Montana Aging of Accounts Payable refers to the process of categorizing and tracking outstanding payables owed by a company based in Montana. It serves as a valuable tool for monitoring and managing a company's cash flow and financial obligations. By analyzing the aging of accounts payable, businesses can gain insights into their payment trends, identify potential liquidity issues, and prioritize payments accordingly. Keywords: Montana aging of accounts payable, payables management, cash flow analysis, financial obligations, payment trends, liquidity issues, payment prioritization. There are generally two types of Montana Aging of Accounts Payable: 1. Summary Aging: This type provides an overview of the company's outstanding payables, typically organized into different age brackets such as current, 30 days overdue, 60 days overdue, and so on. The summary aging report helps in assessing the overall status of payables and identifying significant payment gaps or overdue invoices that require immediate attention. 2. Detailed Aging: The detailed aging of accounts payable provides a more granular view of individual invoices. It lists each payable along with its invoice number, vendor name, original due date, current age, and amount owed. This report enables businesses to track specific invoices, communicate with vendors regarding overdue payments, and take the necessary steps to resolve outstanding obligations. Effectively managing the aging of accounts payable is crucial for ensuring healthy financial operations. By promptly paying outstanding obligations and resolving overdue invoices, businesses can maintain strong relationships with their vendors, avoid penalties or late fees, and secure a positive credit reputation. Furthermore, Montana Aging of Accounts Payable can be integrated with accounting software systems, such as QuickBooks or Excel spreadsheets, to automate the process. This integration enables real-time updates and reduces the manual effort required for tracking and categorizing payments, thereby improving efficiency and accuracy in financial management. In conclusion, Montana Aging of Accounts Payable is a vital tool for businesses in Montana to analyze and monitor their outstanding payables. By utilizing summary and detailed aging reports, companies can gain insights into their payment trends, optimize cash flow, and ensure timely payments, ultimately contributing to their financial stability and success.

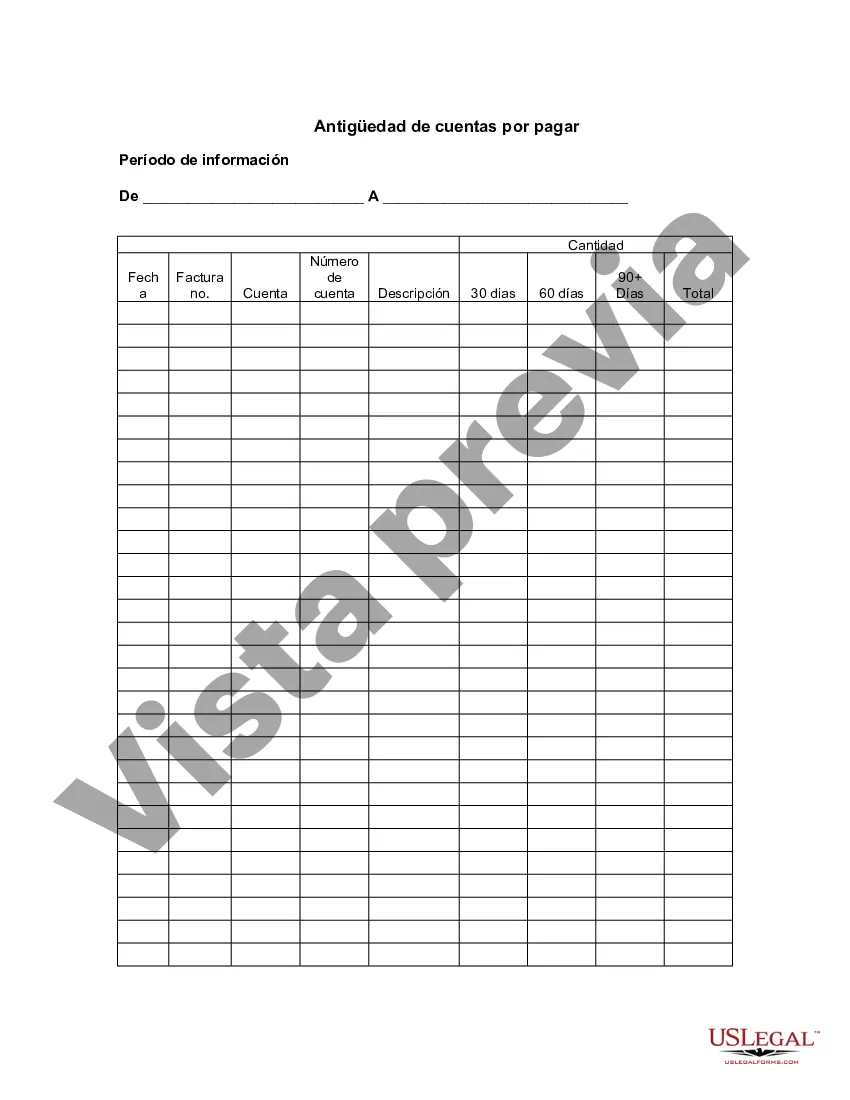

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Montana Antigüedad De Cuentas Por Pagar?

You can invest several hours on-line trying to find the legitimate papers template that meets the state and federal demands you want. US Legal Forms gives a large number of legitimate forms which can be reviewed by professionals. It is possible to download or print the Montana Aging of Accounts Payable from the support.

If you already possess a US Legal Forms bank account, you can log in and click on the Download key. Following that, you can total, change, print, or indication the Montana Aging of Accounts Payable. Every legitimate papers template you buy is your own permanently. To acquire yet another duplicate associated with a acquired form, visit the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms website the first time, adhere to the straightforward instructions listed below:

- Very first, make sure that you have chosen the proper papers template to the county/city that you pick. See the form description to make sure you have selected the appropriate form. If offered, make use of the Review key to search from the papers template also.

- In order to get yet another edition from the form, make use of the Search area to discover the template that fits your needs and demands.

- Once you have identified the template you would like, just click Buy now to move forward.

- Pick the rates strategy you would like, type in your credentials, and register for your account on US Legal Forms.

- Comprehensive the financial transaction. You should use your Visa or Mastercard or PayPal bank account to fund the legitimate form.

- Pick the formatting from the papers and download it to your product.

- Make changes to your papers if required. You can total, change and indication and print Montana Aging of Accounts Payable.

Download and print a large number of papers themes while using US Legal Forms site, that provides the greatest assortment of legitimate forms. Use expert and express-distinct themes to deal with your company or specific requirements.