Montana Assignment and Transfer of Stock refer to the legal processes involved in transferring ownership and rights of a stock or shares in a company. This transaction can occur for various reasons such as a sale, gift, transfer to heirs, or as part of a larger business deal. It is important to understand the specific types of Montana Assignment and Transfer of Stock to ensure compliance with state laws and regulations. Here are some key types of assignments and transfers in Montana: 1. Voluntary Assignment and Transfer of Stock: This type of transfer occurs when an individual willingly transfers their stock to another party. It can be a straightforward process where the stockholder follows Montana's legal requirements for transferring ownership, such as completing stock transfer forms, updating the company's records, and notifying relevant parties. 2. Involuntary Assignment and Transfer of Stock: In certain circumstances, the assignment and transfer of stock may occur involuntarily. This can happen when a court orders the transfer of stock as part of a legal judgment, bankruptcy proceedings, or foreclosure. In such cases, the stockholder has no control over the transfer, and it is usually carried out under the supervision of the court or relevant authorities. 3. Assignment and Transfer of Restricted Stock: Restricted stock refers to shares that come with specific limitations or conditions imposed by the issuing company. These restrictions can include holding periods, transfer restrictions, and vesting requirements. When transferring restricted stock in Montana, it is crucial to adhere to the company's guidelines and comply with any applicable federal securities laws. 4. Assignment and Transfer of Preferred Stock: Preferred stockholders have certain advantages over common stockholders, such as priority dividend payments and higher claim on company assets. When transferring preferred stock in Montana, it is essential to consider any specific requirements outlined in the company's bylaws and ensure compliance with state regulations to protect the rights and interests of both parties involved. 5. Assignment and Transfer of Stock Options: Stock options provide individuals the right to buy or sell company stock at a predetermined price within a specified period. Transferring stock options entails following the terms set forth in the relevant agreement, which may include obtaining company consent and adhering to any restrictions or limitations imposed. When engaging in any Montana Assignment and Transfer of Stock, it is advisable to seek legal counsel to ensure compliance with Montana's Securities Act, corporate laws, and any other relevant regulations. Understanding and following the appropriate procedures will help facilitate a smooth and legally valid transfer of stock ownership.

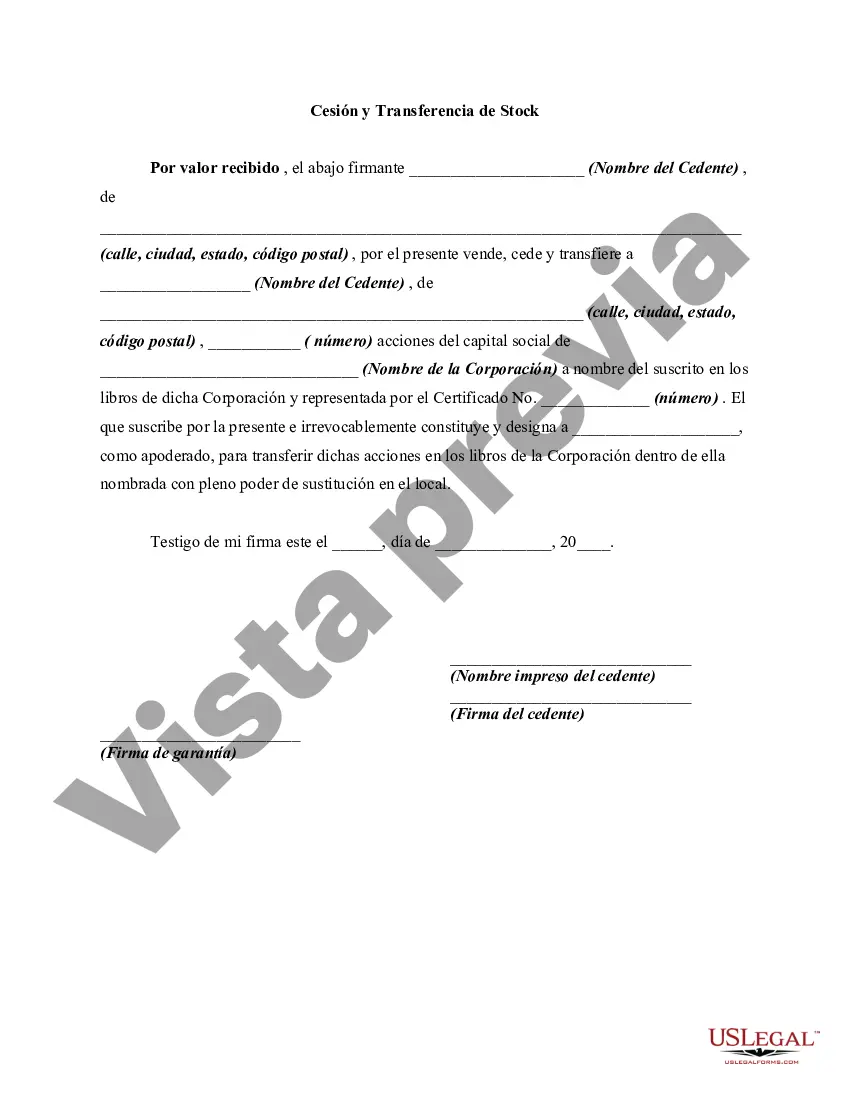

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Montana Cesión Y Transferencia De Stock?

US Legal Forms - one of several most significant libraries of lawful types in America - delivers a variety of lawful document templates you are able to acquire or print out. Making use of the web site, you can find a huge number of types for business and specific uses, categorized by types, suggests, or key phrases.You can get the latest types of types much like the Montana Assignment and Transfer of Stock within minutes.

If you already possess a subscription, log in and acquire Montana Assignment and Transfer of Stock from your US Legal Forms collection. The Download switch will show up on every single type you look at. You have access to all earlier saved types inside the My Forms tab of your own bank account.

If you would like use US Legal Forms the very first time, here are basic guidelines to help you get started off:

- Be sure you have chosen the right type for the town/area. Click the Review switch to review the form`s articles. See the type outline to ensure that you have selected the proper type.

- In the event the type does not satisfy your needs, make use of the Search field near the top of the display screen to obtain the one which does.

- Should you be happy with the shape, affirm your choice by simply clicking the Acquire now switch. Then, pick the costs plan you want and provide your qualifications to register on an bank account.

- Method the financial transaction. Make use of bank card or PayPal bank account to perform the financial transaction.

- Pick the formatting and acquire the shape on your product.

- Make alterations. Fill up, revise and print out and indicator the saved Montana Assignment and Transfer of Stock.

Every single template you included with your bank account lacks an expiration time which is the one you have permanently. So, if you wish to acquire or print out an additional duplicate, just visit the My Forms section and then click around the type you require.

Obtain access to the Montana Assignment and Transfer of Stock with US Legal Forms, probably the most extensive collection of lawful document templates. Use a huge number of skilled and express-distinct templates that fulfill your small business or specific needs and needs.