Montana Assignment of Debt: A Comprehensive Guide Introduction: The Montana Assignment of Debt refers to a legal process wherein a creditor transfers their rights to collect a debt to another party, known as the assignee. This document is commonly utilized in Montana when a creditor wishes to transfer their rights and responsibilities associated with a debt to a third party. Understanding the various types of Montana Assignment of Debt can be essential for both creditors and debtors. 1. Voluntary Assignment of Debt: One type of Montana Assignment of Debt is the voluntary assignment. In this scenario, a creditor willingly transfers their rights to collect the debt to an assignee. Both parties involved should enter into a written agreement that specifies the details of the assignment, including the assigned amount, terms, and conditions. 2. Involuntary Assignment of Debt: In situations where a debtor fails to fulfill their financial obligations, a creditor may pursue legal action to obtain a judgment against the debtor. Once the judgment is obtained, the creditor may initiate an involuntary assignment of debt. This type of assignment allows the creditor to transfer their rights to collect the debt to a third party, ensuring that they receive the owed amount. 3. Montana Assignment of Debt in Business Transactions: In the context of business transactions, the Montana Assignment of Debt becomes particularly relevant. When a business sells another business or relevant assets, the debt associated with those assets can also be assigned to the buyer. This type of assignment often involves complex agreements and negotiations between the parties involved. 4. Medical Debt Assignment: Montana Assignment of Debt also encompasses medical debt. In some cases, medical providers may assign their debts to collection agencies or other medical finance companies. This enables medical providers to focus on their core operations while ensuring that the outstanding balances are properly pursued for recovery. 5. Assignment of Debt in Real Estate: Real estate transactions in Montana can involve an Assignment of Debt. For instance, if a property owner sells their property with an existing mortgage, the parties involved may agree to an assignment of debt, allowing the new property owner to assume the mortgage responsibilities. Conclusion: The Montana Assignment of Debt serves as a mechanism for transferring debt rights from one party to another. It encompasses voluntary and involuntary assignments, and plays a significant role in business transactions, medical debt recovery, and real estate dealings. Understanding the various types of Montana Assignment of Debt is crucial for individuals, businesses, and creditors involved in legal and financial matters in the state. It is advisable to consult legal professionals experienced in Montana's debt assignment laws for accurate guidance in specific cases.

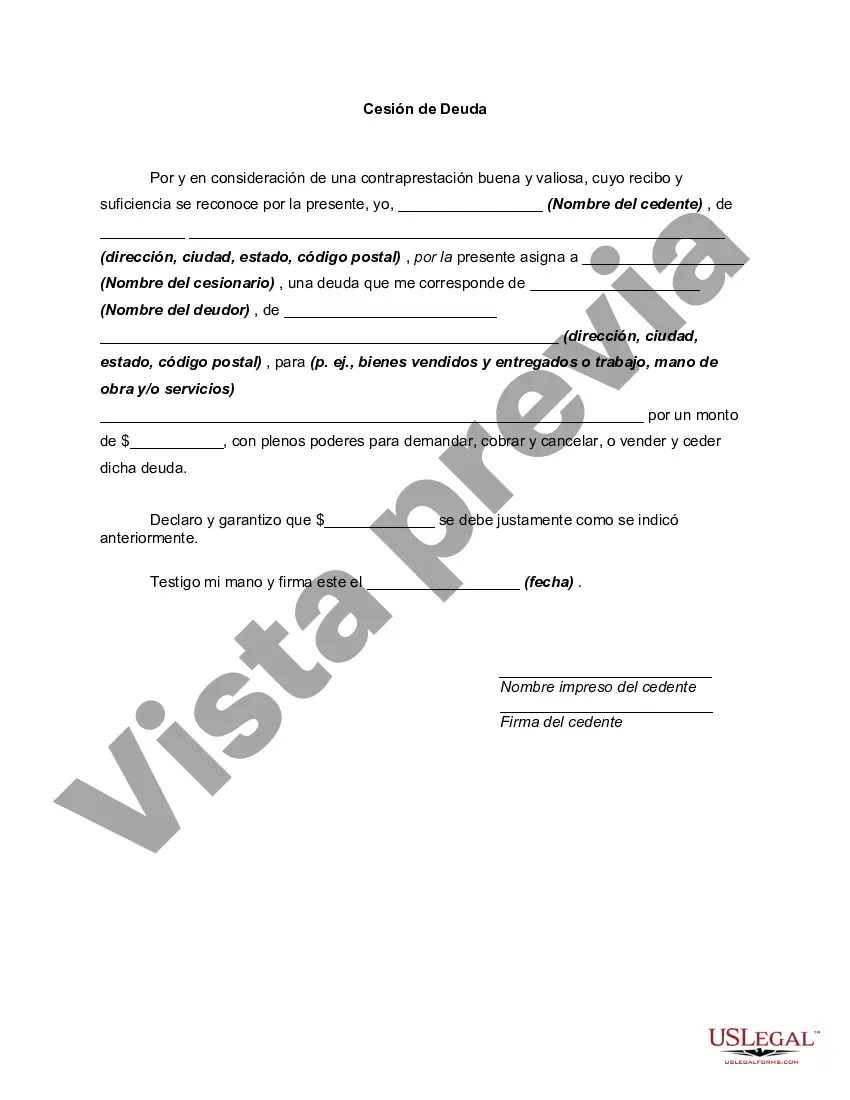

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Cesión de Deuda - Assignment of Debt

Description

How to fill out Montana Cesión De Deuda?

If you wish to total, down load, or print legitimate papers themes, use US Legal Forms, the largest collection of legitimate varieties, that can be found online. Utilize the site`s basic and hassle-free research to find the papers you will need. Different themes for organization and individual uses are categorized by groups and says, or keywords. Use US Legal Forms to find the Montana Assignment of Debt with a couple of clicks.

If you are previously a US Legal Forms buyer, log in for your accounts and click on the Acquire key to obtain the Montana Assignment of Debt. Also you can gain access to varieties you in the past delivered electronically inside the My Forms tab of your accounts.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for the proper area/region.

- Step 2. Make use of the Review option to check out the form`s information. Do not overlook to read through the explanation.

- Step 3. If you are unsatisfied with all the form, utilize the Look for area near the top of the display screen to find other models of the legitimate form design.

- Step 4. When you have identified the form you will need, select the Get now key. Select the prices plan you prefer and put your accreditations to sign up for an accounts.

- Step 5. Method the transaction. You should use your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Pick the file format of the legitimate form and down load it in your device.

- Step 7. Total, edit and print or indication the Montana Assignment of Debt.

Each legitimate papers design you purchase is your own property for a long time. You might have acces to each and every form you delivered electronically inside your acccount. Select the My Forms area and decide on a form to print or down load again.

Remain competitive and down load, and print the Montana Assignment of Debt with US Legal Forms. There are many specialist and state-particular varieties you may use for your organization or individual requires.