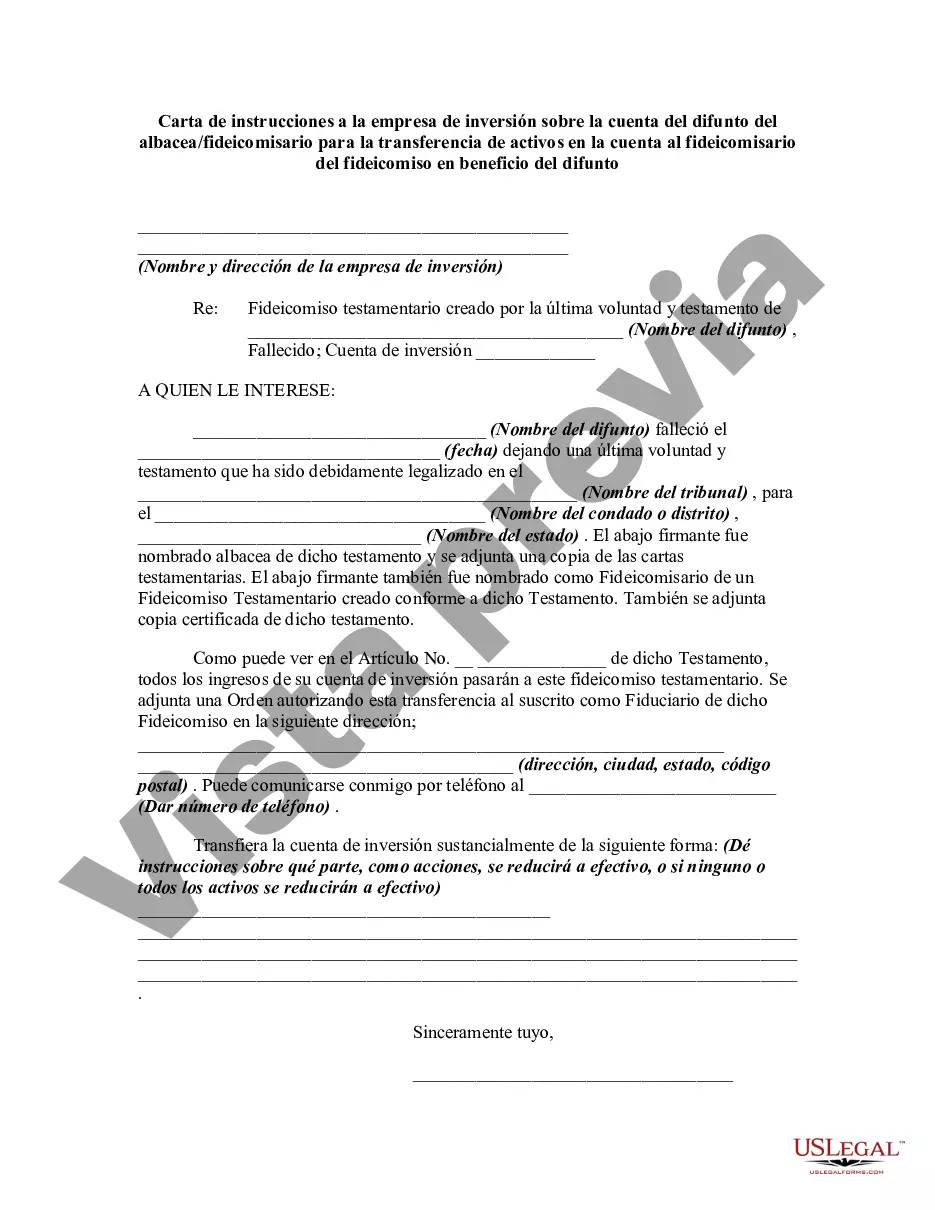

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

A Montana Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from an Executor or Trustee for the Transfer of Assets in the Account to a Trustee of a Trust for the Benefit of the Decedent is an important document that outlines the necessary steps and directions for transferring assets from the account of a deceased individual to a trust. This legal document serves as a guide for the investment firm and ensures a smooth and efficient transfer process. The Montana Letter of Instruction includes specific instructions provided by the executor or trustee, who is responsible for managing the estate of the deceased and ensuring that the assets are distributed according to the wishes of the decedent. The letter typically begins with a detailed introduction that identifies the executor or trustee, the investment firm, and the purpose of the document. Keywords: Montana, Letter of Instruction, Investment Firm, Account, Decedent, Executor, Trustee, Transfer of Assets, Trust, Benefit, Estate, Distribute. Different types of Montana Letters of Instruction may include variations in terms of specific instructions, account details, or beneficiaries. Some possible variations are: 1. Montana Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor for the Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: This letter outlines the transfer process with the executor solely responsible for managing the estate of the deceased. 2. Montana Letter of Instruction to Investment Firm Regarding Account of Decedent from Trustee for the Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: In this variation, the letter is directed from a trustee who has been appointed as the primary executor of the estate and is responsible for carrying out the transfer process. 3. Montana Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Multiple Trustees of Trust for the Benefit of Decedent: This type of letter applies when the assets need to be transferred to multiple trustees, potentially to manage different aspects of the trust or cater to various beneficiaries. 4. Montana Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of a Special Needs Trust for the Benefit of Decedent: Here, the letter specifies that the assets be transferred to a special needs trust to cater to the financial needs of a disabled beneficiary, ensuring that their government assistance remains intact. In each case, the content and specific instructions may vary, but the primary purpose of the Montana Letter of Instruction remains the same: to guide the investment firm in transferring the assets from the decedent's account to the designated trustee of the trust, ensuring the proper and efficient management of the deceased's estate.A Montana Letter of Instruction to an Investment Firm Regarding the Account of a Decedent from an Executor or Trustee for the Transfer of Assets in the Account to a Trustee of a Trust for the Benefit of the Decedent is an important document that outlines the necessary steps and directions for transferring assets from the account of a deceased individual to a trust. This legal document serves as a guide for the investment firm and ensures a smooth and efficient transfer process. The Montana Letter of Instruction includes specific instructions provided by the executor or trustee, who is responsible for managing the estate of the deceased and ensuring that the assets are distributed according to the wishes of the decedent. The letter typically begins with a detailed introduction that identifies the executor or trustee, the investment firm, and the purpose of the document. Keywords: Montana, Letter of Instruction, Investment Firm, Account, Decedent, Executor, Trustee, Transfer of Assets, Trust, Benefit, Estate, Distribute. Different types of Montana Letters of Instruction may include variations in terms of specific instructions, account details, or beneficiaries. Some possible variations are: 1. Montana Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor for the Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: This letter outlines the transfer process with the executor solely responsible for managing the estate of the deceased. 2. Montana Letter of Instruction to Investment Firm Regarding Account of Decedent from Trustee for the Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: In this variation, the letter is directed from a trustee who has been appointed as the primary executor of the estate and is responsible for carrying out the transfer process. 3. Montana Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Multiple Trustees of Trust for the Benefit of Decedent: This type of letter applies when the assets need to be transferred to multiple trustees, potentially to manage different aspects of the trust or cater to various beneficiaries. 4. Montana Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of a Special Needs Trust for the Benefit of Decedent: Here, the letter specifies that the assets be transferred to a special needs trust to cater to the financial needs of a disabled beneficiary, ensuring that their government assistance remains intact. In each case, the content and specific instructions may vary, but the primary purpose of the Montana Letter of Instruction remains the same: to guide the investment firm in transferring the assets from the decedent's account to the designated trustee of the trust, ensuring the proper and efficient management of the deceased's estate.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.