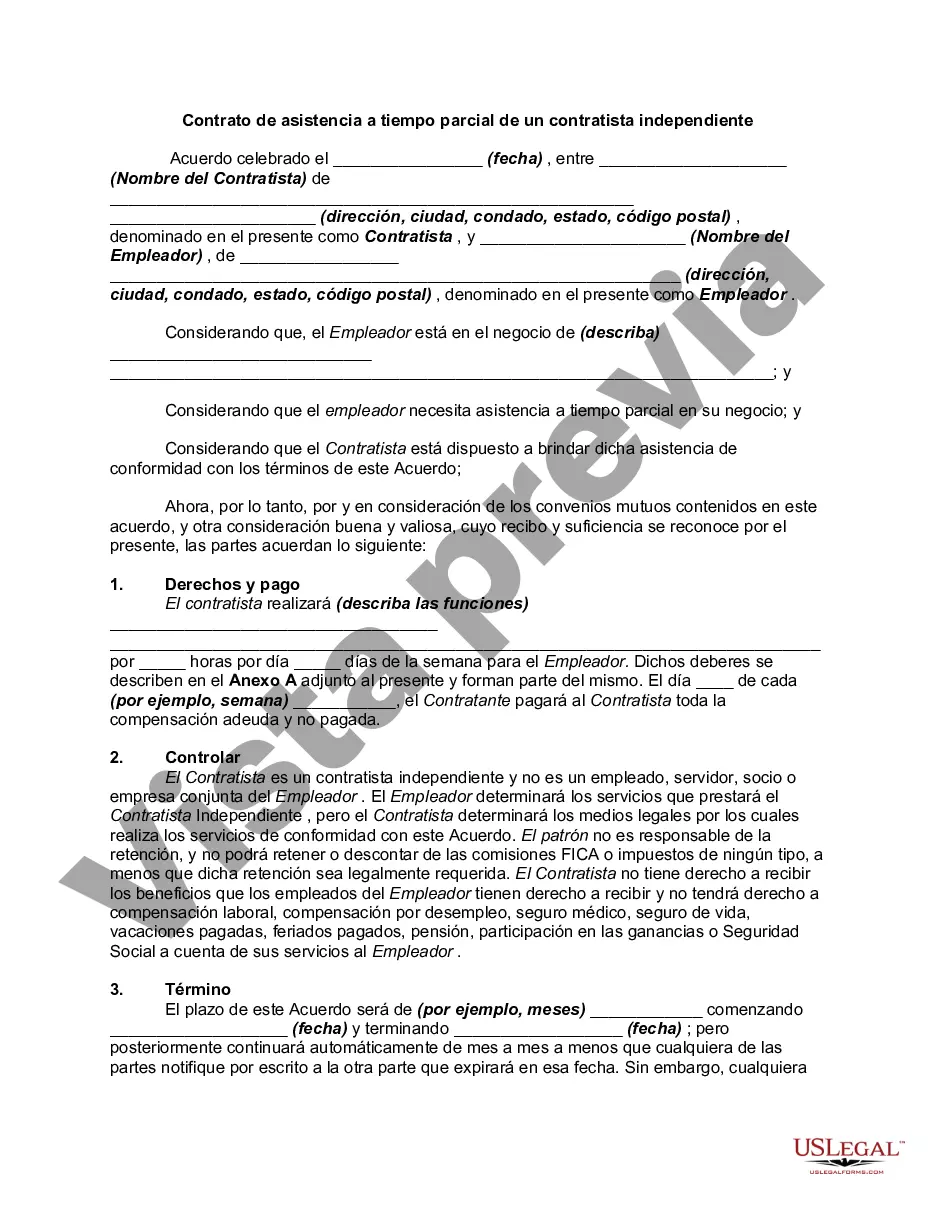

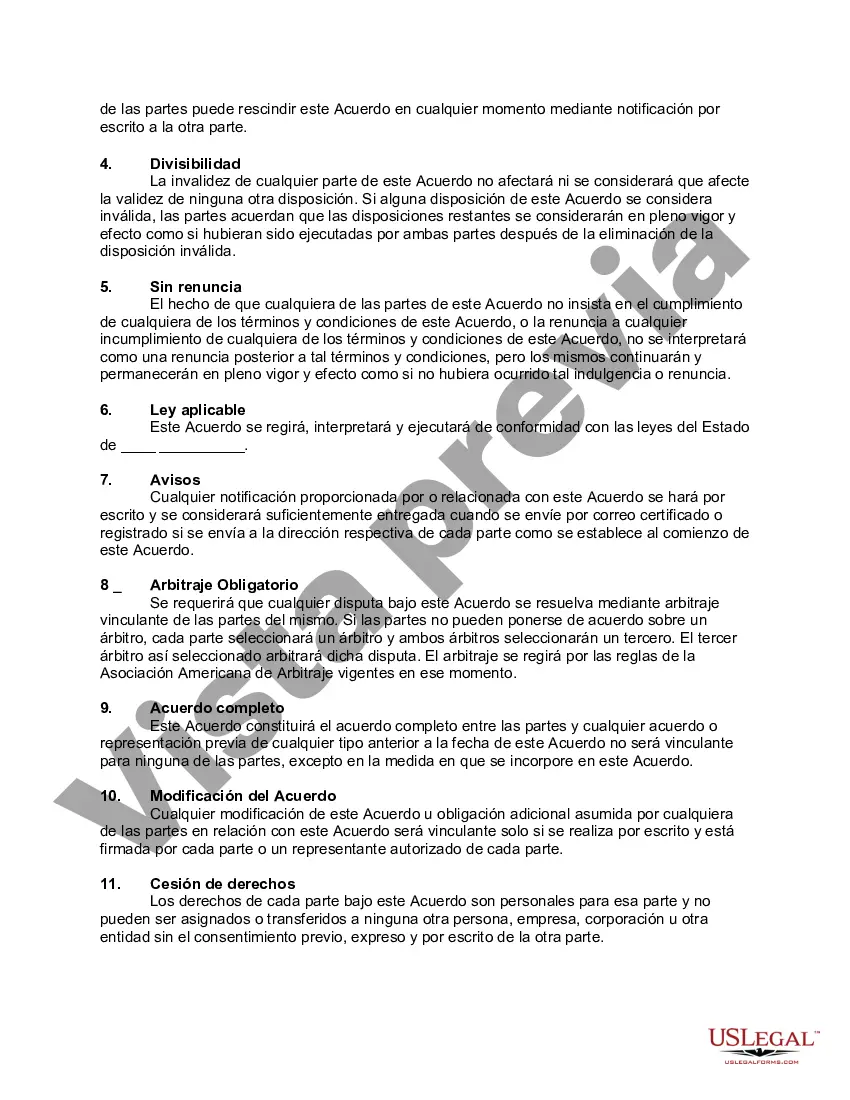

A Montana Contract for Part-Time Assistance from an Independent Contractor is a legally binding agreement between a company or individual seeking assistance and an independent contractor providing part-time services in the state of Montana. This contract outlines the terms and conditions of the working relationship, ensuring clarity and agreement between both parties involved. It is essential to have a properly drafted contract to avoid any potential legal disputes. Keywords: Montana, contract, part-time assistance, independent contractor, agreement, terms and conditions, working relationship, legally binding, services, clarity, legal disputes. Different types of Montana Contracts for Part-Time Assistance from Independent Contractors may include: 1. General Part-Time Assistance Contract: This contract is used when a company or individual requires part-time support from an independent contractor for various job roles or tasks. 2. Specific Task-based Contract: This type of contract is used when an independent contractor is hired for specific tasks or projects, such as graphic design, content writing, or website development. 3. Professional Services Contract: This contract is commonly used when an independent contractor provides specialized professional services, such as legal advice, accounting, consultation, or medical assistance. 4. Remote Work Agreement: This contract is specifically tailored for independent contractors who work remotely, outlining guidelines for communication, task delivery, and performance evaluation. 5. Non-Disclosure Agreement (NDA): In cases where the independent contractor will have access to confidential information or trade secrets, an NDA may be added as an annex to the contract, ensuring the protection of sensitive information. 6. Time and Expense Sheet: Although not a contract itself, a time and expense sheet can be attached to the contract, detailing the hours worked, tasks performed, and any reimbursable expenses incurred by the independent contractor. Remember, it is always advisable to consult with a legal professional to ensure your Montana Contract for Part-Time Assistance from an Independent Contractor complies with all applicable laws in the state and provides adequate protection for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Contrato de asistencia a tiempo parcial de un contratista independiente - Contract for Part-Time Assistance from Independent Contractor

