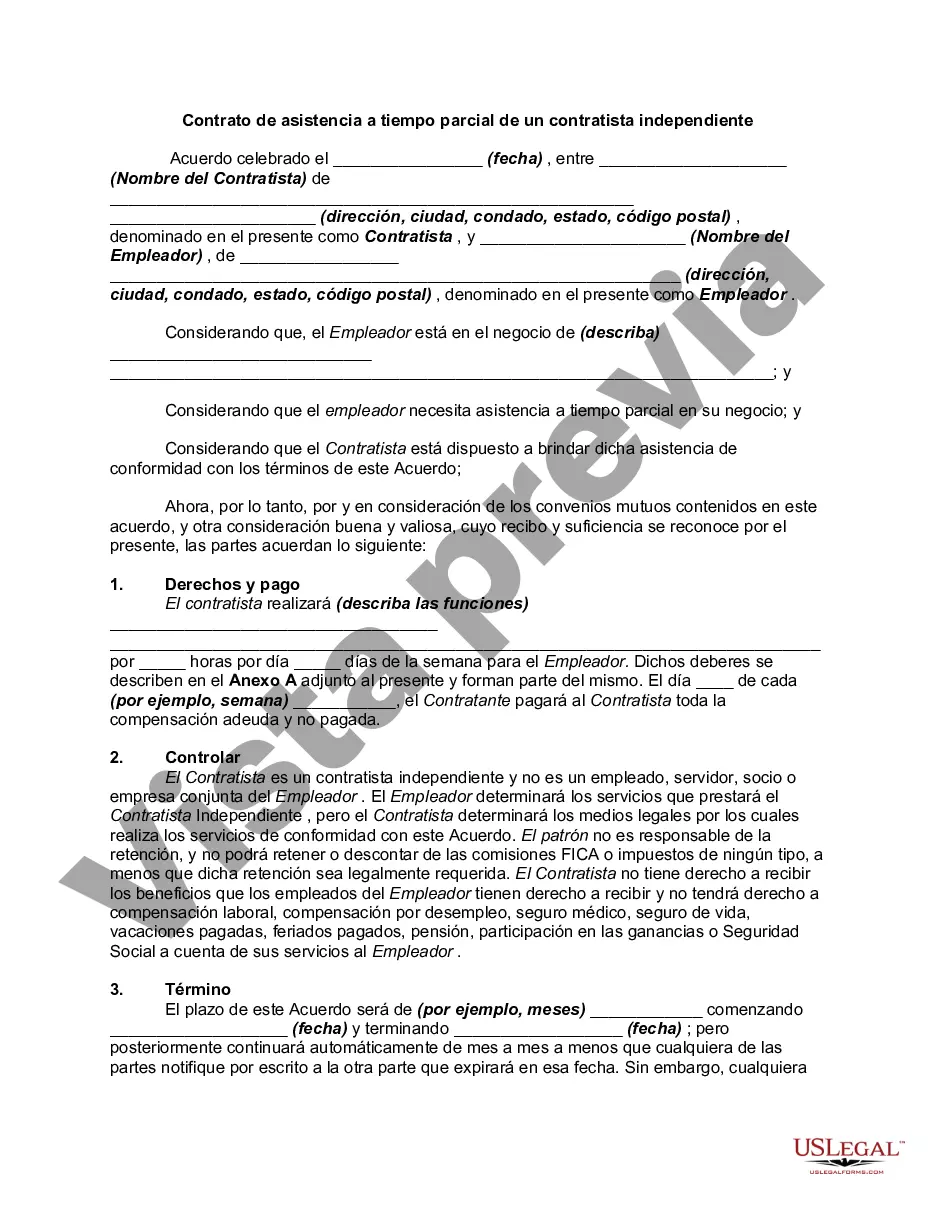

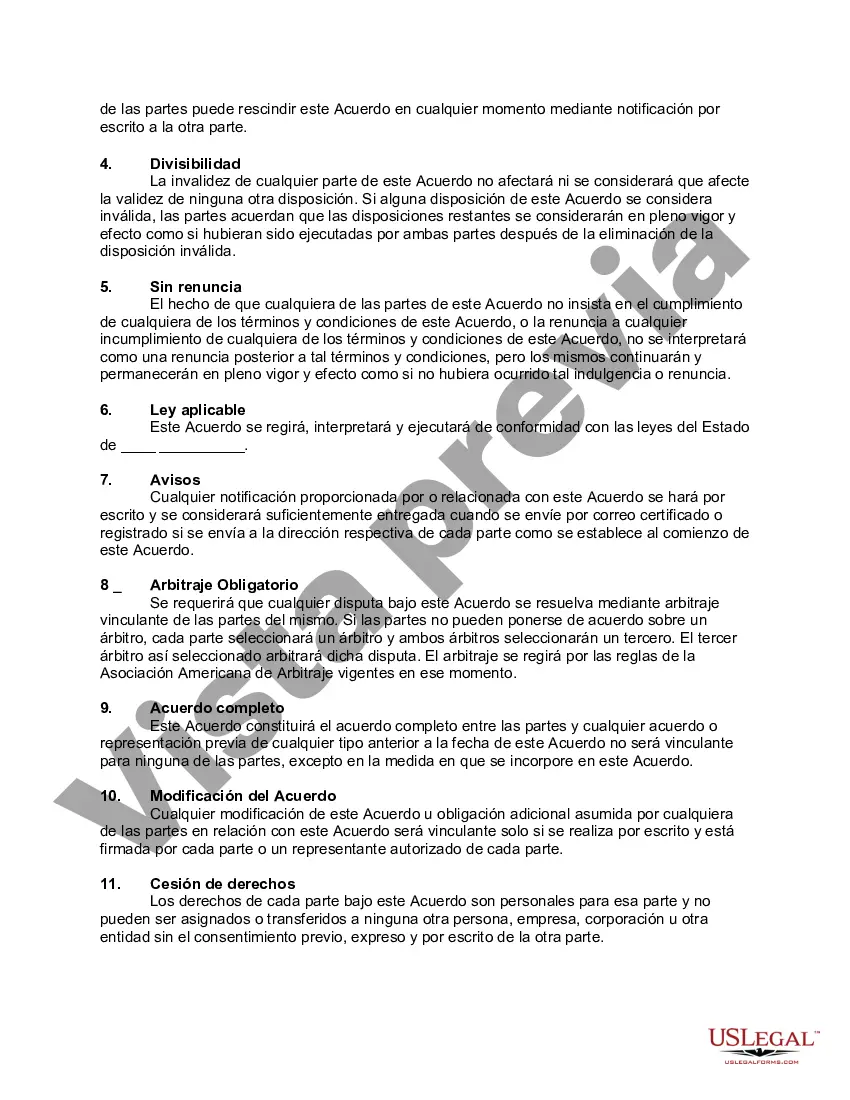

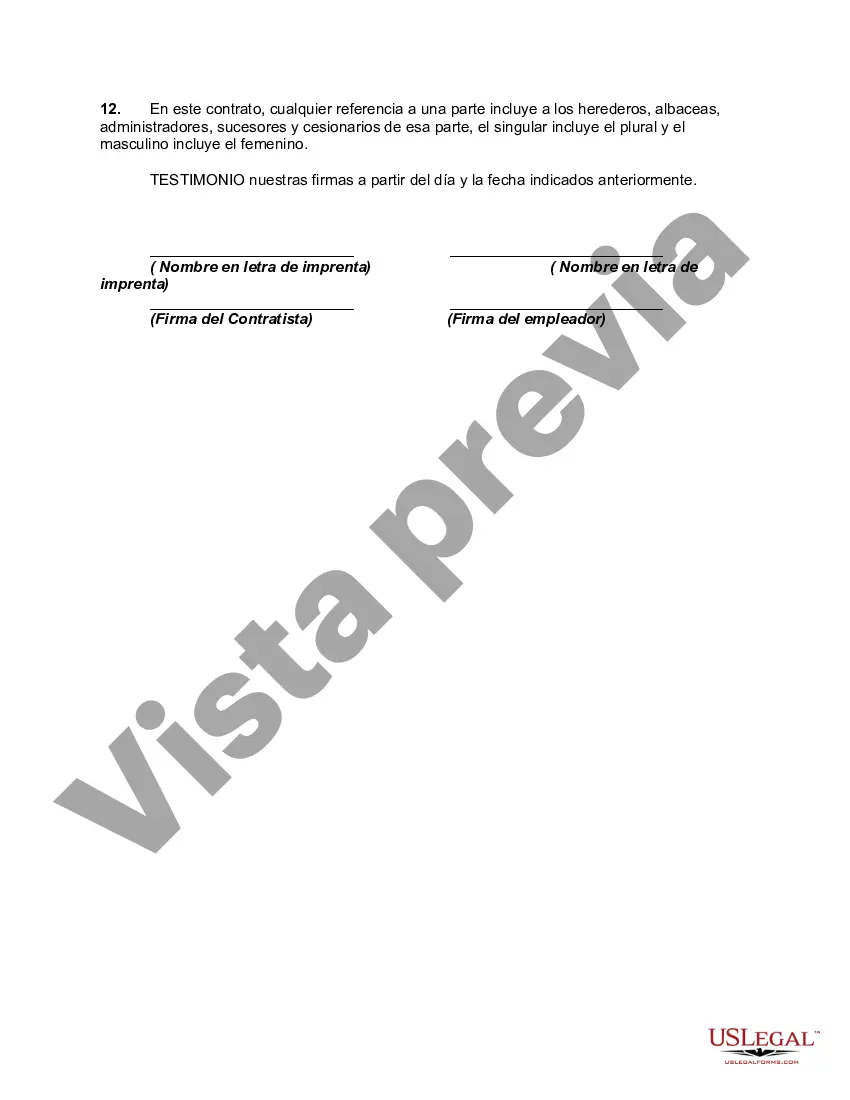

A Montana Contract for Part-Time Assistance from an Independent Contractor is a legally binding agreement between a company or individual seeking assistance and an independent contractor providing part-time services in the state of Montana. This contract outlines the terms and conditions of the working relationship, ensuring clarity and agreement between both parties involved. It is essential to have a properly drafted contract to avoid any potential legal disputes. Keywords: Montana, contract, part-time assistance, independent contractor, agreement, terms and conditions, working relationship, legally binding, services, clarity, legal disputes. Different types of Montana Contracts for Part-Time Assistance from Independent Contractors may include: 1. General Part-Time Assistance Contract: This contract is used when a company or individual requires part-time support from an independent contractor for various job roles or tasks. 2. Specific Task-based Contract: This type of contract is used when an independent contractor is hired for specific tasks or projects, such as graphic design, content writing, or website development. 3. Professional Services Contract: This contract is commonly used when an independent contractor provides specialized professional services, such as legal advice, accounting, consultation, or medical assistance. 