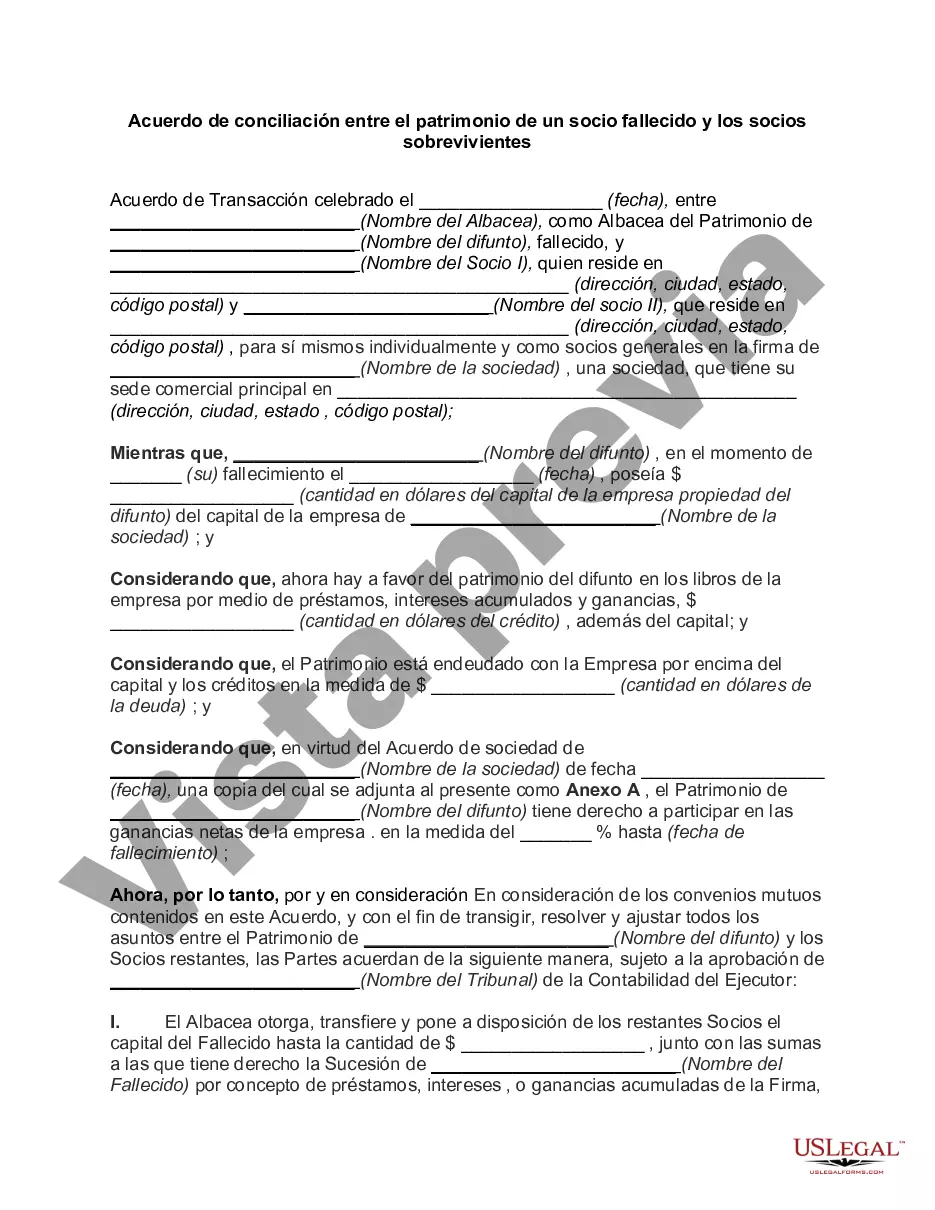

The Montana Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is a legally binding document that outlines the terms and conditions for the distribution of assets and resolution of any potential disputes that may arise after the death of a partner in a business. This agreement is specific to the state of Montana and ensures a smooth transition for the surviving partners and the estate of the deceased partner. The primary purpose of this settlement agreement is to provide a clear framework for the fair division of the deceased partner's interests in the business among the surviving partners and the estate. It aims to address various important aspects, such as ownership transfer, allocation of assets, valuation of the deceased partner's share, and the resolution of any outstanding debts or liabilities. Key terms and provisions often included in the Montana Settlement Agreement include: 1. Asset Distribution: The agreement will specify the manner in which the deceased partner's ownership interests, profits, and any other assets shall be distributed among the surviving partners and the estate. 2. Valuation: If the agreement does not already establish a valuation method for the partnership interests, it will usually include provisions on how the value of the deceased partner's share will be determined. This may involve appraisals or other agreed-upon valuation methods. 3. Buyout Option: Depending on the circumstances, the agreement may grant the surviving partners the option to buy out the deceased partner's interests, either in full or in part, within a specified timeframe. 4. Payment Terms: The settlement agreement will outline the payment terms for any amounts owing to the estate or from the estate to the surviving partners. This may include lump-sum payments, installment plans, or the transfer of specific assets in lieu of cash. 5. Non-Compete and Non-Disclosure: To protect the business's interests, the agreement might include non-compete and non-disclosure clauses to prevent the surviving partners from engaging in similar business ventures or divulging proprietary information. Different types of Montana Settlement Agreements between the Estate of a Deceased Partner and the Surviving Partners can vary depending on the circumstances and intentions of the parties involved. These may include: 1. Fixed Percentage Buyout Agreement: This agreement establishes a set percentage or price for the surviving partners to buy out the deceased partner's interests. 2. Promissory Note or Installment Agreement: If the surviving partners are unable to pay the full amount at once, this agreement allows them to make payments to the estate over a specified period, usually with interest. 3. Cross-Purchase Agreement: In this arrangement, the surviving partners individually buy out the deceased partner's share, rather than purchasing it collectively as a partnership entity. 