A Montana Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms of a loan agreement between a lender and a borrower in the state of Montana. It serves as a written promise from the borrower to repay a specific amount of money to the lender by a predetermined date. Keywords: Montana Promissory Note, Payable on a Specific Date, loan agreement, lender, borrower. There are various types of Montana Promissory Notes Payable on a Specific Date with different specifications. Here are some common ones: 1. Simple Promissory Note: This is the most basic form of a promissory note in Montana, where the borrower agrees to repay the principal amount along with any applicable interest in a specified date. 2. Secured Promissory Note: In this type of note, the borrower pledges collateral, such as property or assets, to secure the loan. If the borrower fails to repay the loan as agreed, the lender has the right to seize the collateral to recover the outstanding balance. 3. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require collateral. The borrower's ability to repay the loan is based solely on their creditworthiness and trustworthiness. 4. Fixed-Rate Promissory Note: This type of note includes a fixed interest rate over the loan term, meaning the borrower will pay the same interest rate from the beginning to the end of the loan. 5. Variable-Rate Promissory Note: In contrast to a fixed-rate note, a variable-rate note has an interest rate that fluctuates based on a specified financial index. The interest rate may change periodically throughout the loan term, impacting the borrower's repayment amount. 6. Installment Promissory Note: This note divides the loan repayment into equal installments over a specific period. Each installment includes a portion of the principal amount and interest, allowing the borrower to repay the loan in smaller, regular payments. 7. Balloon Promissory Note: A balloon note involves making smaller regular payments over the loan term, with a larger "balloon" payment due at the end. This type of note is commonly used when the borrower anticipates having the funds available to make a lump-sum payment at the end of the term. In Montana, it is crucial for both parties involved in a promissory note transaction to carefully review and understand the terms and conditions outlined in the document before signing. Seeking legal advice or using a promissory note template specific to Montana can help ensure compliance with state laws and protect the rights of both the lender and the borrower.

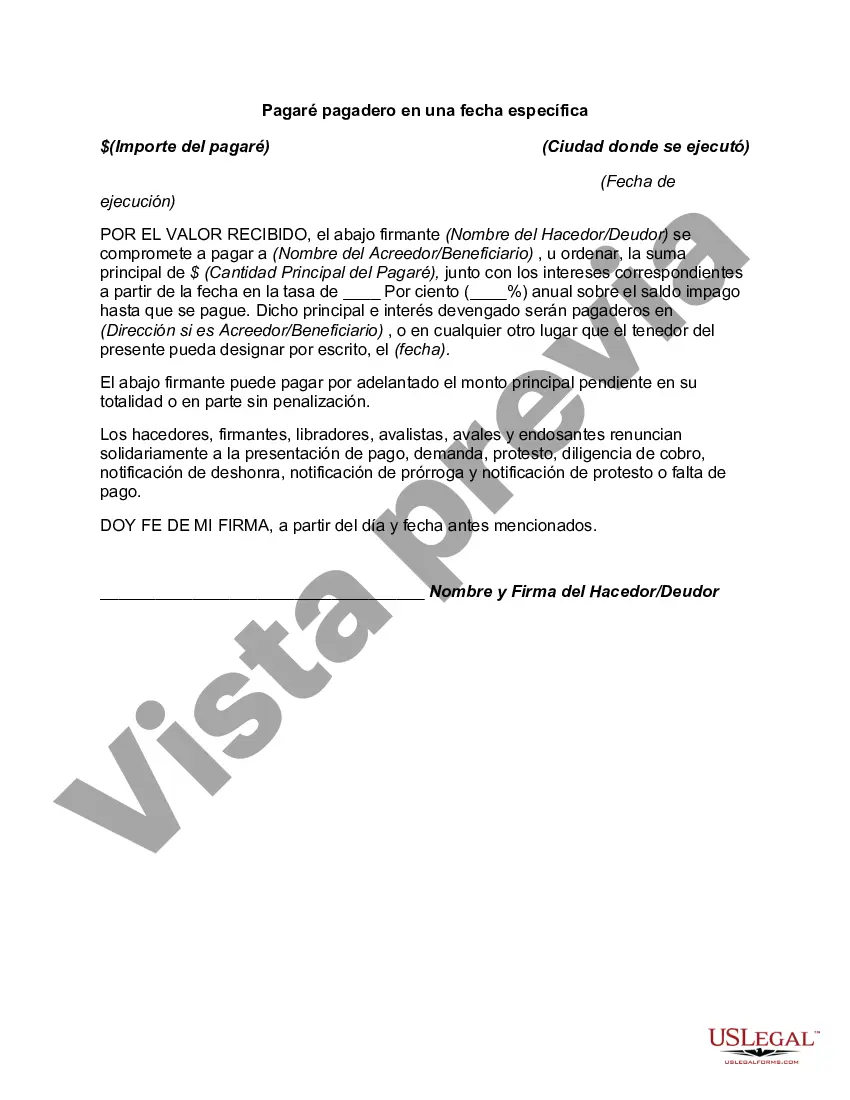

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out Montana Pagaré Pagadero En Una Fecha Específica?

US Legal Forms - one of many most significant libraries of authorized forms in the United States - gives a variety of authorized file themes you can acquire or print out. While using site, you can get thousands of forms for business and person purposes, categorized by categories, claims, or search phrases.You will discover the newest versions of forms much like the Montana Promissory Note Payable on a Specific Date within minutes.

If you already have a membership, log in and acquire Montana Promissory Note Payable on a Specific Date in the US Legal Forms library. The Download key will show up on every form you look at. You get access to all in the past delivered electronically forms from the My Forms tab of your own account.

If you would like use US Legal Forms the first time, allow me to share easy directions to help you get started off:

- Make sure you have selected the right form to your metropolis/region. Go through the Preview key to analyze the form`s articles. Look at the form information to ensure that you have chosen the correct form.

- In case the form doesn`t suit your requirements, use the Search area near the top of the monitor to obtain the the one that does.

- If you are pleased with the shape, verify your decision by clicking on the Purchase now key. Then, opt for the rates plan you like and give your credentials to register to have an account.

- Process the financial transaction. Make use of credit card or PayPal account to finish the financial transaction.

- Select the file format and acquire the shape on your product.

- Make modifications. Load, modify and print out and sign the delivered electronically Montana Promissory Note Payable on a Specific Date.

Each and every design you added to your money does not have an expiry particular date and it is your own eternally. So, if you want to acquire or print out another version, just proceed to the My Forms segment and then click on the form you want.

Get access to the Montana Promissory Note Payable on a Specific Date with US Legal Forms, the most comprehensive library of authorized file themes. Use thousands of skilled and express-certain themes that meet your business or person requirements and requirements.