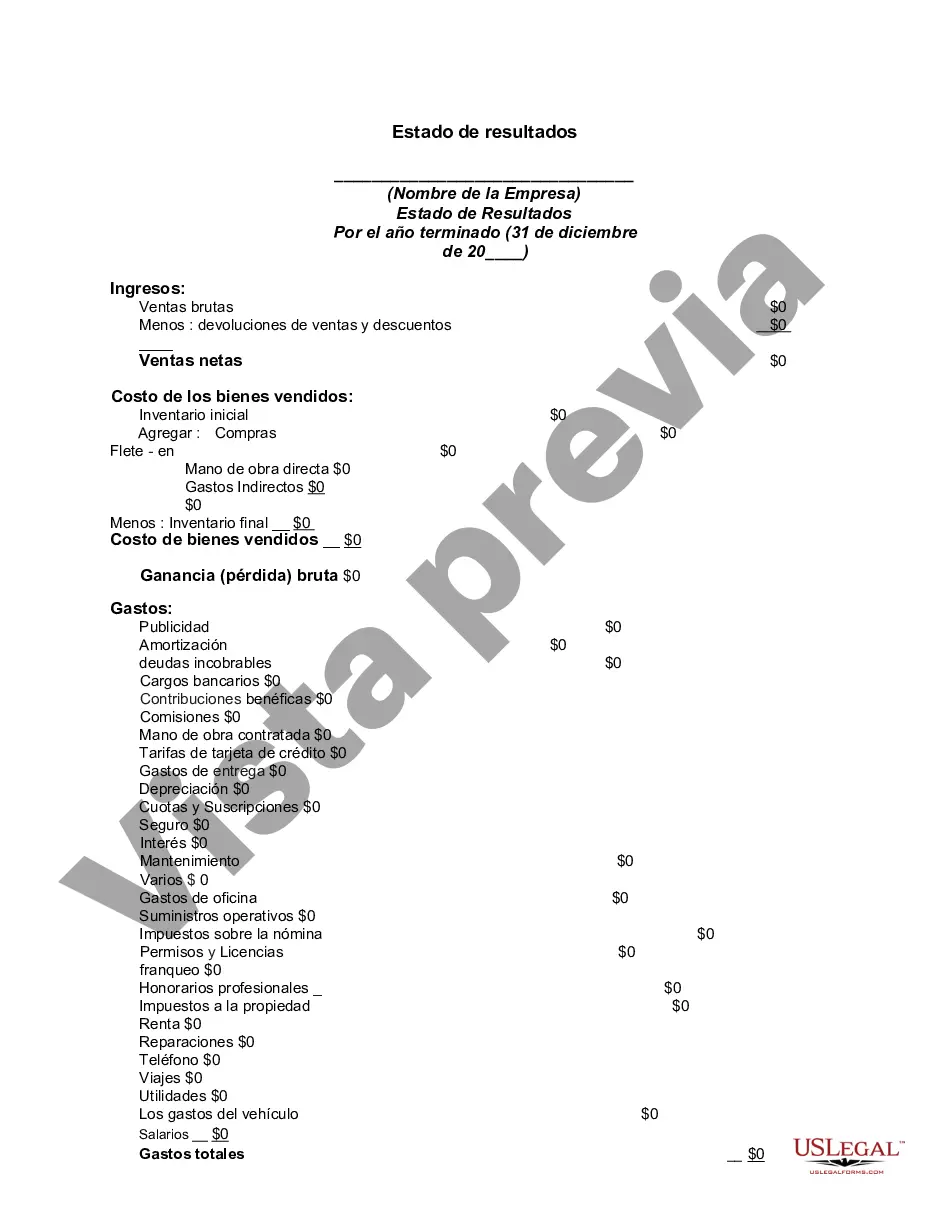

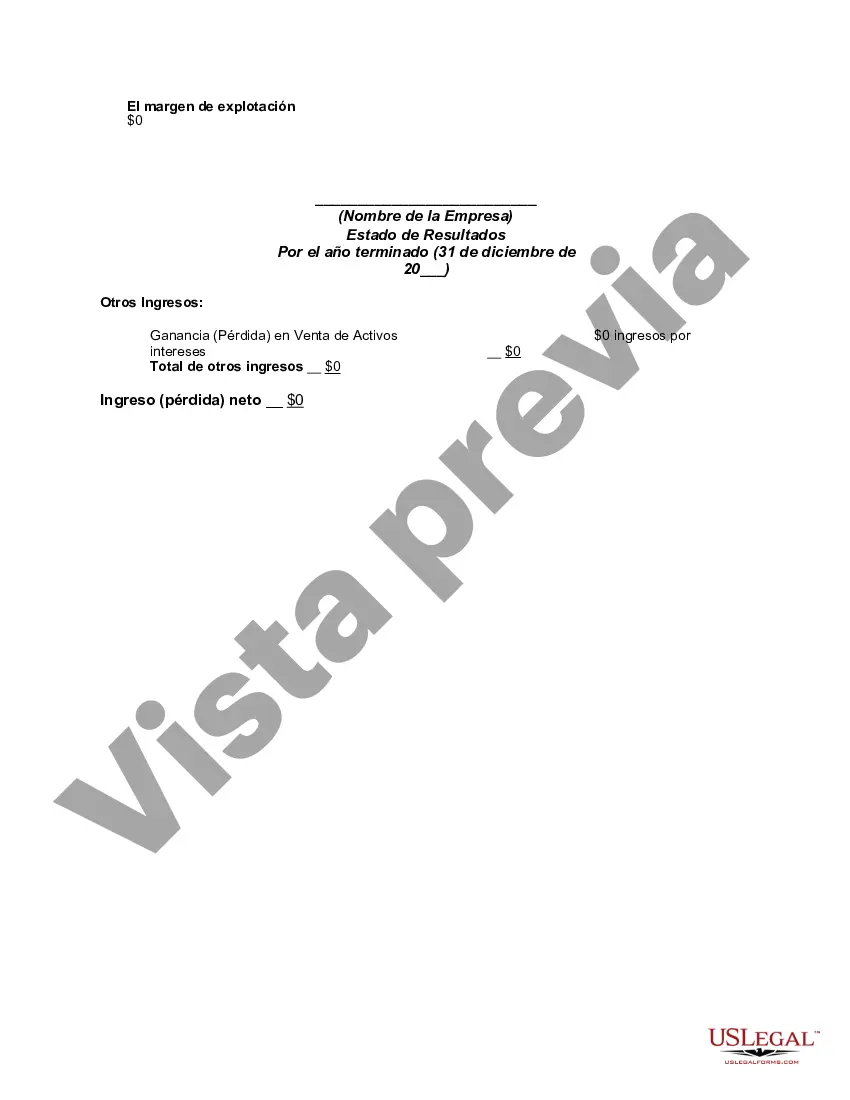

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The Montana Income Statement, otherwise known as the Montana Department of Revenue Income Statement, is a crucial financial document that provides a detailed overview of an individual or business entity's income and expenses within the state of Montana. The document summarizes the revenues, gains, expenses, and losses incurred during a specific period, typically on an annual basis, allowing for an accurate evaluation of financial performance and taxable income. The Montana Income Statement is a fundamental component of tax compliance, as it helps individuals, partnerships, corporations, and other entities calculate and report their income tax liability to the Montana Department of Revenue. This statement serves as a blueprint to determine if the taxpayer owes additional taxes or if they are eligible for a refund. The Montana Department of Revenue requires taxpayers to report various types of income on their income statements, including wages, salaries, tips, self-employment income, rental income, interest, dividends, and capital gains. These sources of income are categorized separately, allowing for a comprehensive view of the taxpayer's overall financial situation. Expenses are also classified on the Montana Income Statement and are deducted from the total revenue to determine the taxable income. Common deductions include business expenses, home office expenses, vehicle expenses, mortgage interest, property taxes, medical expenses, and charitable contributions. By subtracting these expenses from the total revenue, taxpayers can lower their taxable income, potentially reducing their tax liability. It is important to note that Montana has specific regulations and guidelines regarding income tax reporting and deductions, so individuals and businesses should consult the Montana Department of Revenue website or seek professional advice to ensure compliance with state laws. While there are no specific types of Montana Income Statements, variations may occur depending on the entity's structure and purpose. For instance, individuals typically prepare a personal income statement, while partnerships or corporations may have separate income statements for each partner or shareholder, respectively. Corporations may also produce consolidated income statements to present the financial picture of the entire company. In conclusion, the Montana Income Statement is a vital financial document used to summarize an individual or business entity's income and expenses for tax compliance purposes. By accurately reporting income sources and deductions, taxpayers can determine their taxable income and calculate the amount of Montana state income tax they owe or are entitled to in the form of a refund. Keeping track of and maintaining a detailed Montana Income Statement is essential for both tax planning