile to check through the legal forms you possess purchased previously. Visit the My Forms tab of your profile and acquire another backup of your record you will need.

Should you be a fresh consumer of US Legal Forms, listed below are straightforward recommendations for you to comply with:

- First, ensure you have chosen the proper type for the area/state. You are able to check out the shape using the Preview button and look at the shape description to ensure it is the best for you.

- If the type will not meet up with your preferences, use the Seach area to discover the right type.

- Once you are positive that the shape would work, go through the Buy now button to find the type.

- Select the pricing prepare you need and enter the required details. Build your profile and pay money for the transaction utilizing your PayPal profile or Visa or Mastercard.

- Pick the file format and acquire the legal record template to your product.

- Comprehensive, edit and produce and indication the received Montana Relocation Agreement between Employer and Employee Regarding Moving Expenses.

US Legal Forms may be the greatest catalogue of legal forms where you can find numerous record layouts. Make use of the company to acquire appropriately-manufactured papers that comply with status requirements.