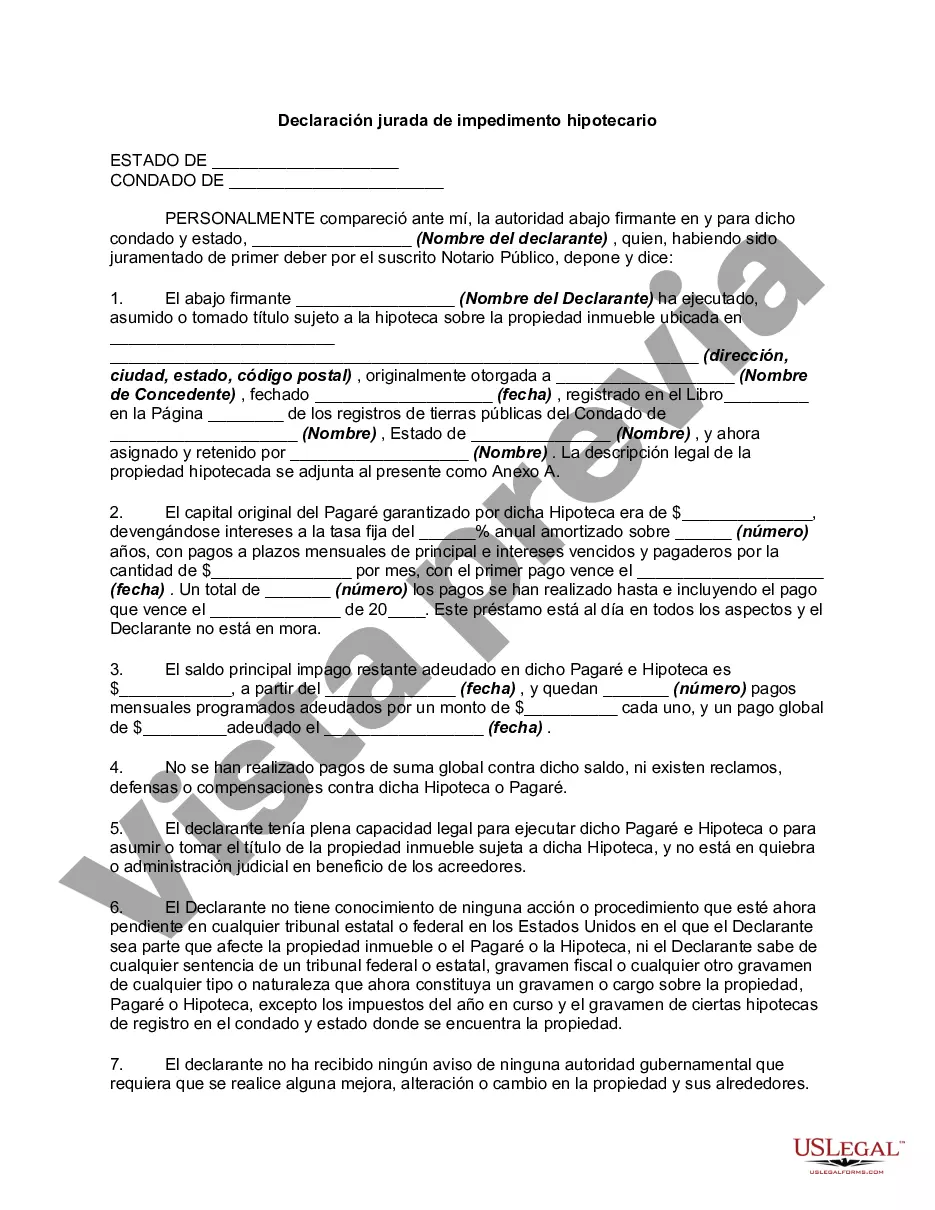

Montana Estoppel Affidavit of Mortgagor is a legal document used in real estate transactions in the state of Montana. It serves as a statement made by a mortgagor (borrower) declaring the current status of their mortgage and any outstanding obligations related to the property. This affidavit is crucial for lenders and buyers who need to ensure that there are no hidden liens or encumbrances on the property before finalizing a deal. The Montana Estoppel Affidavit of Mortgagor typically contains essential information such as the name and contact details of the mortgagor, the property's legal description, the mortgage lender's details, the loan amount, interest rate, and payment terms. It also includes a section where the mortgagor must declare any additional loans, secondary mortgages, judgments, or outstanding debts related to the property. By signing the Montana Estoppel Affidavit of Mortgagor, the borrower confirms that the information provided is accurate and up-to-date. This legally binds the mortgagor and prohibits them from altering or denying the mentioned facts in the future. This affidavit acts as protection for prospective buyers and lenders as it discloses any potential legal issues, preventing unforeseen complications in the transaction. Different types of Montana Estoppel Affidavit of Mortgagor may include: 1. Residential Estoppel Affidavit: This type of affidavit is used for residential properties, such as single-family homes, townhouses, or condominiums. It is typically used when a borrower is refinancing their mortgage or when a property is being sold. 2. Commercial Estoppel Affidavit: This type of affidavit is used for commercial properties, such as office buildings, retail spaces, or industrial properties. Commercial Estoppel Affidavit is often required during commercial real estate transactions, ensuring that the property is free from any liens or encumbrances. 3. Multifamily Estoppel Affidavit: This type of affidavit is used for properties that consist of multiple residential units, such as apartment buildings or duplexes. Multifamily Estoppel Affidavit is often used when the property is being sold or when a new lender is refinancing the existing mortgage. In summary, the Montana Estoppel Affidavit of Mortgagor is a critical legal document used in real estate transactions in Montana. It provides a detailed declaration of the current mortgage status, outstanding debts, and potential legal issues related to the property. Different types of this affidavit may be used depending on the nature of the property, such as residential, commercial, or multifamily properties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Declaración jurada de impedimento hipotecario - Estoppel Affidavit of Mortgagor

Description

How to fill out Montana Declaración Jurada De Impedimento Hipotecario?

Choosing the right authorized record web template can be a battle. Obviously, there are tons of templates available online, but how can you get the authorized form you require? Make use of the US Legal Forms internet site. The assistance delivers a huge number of templates, such as the Montana Estoppel Affidavit of Mortgagor, which can be used for organization and personal requirements. Every one of the forms are checked out by specialists and satisfy state and federal requirements.

In case you are currently signed up, log in for your profile and then click the Acquire button to obtain the Montana Estoppel Affidavit of Mortgagor. Make use of profile to appear through the authorized forms you may have ordered earlier. Proceed to the My Forms tab of your own profile and get yet another copy of your record you require.

In case you are a whole new consumer of US Legal Forms, allow me to share straightforward guidelines for you to follow:

- First, be sure you have chosen the correct form for the town/region. You may check out the shape utilizing the Preview button and study the shape outline to ensure this is the right one for you.

- In the event the form will not satisfy your expectations, utilize the Seach discipline to get the right form.

- When you are sure that the shape would work, click the Get now button to obtain the form.

- Choose the pricing plan you desire and type in the necessary details. Create your profile and purchase an order with your PayPal profile or credit card.

- Choose the data file file format and acquire the authorized record web template for your product.

- Complete, change and printing and indication the acquired Montana Estoppel Affidavit of Mortgagor.

US Legal Forms may be the largest catalogue of authorized forms that you can see different record templates. Make use of the company to acquire appropriately-manufactured documents that follow status requirements.