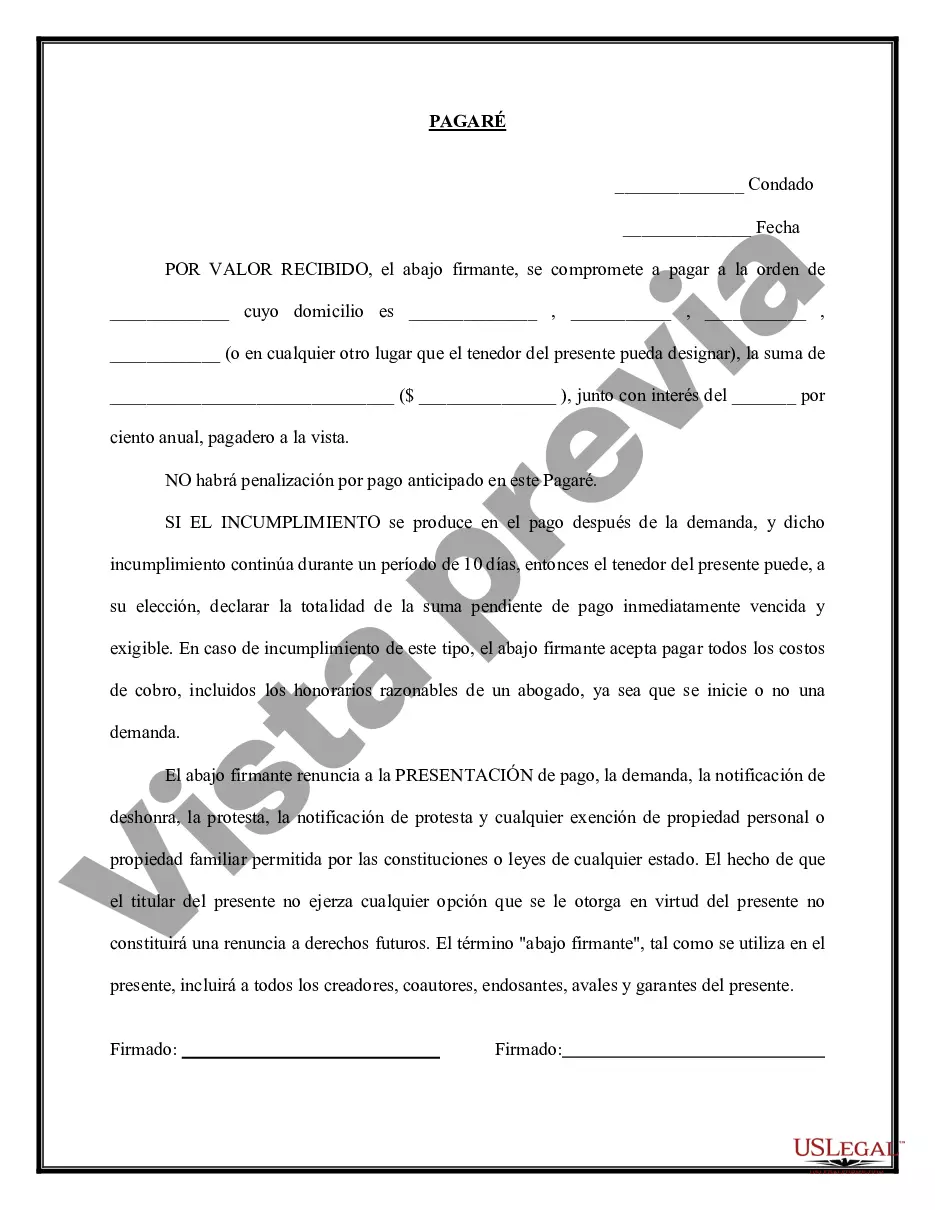

A Montana Promissory Note — Payable on Demand is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Montana. This type of promissory note specifies that the borrowed amount must be repaid by the borrower upon demand of the lender. Promissory notes are commonly used in various financial transactions, such as personal loans, business loans, or even loans between friends or family members. In Montana, promissory notes can be used for any type of loan where the repayment is required on demand. Here are some relevant keywords associated with Montana Promissory Note — Payable on Demand: 1. Legal validity: A Montana Promissory Note — Payable on Demand is a legally enforceable agreement between the lender and borrower. It holds both parties accountable for fulfilling their obligations as agreed upon. 2. Loan terms: The promissory note includes specific details regarding the loan, such as the loan amount, interest rate (if applicable), repayment terms, and any additional fees or charges. 3. Repayment on demand: Unlike other types of promissory notes with fixed repayment schedules, a Montana Promissory Note — Payable on Demand allows the lender to request repayment in full at any time. 4. Borrower's obligations: The borrower is legally bound to repay the principal amount along with any accrued interest or fees upon the lender's demand. Failure to comply may result in legal action or other consequences. 5. Lender's rights: By signing the promissory note, the borrower authorizes the lender to demand repayment and take necessary legal actions to recover the loaned amount and any associated costs. Types of Montana Promissory Note — Payable on Demand: 1. Personal Loan Promissory Note: This type of promissory note is commonly used when individuals borrow money from friends, family, or acquaintances. It outlines the terms of the loan and repayment on demand. 2. Business Loan Promissory Note: In business transactions, a promissory note may be used when a company borrows money from another business or individual. The note specifies the terms, repayment details, and demand rights. 3. Student Loan Promissory Note: Educational institutions or private lenders may use this type of promissory note to document student loans that are payable on demand. It includes provisions specific to educational loans. In conclusion, a Montana Promissory Note — Payable on Demand is a vital legal document for loan agreements in the state. It outlines the rights and obligations of both the lender and borrower, with repayment required upon demand. Personal, business, and student loans are common types of promissory notes that may utilize this payable on demand clause. It is essential to consult legal professionals to ensure compliance with Montana state laws and to create a customized promissory note that meets specific requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Montana Pagaré - Pagadero A La Vista?

Are you currently inside a position where you need to have documents for either business or individual purposes just about every time? There are a variety of legitimate document templates available online, but finding versions you can rely on isn`t simple. US Legal Forms gives thousands of form templates, just like the Montana Promissory Note - Payable on Demand, which are written to meet state and federal demands.

If you are currently informed about US Legal Forms site and have an account, simply log in. After that, you can down load the Montana Promissory Note - Payable on Demand design.

Unless you have an accounts and would like to begin using US Legal Forms, follow these steps:

- Obtain the form you want and make sure it is for the correct metropolis/region.

- Make use of the Review switch to examine the shape.

- Look at the information to actually have selected the correct form.

- In case the form isn`t what you are seeking, use the Lookup industry to discover the form that suits you and demands.

- When you get the correct form, click Acquire now.

- Opt for the pricing prepare you want, complete the necessary information and facts to create your bank account, and buy an order making use of your PayPal or bank card.

- Choose a convenient file formatting and down load your copy.

Locate all the document templates you might have purchased in the My Forms menus. You can aquire a additional copy of Montana Promissory Note - Payable on Demand any time, if possible. Just click on the essential form to down load or printing the document design.

Use US Legal Forms, one of the most extensive selection of legitimate types, in order to save some time and stay away from faults. The assistance gives expertly produced legitimate document templates which can be used for a range of purposes. Produce an account on US Legal Forms and commence generating your lifestyle easier.