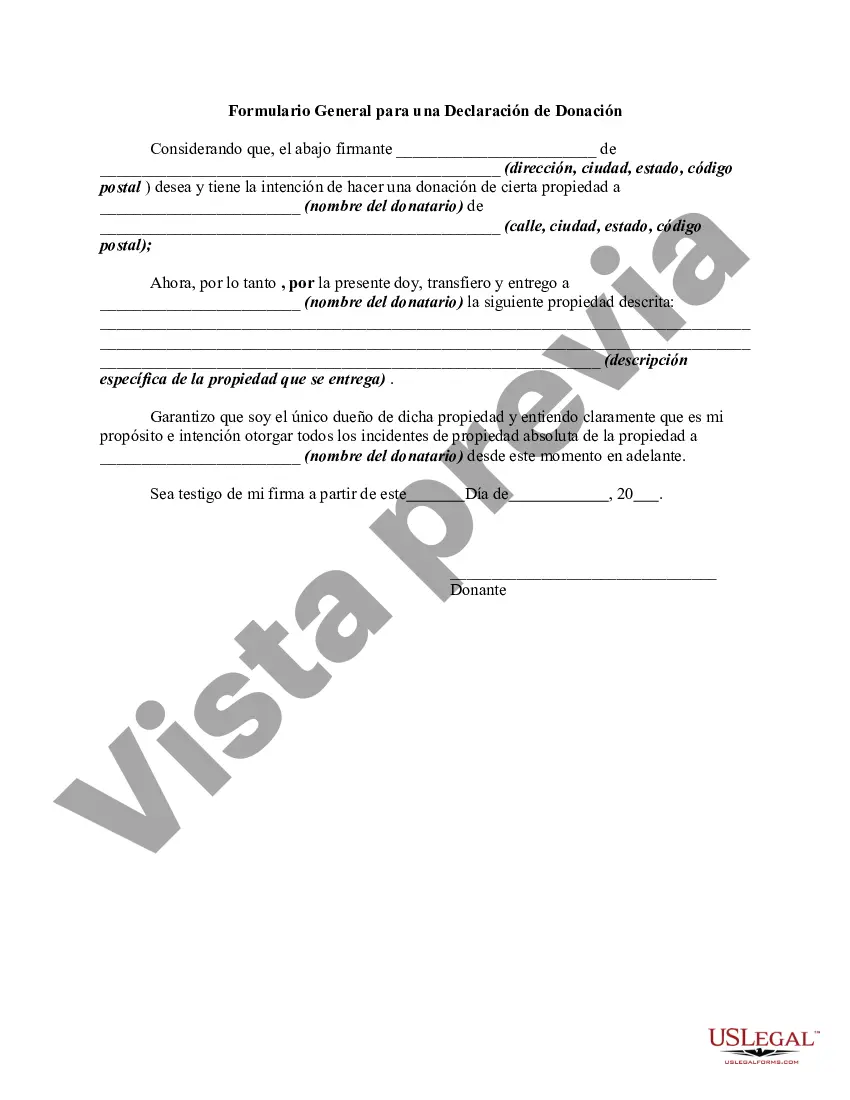

The following form is a general form for a declaration of a gift of property.

The Montana Declaration of Gift is a legal document that allows an individual in the state of Montana to transfer ownership of their assets to another person or organization. Also known as a gift declaration or gift deed, this document is often used for estate planning purposes or to ensure the smooth transfer of assets. The Montana Declaration of Gift serves as concrete evidence of the donor's intent to gift their assets without any expectation of repayment or consideration. It is a legally binding agreement that outlines the specifics of the transfer, including the description of the property or assets being gifted, the identity of the donor and the recipient, and any conditions or restrictions attached to the gift. In Montana, there are different types of Declaration of Gift that can be used depending on the nature of the assets being transferred: 1. Real Estate Declaration of Gift: This type of gift declaration is used when the donor intends to transfer ownership of real property or land. It includes details such as the legal description of the property, any liens, mortgages, or encumbrances on the property, and any applicable zoning restrictions. 2. Personal Property Declaration of Gift: This type of gift declaration pertains to the transfer of personal belongings such as vehicles, jewelry, artwork, or other valuable items. It provides a description of the property being gifted, including any relevant serial numbers, titles, or appraisals. 3. Financial Account Declaration of Gift: This variant of the Montana Declaration of Gift is utilized when the donor intends to transfer ownership of a financial account, such as a bank account or investment portfolio. It requires the donor to specify the account details, including the account holder's name, account number, and the institution where the account is held. Regardless of the type of Declaration of Gift used, it is crucial to follow the legal requirements and formalities to ensure its validity and enforceability. The document should be signed and notarized by the donor and the recipient as well as witnessed by two competent individuals who are not beneficiaries of the gift. In conclusion, the Montana Declaration of Gift is a fundamental legal document that facilitates the transfer of ownership of assets from a donor to a recipient without any expectation of compensation. It is available in different forms to accommodate the various types of assets being gifted, including real estate, personal property, and financial accounts. Consulting with an attorney or legal professional is advisable when undertaking any significant gift transfers to ensure compliance with Montana's legal requirements and to protect the interests of all parties involved.The Montana Declaration of Gift is a legal document that allows an individual in the state of Montana to transfer ownership of their assets to another person or organization. Also known as a gift declaration or gift deed, this document is often used for estate planning purposes or to ensure the smooth transfer of assets. The Montana Declaration of Gift serves as concrete evidence of the donor's intent to gift their assets without any expectation of repayment or consideration. It is a legally binding agreement that outlines the specifics of the transfer, including the description of the property or assets being gifted, the identity of the donor and the recipient, and any conditions or restrictions attached to the gift. In Montana, there are different types of Declaration of Gift that can be used depending on the nature of the assets being transferred: 1. Real Estate Declaration of Gift: This type of gift declaration is used when the donor intends to transfer ownership of real property or land. It includes details such as the legal description of the property, any liens, mortgages, or encumbrances on the property, and any applicable zoning restrictions. 2. Personal Property Declaration of Gift: This type of gift declaration pertains to the transfer of personal belongings such as vehicles, jewelry, artwork, or other valuable items. It provides a description of the property being gifted, including any relevant serial numbers, titles, or appraisals. 3. Financial Account Declaration of Gift: This variant of the Montana Declaration of Gift is utilized when the donor intends to transfer ownership of a financial account, such as a bank account or investment portfolio. It requires the donor to specify the account details, including the account holder's name, account number, and the institution where the account is held. Regardless of the type of Declaration of Gift used, it is crucial to follow the legal requirements and formalities to ensure its validity and enforceability. The document should be signed and notarized by the donor and the recipient as well as witnessed by two competent individuals who are not beneficiaries of the gift. In conclusion, the Montana Declaration of Gift is a fundamental legal document that facilitates the transfer of ownership of assets from a donor to a recipient without any expectation of compensation. It is available in different forms to accommodate the various types of assets being gifted, including real estate, personal property, and financial accounts. Consulting with an attorney or legal professional is advisable when undertaking any significant gift transfers to ensure compliance with Montana's legal requirements and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.