4. Remote Work Agreement: This contract is specifically tailored for independent contractors who work remotely, outlining guidelines for communication, task delivery, and performance evaluation. 5. Non-Disclosure Agreement (NDA): In cases where the independent contractor will have access to confidential information or trade secrets, an NDA may be added as an annex to the contract, ensuring the protection of sensitive information. 6. Time and Expense Sheet: Although not a contract itself, a time and expense sheet can be attached to the contract, detailing the hours worked, tasks performed, and any reimbursable expenses incurred by the independent contractor. Remember, it is always advisable to consult with a legal professional to ensure your Montana Contract for Part-Time Assistance from an Independent Contractor complies with all applicable laws in the state and provides adequate protection for both parties involved.

A Montana Contract for Part-Time Assistance from an Independent Contractor is a legally binding agreement between a company or individual seeking assistance and an independent contractor providing part-time services in the state of Montana. This contract outlines the terms and conditions of the working relationship, ensuring clarity and agreement between both parties involved. It is essential to have a properly drafted contract to avoid any potential legal disputes. Keywords: Montana, contract, part-time assistance, independent contractor, agreement, terms and conditions, working relationship, legally binding, services, clarity, legal disputes. Different types of Montana Contracts for Part-Time Assistance from Independent Contractors may include: 1. General Part-Time Assistance Contract: This contract is used when a company or individual requires part-time support from an independent contractor for various job roles or tasks. 2. Specific Task-based Contract: This type of contract is used when an independent contractor is hired for specific tasks or projects, such as graphic design, content writing, or website development. 3. Professional Services Contract: This contract is commonly used when an independent contractor provides specialized professional services, such as legal advice, accounting, consultation, or medical assistance. 4. Remote Work Agreement: This contract is specifically tailored for independent contractors who work remotely, outlining guidelines for communication, task delivery, and performance evaluation. 5. Non-Disclosure Agreement (NDA): In cases where the independent contractor will have access to confidential information or trade secrets, an NDA may be added as an annex to the contract, ensuring the protection of sensitive information. 6. Time and Expense Sheet: Although not a contract itself, a time and expense sheet can be attached to the contract, detailing the hours worked, tasks performed, and any reimbursable expenses incurred by the independent contractor. Remember, it is always advisable to consult with a legal professional to ensure your Montana Contract for Part-Time Assistance from an Independent Contractor complies with all applicable laws in the state and provides adequate protection for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.