Montana Credit Information Request is a process where individuals or businesses in the state of Montana seek access to their credit information. Credit information provides a detailed overview of an individual's or a business's credit history, including their borrowing and repayment activities, credit scores, outstanding debts, and other relevant financial information. Montana Credit Information Requests are initiated to gain insights into one's creditworthiness, track financial progress, detect errors or discrepancies in credit reports, and make informed decisions related to loans, mortgages, or employment opportunities. By reviewing credit reports, individuals can identify areas that need improvement, rectify incorrect information, and enhance their financial standing. In Montana, credit information requests can be categorized into the following types: 1. Annual Credit Report Request: Under the Montana Credit Reporting Act, residents are entitled to request a free yearly credit report from each nationwide credit reporting agency. This report offers a comprehensive overview of an individual's credit information from all reporting agencies and is instrumental in identifying any incorrect or fraudulent activities. 2. Credit Score Request: Obtaining credit scores is crucial as they reflect an individual's creditworthiness. Individuals can request their credit scores from various credit reporting agencies or use online platforms to access their scores. Credit scores play a vital role in determining eligibility for loans, interest rates, and other financial transactions. 3. Credit Report Dispute Request: If an individual identifies incorrect or outdated information in their credit report, they can initiate a dispute process with the credit reporting agency. This request involves providing documentation to support the dispute claim and requesting the removal or correction of the erroneous information. 4. Employment Background Check Request: Some employers may request access to an applicant's credit information as part of the hiring process, especially for positions that involve financial responsibility. Individuals can be asked to provide consent for the potential employer to access their credit information for assessment purposes. 5. Loan or Credit Application Request: When applying for loans, mortgages, or credit cards, financial institutions or lenders usually require individuals to authorize the credit reporting agencies to share their credit information. This request is necessary to assess an individual's creditworthiness and determine loan eligibility, interest rates, and loan terms. 6. Credit Freeze Request: Montana residents have the option to request a credit freeze, which restricts access to their credit information. This measure helps protect against identity theft and prevents unauthorized individuals from opening new accounts or credit lines in the individual's name. It is important to note that while Montana Credit Information Requests follow standardized procedures, each request type serves a distinct purpose, fulfilling various financial and legal requirements. By understanding the different types of Montana Credit Information Requests, individuals can navigate the credit landscape more effectively and make sound financial decisions.

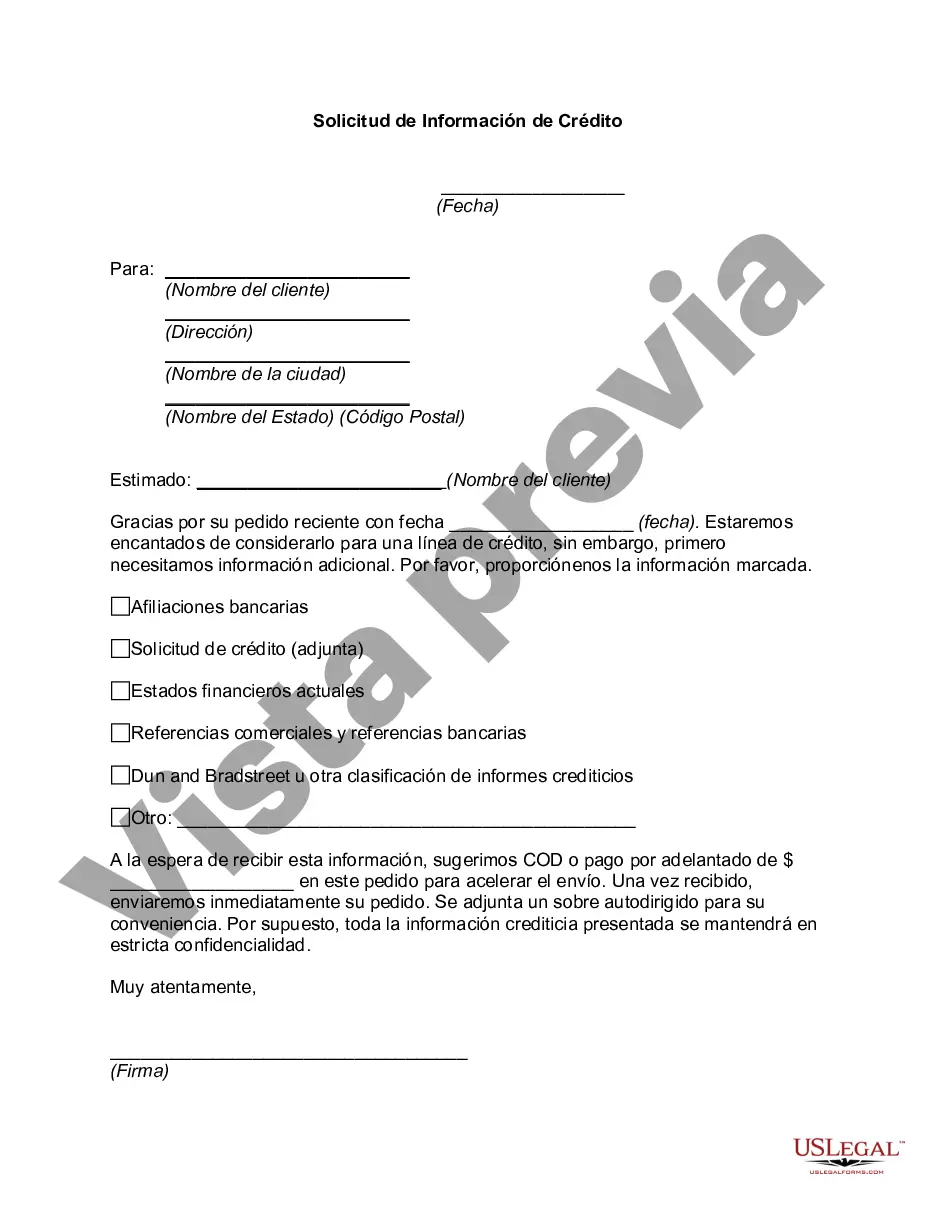

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Montana Solicitud De Información De Crédito?

US Legal Forms - one of several biggest libraries of legal kinds in the States - gives a wide array of legal file themes it is possible to obtain or printing. Making use of the internet site, you can get a large number of kinds for organization and person uses, categorized by categories, claims, or keywords.You will find the most up-to-date versions of kinds just like the Montana Credit Information Request within minutes.

If you currently have a membership, log in and obtain Montana Credit Information Request in the US Legal Forms collection. The Acquire key will show up on every single develop you perspective. You have accessibility to all formerly downloaded kinds from the My Forms tab of your profile.

In order to use US Legal Forms for the first time, here are basic recommendations to help you get began:

- Be sure you have picked out the best develop for your metropolis/county. Select the Review key to check the form`s content material. Look at the develop outline to ensure that you have chosen the right develop.

- If the develop does not match your needs, use the Look for discipline at the top of the display to find the one that does.

- If you are happy with the shape, validate your selection by visiting the Acquire now key. Then, pick the costs plan you want and give your references to sign up on an profile.

- Process the purchase. Utilize your credit card or PayPal profile to perform the purchase.

- Choose the structure and obtain the shape on your product.

- Make changes. Load, modify and printing and signal the downloaded Montana Credit Information Request.

Every format you included with your account does not have an expiry time and it is yours permanently. So, if you wish to obtain or printing one more version, just visit the My Forms area and click on on the develop you will need.

Obtain access to the Montana Credit Information Request with US Legal Forms, probably the most comprehensive collection of legal file themes. Use a large number of specialist and status-particular themes that meet your company or person demands and needs.