and transparency in financial reporting.The Montana Income Statement, otherwise known as the Montana Department of Revenue Income Statement, is a crucial financial document that provides a detailed overview of an individual or business entity's income and expenses within the state of Montana. The document summarizes the revenues, gains, expenses, and losses incurred during a specific period, typically on an annual basis, allowing for an accurate evaluation of financial performance and taxable income. The Montana Income Statement is a fundamental component of tax compliance, as it helps individuals, partnerships, corporations, and other entities calculate and report their income tax liability to the Montana Department of Revenue. This statement serves as a blueprint to determine if the taxpayer owes additional taxes or if they are eligible for a refund. The Montana Department of Revenue requires taxpayers to report various types of income on their income statements, including wages, salaries, tips, self-employment income, rental income, interest, dividends, and capital gains. These sources of income are categorized separately, allowing for a comprehensive view of the taxpayer's overall financial situation. Expenses are also classified on the Montana Income Statement and are deducted from the total revenue to determine the taxable income. Common deductions include business expenses, home office expenses, vehicle expenses, mortgage interest, property taxes, medical expenses, and charitable contributions. By subtracting these expenses from the total revenue, taxpayers can lower their taxable income, potentially reducing their tax liability. It is important to note that Montana has specific regulations and guidelines regarding income tax reporting and deductions, so individuals and businesses should consult the Montana Department of Revenue website or seek professional advice to ensure compliance with state laws. While there are no specific types of Montana Income Statements, variations may occur depending on the entity's structure and purpose. For instance, individuals typically prepare a personal income statement, while partnerships or corporations may have separate income statements for each partner or shareholder, respectively. Corporations may also produce consolidated income statements to present the financial picture of the entire company. In conclusion, the Montana Income Statement is a vital financial document used to summarize an individual or business entity's income and expenses for tax compliance purposes. By accurately reporting income sources and deductions, taxpayers can determine their taxable income and calculate the amount of Montana state income tax they owe or are entitled to in the form of a refund. Keeping track of and maintaining a detailed Montana Income Statement is essential for both tax planning and transparency in financial reporting.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.