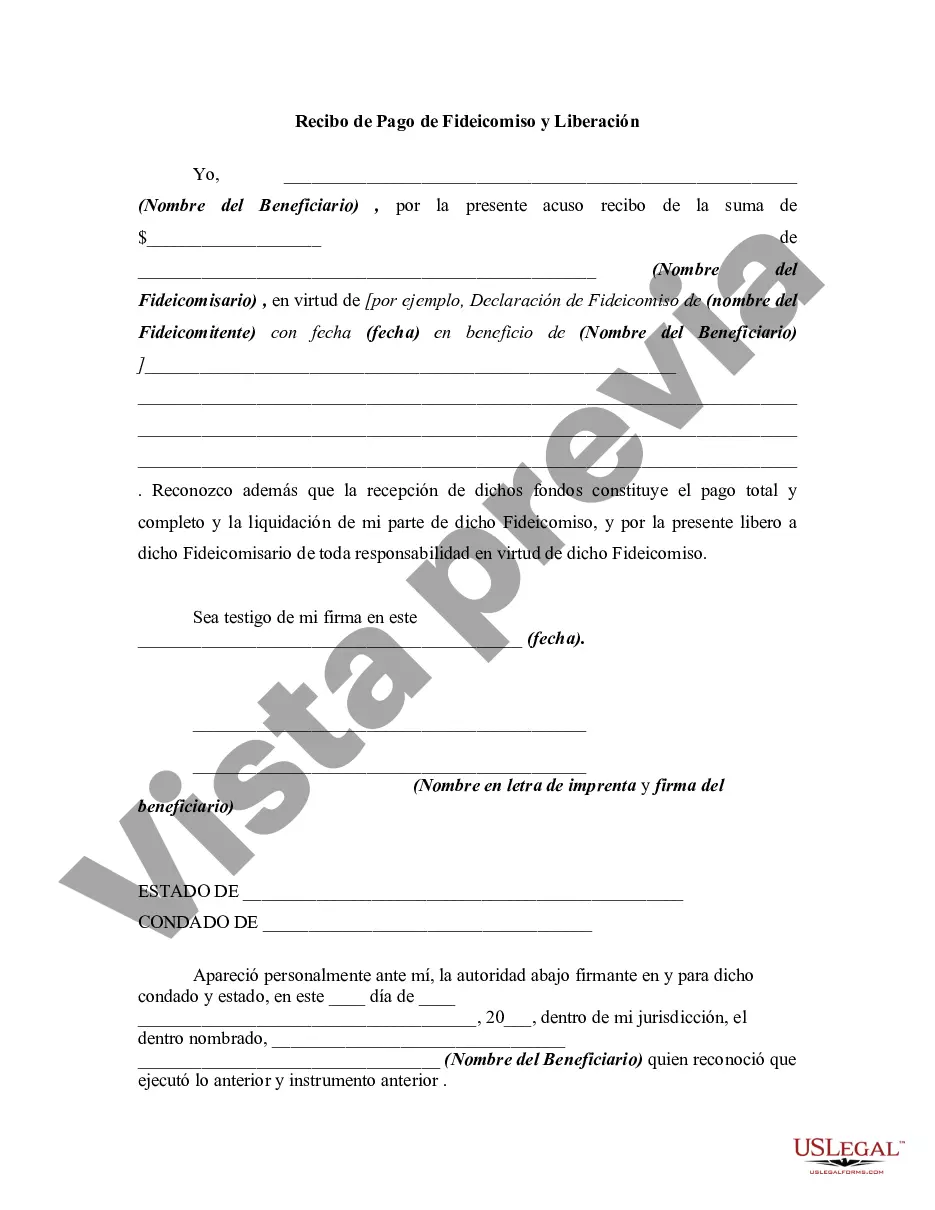

In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Receipt for Payment of Trust Fund and Release is a legal document used in Montana to acknowledge that a payment has been made towards a trust fund, and to release any claims or obligations related to that trust fund. This document serves as proof of payment and ensures transparency between the payer and the recipient. The Montana Receipt for Payment of Trust Fund and Release includes crucial information such as the names and addresses of both parties involved, the date of payment, the amount paid, and a clear description of the trust fund being addressed. It also outlines the terms and conditions of the release, specifying that the recipient has received the funds in full satisfaction and discharge of any claims, obligations, or liabilities related to the trust fund. There may be different types of Montana Receipt for Payment of Trust Fund and Release, depending on the nature of the trust fund and the specific transaction at hand. Some common variations include: 1. Real Estate Trust Fund Receipt and Release: This type of receipt is used when a payment is made towards a real estate trust fund. It ensures that all financial obligations related to the trust fund have been met, and releases any claims or liabilities associated with it. 2. Investment Trust Fund Receipt and Release: This variation is used when a payment is made towards an investment trust fund. It acknowledges the receipt of funds and releases the payer from any further obligations or claims pertaining to the trust. 3. Charitable Trust Fund Receipt and Release: When a payment is made towards a charitable trust fund, this type of receipt is utilized. It confirms the payment made and releases the payer from any future responsibilities or liabilities related to the charitable trust fund. In summary, a Montana Receipt for Payment of Trust Fund and Release is an essential legal document that acknowledges the payment made towards a trust fund and releases the payer from any claims or obligations connected to that fund. Different variations of this receipt exist, depending on the type of trust fund being addressed. It is crucial to consult with legal professionals to ensure the appropriate document is used for each specific transaction involving a trust fund.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.