Montana Corporate Resolution Authorizing a Charitable Contribution

Description

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

Are you in a location where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates available on the web, but finding reliable ones isn't simple.

US Legal Forms offers thousands of form templates, such as the Montana Corporate Resolution Authorizing a Charitable Contribution, designed to meet state and federal standards.

If you find the correct form, click on Purchase now.

Select the pricing plan you want, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Montana Corporate Resolution Authorizing a Charitable Contribution template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct state/region.

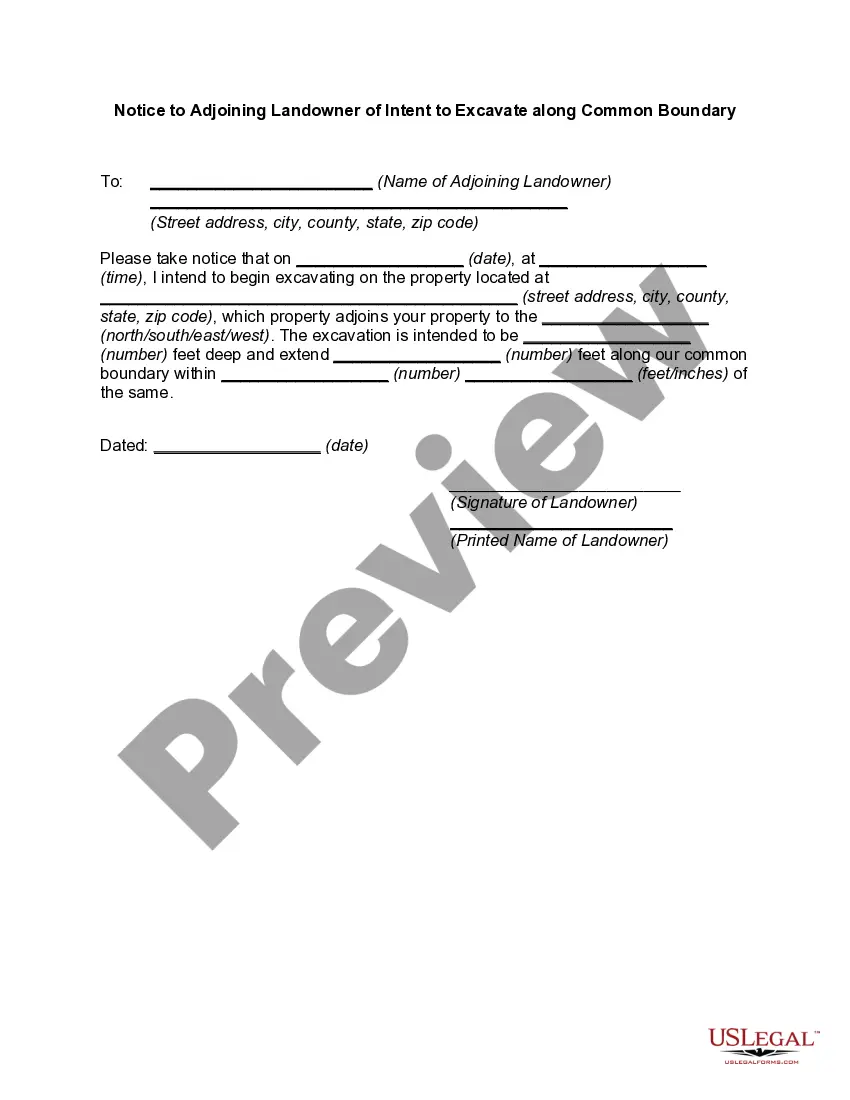

- Utilize the Review option to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your needs, use the Lookup field to find the form that suits your requirements.

Form popularity

FAQ

In 2024, Montana plans to implement several tax changes that could affect both individuals and corporations. Updates may include changes in tax rates, standard deductions, or eligibility for credits. If you're considering a Montana Corporate Resolution Authorizing a Charitable Contribution, it's important to stay informed about these tax changes, as they could influence your charitable giving strategy. Always refer to the Montana Department of Revenue or trusted tax advisors for the most accurate information.

Itemized deductions for Montana can be found in the official Montana Department of Revenue guidelines, or you can consult with tax preparation resources. These deductions may cover medical expenses, mortgage interest, and charitable contributions, among other items. If you're exploring a Montana Corporate Resolution Authorizing a Charitable Contribution, it’s vital to keep records of your contributions, as these play a role in your itemized deductions. This knowledge empowers you to make informed decisions regarding your finances.

Montana provides its residents with a standard deduction that varies depending on filing status. For the tax year, this deduction helps lower your taxable income, making it a significant consideration for many taxpayers. If you're planning to authorize a charitable contribution through a Montana Corporate Resolution, noting how the standard deduction interacts with your contributions can enhance your financial planning. Keep in mind that this deduction can affect your overall tax liability.

In Montana, individuals can deduct charitable contributions made to qualified organizations from their taxable income. This deduction allows taxpayers to lower their taxable income, thus resulting in potential tax savings. When you create a Montana Corporate Resolution Authorizing a Charitable Contribution, it ensures that your contribution is documented correctly, maximizing this benefit. Always consult with a tax professional to fully understand your eligibility for deductions.

Montana's state income tax system features a progressive tax structure with rates ranging from 1% to 6.9%. As you consider making a charitable contribution, it’s essential to understand how a Montana Corporate Resolution Authorizing a Charitable Contribution could affect your tax liability. By properly authorizing such contributions, you may take advantage of potential tax benefits. This can help optimize your overall tax strategy.

A corporate resolution generally involves major decisions such as the changing of ownership structure, voting in of new board members, or the sale of company shares. A corporate resolution is also generally used to authorize people to access corporate funds, sign checks and acquire loans on behalf of the corporation.

Primarily a board resolution is needed to keep a record of two things: To record decisions concerning company affairs (except for shares) made in the board of directors meeting. This is also known as a board resolution. To record decisions concerning company equity made by shareholders of the corporation.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers.Acceptance of the corporate bylaws.Creation of a corporate bank account.Designating which board members and officers can access the bank account.Documentation of a shareholder decision.Approval of hiring or firing employees.More items...

Special resolutions - also known as 'extraordinary resolutions' - are needed for more important decisions or those decisions affecting the constitution of a company. These require at least 75% of the shareholders or directors to agree - and in some situations as much as 95%.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.