Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

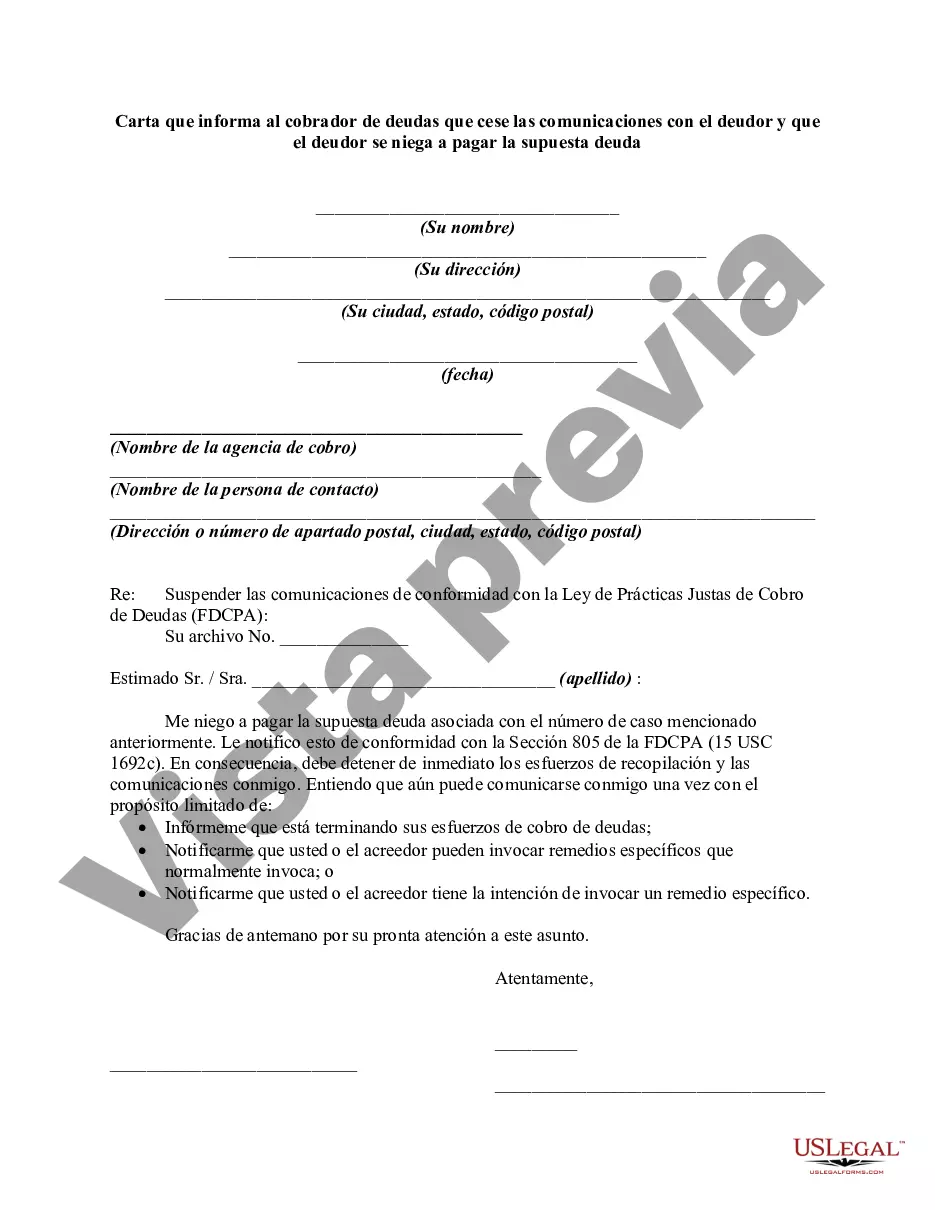

Title: Montana Letter Informing Debt Collector to Cease Communications with Debtor and that Debtor Refuses to Pay Alleged Debt Introduction: In Montana, individuals have the right to control how debt collectors communicate with them regarding alleged debts. This detailed description aims to explain the process of drafting a letter informing a debt collector to cease all communication with the debtor. It also addresses the debtor's refusal to pay the alleged debt, empowering Montana residents to protect their rights in such situations. Key Points to Include in the Letter: 1. Header and Contact Information: — Full name and addresghettoto— - Full name and address of the debt collector agency 2. Date: — Clearly state the date of the letter. 3. Subject Line: — Clearly mention the purpose of the letter, such as "Cease Communication Request and Denial of Alleged Debt Payment — Montana Legal Rights" 4. Opening Paragraph: — State that the purpose of the letter is to formally request the debt collector to cease all communication with the debtor, as allowed under the Fair Debt Collection Practices Act (FD CPA) and Montana state laws. — Acknowledge receipt of any previous correspondence from the debt collector regarding the alleged debt. 5. Alleged Debt Denial: — Clearly state that the debtor denies owing any debt to the collector. Include specific reasons for the denial if applicable (e.g., incorrect identity, expired statute of limitations, lack of evidence). — Cite the relevant Montana state law that supports the debtor's rights in disputing the debt. 6. Explicit Request for Cease Communication: — Assert the debtor's rightunderhandFPAPAPA and Montana law to demand the cessation of all communication by the debt collector. — Provide specific instructions for the debt collector to follow, such as ceasing phone calls, letters, text messages, or any form of communication. — Mention that any further communication attempts will be considered harassment, and the debtor might take appropriate legal action if the harassment persists. 7. Documentation Request: — Request that the debt collector provide written acknowledgement of receipt of the letter and compliance with the cease communication request. — Ask the debt collector to include any supporting documents they have regarding the alleged debt, if applicable. — Specify a reasonable timeframe within which the debt collector should provide the requested documentation. 8. Closure: — Thank the reader for their attention— - Restate the debtor's expectation to receive confirmation of the cease communication request and any accompanying documentation within the specified timeframe. — Specify the debtor's preferred method of future communication if necessary (e.g., written mail only). Additional Types of Montana Letters of Alleged Debt Denial: 1. Montana Letter Disputing Debt's Validity: — Used when the debtor wants to dispute the validity of the alleged debt but does not request a cease communication order. 2. Montana Letter Confirming Payment Arrangement: — Used when the debtor acknowledges the existence of the alleged debt but seeks to negotiate a payment agreement with the debt collector. Remember, it is advisable to consult with an attorney to ensure the letter complies with Montana state laws, protecting the debtor's rights effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.