4. Entity-Purchase Agreement: This type of agreement allows the partnership itself to buy out the deceased partner's interest. The assets are then redistributed among the remaining partners. It is essential for anyone navigating the complexities of a Montana Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners to consult with legal professionals to ensure the agreement appropriately reflects their intentions and protects their rights and interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Acuerdo de conciliación entre el patrimonio de un socio fallecido y los socios sobrevivientes - Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

How to fill out Montana Acuerdo De Conciliación Entre El Patrimonio De Un Socio Fallecido Y Los Socios Sobrevivientes?

Discovering the right legitimate record template might be a struggle. Needless to say, there are a lot of web templates available online, but how do you obtain the legitimate develop you require? Use the US Legal Forms web site. The support offers 1000s of web templates, such as the Montana Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners, which can be used for company and private needs. All of the types are examined by professionals and meet state and federal specifications.

Should you be already authorized, log in to your bank account and click on the Down load switch to obtain the Montana Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners. Use your bank account to look throughout the legitimate types you may have bought earlier. Proceed to the My Forms tab of your respective bank account and get another copy of your record you require.

Should you be a whole new customer of US Legal Forms, here are basic recommendations so that you can stick to:

- Initially, be sure you have chosen the appropriate develop for your personal town/state. You are able to check out the form using the Review switch and browse the form outline to make sure this is basically the right one for you.

- In case the develop fails to meet your expectations, take advantage of the Seach area to obtain the right develop.

- When you are sure that the form is proper, click the Purchase now switch to obtain the develop.

- Opt for the prices strategy you need and enter in the necessary info. Build your bank account and buy an order using your PayPal bank account or Visa or Mastercard.

- Choose the file file format and download the legitimate record template to your product.

- Complete, change and print out and sign the attained Montana Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners.

US Legal Forms is the largest catalogue of legitimate types in which you can find various record web templates. Use the service to download expertly-created papers that stick to express specifications.