Description

How to fill out Montana Contrato De Asistencia A Tiempo Parcial De Un Contratista Independiente?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can locate thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can obtain the latest versions of documents such as the Montana Contract for Part-Time Assistance from Independent Contractor in just minutes.

Check the description of the form to confirm you have chosen the correct document.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you already have an account, sign in to download the Montana Contract for Part-Time Assistance from Independent Contractor from the US Legal Forms database.

- The Download button will appear on every document you view.

- You can access all previously saved forms in the My documents section of your profile.

- If you would like to use US Legal Forms for the first time, below are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/county.

- Click on the Review button to examine the form's details.

Form popularity

FAQ

Filling out an independent contractor agreement involves several key steps. Start with the Montana Contract for Part-Time Assistance from Independent Contractor, which provides a structured template. Clearly state the contractor's obligations, payment terms, and duration of the agreement. Tools like USLegal Forms can guide you through the process, helping you ensure that all legal requirements are met and both parties understand their roles.

To hire an independent contractor in Montana, you will want to use the Montana Contract for Part-Time Assistance from Independent Contractor. This form outlines the terms of the contract, responsibilities, and payment details. You can find this form through various legal resources, including USLegal Forms, which simplifies the process. Filling out this form correctly ensures clarity and legal compliance.

Typically, either the hiring party or the independent contractor can create an independent contractor agreement. It is essential that both parties come to a mutual understanding of the contract terms. By utilizing a Montana Contract for Part-Time Assistance from Independent Contractor, you can simplify this process and establish a clear, professional relationship.

When writing a contract as an independent contractor, focus on clarity and detail. Describe the services you offer, your rates, and the timeline for deliverables. A Montana Contract for Part-Time Assistance from Independent Contractor can help you structure your agreement effectively, ensuring you meet legal requirements while presenting your terms to clients.

To write your own contract, begin with the names and addresses of both parties involved. Clearly state the services to be provided, payment conditions, and any confidentiality clauses. For a reliable framework, consider using a Montana Contract for Part-Time Assistance from Independent Contractor as your guide, ensuring you include all necessary components for a valid agreement.

Creating a contract for a contractor involves outlining the scope of work, payment terms, and deadlines. Start by detailing the specific services you need, then include any relevant legal terms to protect your interests. Using a Montana Contract for Part-Time Assistance from Independent Contractor provides a structured format, making the process easier and more comprehensive.

Yes, a 1099 employee can have a contract, which is often referred to as an independent contractor agreement. This contract clarifies the terms of the work relationship, including payment, services rendered, and duration. Utilizing a Montana Contract for Part-Time Assistance from Independent Contractor can help define expectations and protect both parties legally.

If you do not have a contract, you may face several challenges, including unclear expectations and potential disputes. A Montana Contract for Part-Time Assistance from Independent Contractor can protect your rights and define your work arrangement. Without this document, resolving misunderstandings can become complicated and may lead to unnecessary friction between parties.

While it is possible to work as a 1099 employee without a formal contract, it is not advisable. A Montana Contract for Part-Time Assistance from Independent Contractor helps clarify terms such as payment and job responsibilities. Without a contract, you may find yourself in uncertain situations that can lead to conflicts or legal issues.

Having a contract for an independent contractor is essential. It provides legal protection and establishes clear expectations for both parties. A Montana Contract for Part-Time Assistance from Independent Contractor can significantly reduce the risk of disputes and misunderstandings, making your working relationship smoother and more professional.

More info

… ref HTTPS ref.