Montana Demand for a Shareholders Meeting refers to the legal process that allows shareholders of a company to request a meeting to discuss important matters and make critical decisions regarding the company's operations and management. This process is governed by Montana state laws, specifically the Montana Business Corporation Act. In order to initiate a Montana Demand for a Shareholders Meeting, shareholders must meet certain criteria. Firstly, they must own a minimum number of shares or hold a specified percentage of the company's total outstanding shares. The exact requirements may vary depending on the company's bylaws or state regulations. A Montana Demand for a Shareholders Meeting can be made for various reasons, including but not limited to: 1. Election of Directors: Shareholders may want to convene a meeting to vote on the appointment or removal of directors. This could occur when there is a lack of confidence in the current board or when new candidates are proposed. 2. Executive Compensation: Shareholders may demand a meeting to discuss and vote on executive compensation packages, bonus structures, or other remuneration-related matters. 3. Financial Matters: Shareholders may seek a meeting to discuss the company's financial performance, such as approving or rejecting financial statements, dividend payments, or financing arrangements. 4. Mergers and Acquisitions: If a major merger or acquisition is proposed, shareholders may request a meeting to evaluate the terms and conditions of the deal and decide whether to proceed. 5. Corporate Governance: Shareholders may use a demand for a meeting to address corporate governance concerns, such as requesting changes to the bylaws, adopting shareholder rights plans, or implementing stricter ethical standards. 6. Extraordinary Events: In cases where the company experiences a crisis, such as bankruptcy, fraud allegations, or major legal issues, shareholders may call for a meeting to discuss these matters and determine appropriate actions. It is crucial for shareholders considering a Montana Demand for a Shareholders Meeting to review the company's bylaws and state laws to ensure compliance with all procedures and timeframes. Additionally, this process may involve drafting and circulating a formal demand letter to the company's board of directors, specifying the purpose of the meeting and the issues to be addressed. Once a valid demand is submitted, the board of directors is legally bound to fulfill the shareholders' request and promptly schedule the meeting. However, if the demand is not met within a reasonable time frame, shareholders may have legal options to enforce their rights through litigation or other legal remedies. Overall, a Montana Demand for a Shareholders Meeting enables shareholders to actively participate in the decision-making process of a company and safeguard their interests. It serves as a vital mechanism for promoting transparency, accountability, and effective corporate governance.

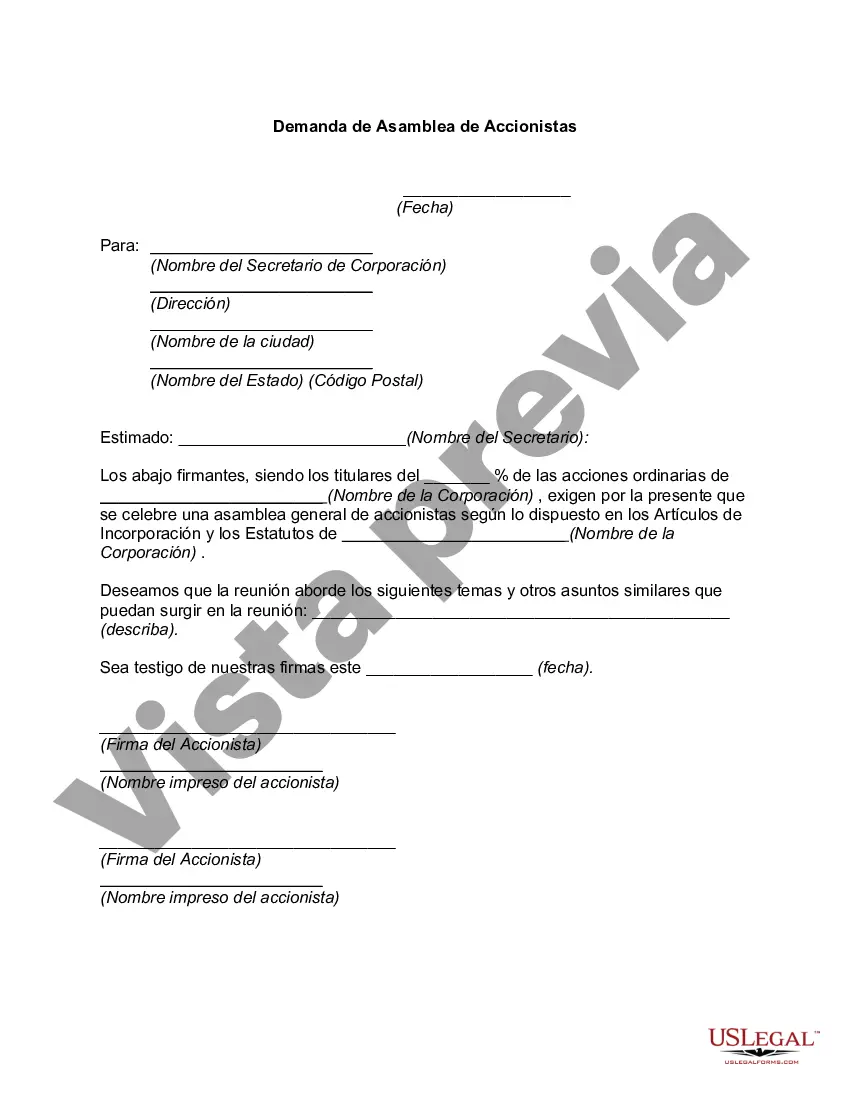

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Demanda de Asamblea de Accionistas - Demand for a Shareholders Meeting

Description

How to fill out Montana Demanda De Asamblea De Accionistas?

If you need to total, download, or printing legitimate file web templates, use US Legal Forms, the most important selection of legitimate varieties, that can be found on-line. Make use of the site`s simple and easy convenient search to discover the documents you require. Different web templates for business and personal functions are sorted by classes and states, or keywords. Use US Legal Forms to discover the Montana Demand for a Shareholders Meeting within a couple of mouse clicks.

If you are previously a US Legal Forms customer, log in to your bank account and click the Obtain button to get the Montana Demand for a Shareholders Meeting. You may also entry varieties you previously acquired from the My Forms tab of the bank account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for the proper area/land.

- Step 2. Make use of the Review method to examine the form`s content material. Don`t neglect to read the explanation.

- Step 3. If you are unsatisfied with all the form, take advantage of the Search discipline towards the top of the display to discover other types from the legitimate form design.

- Step 4. Upon having found the shape you require, click the Acquire now button. Opt for the prices strategy you choose and add your credentials to register to have an bank account.

- Step 5. Method the purchase. You should use your Мisa or Ьastercard or PayPal bank account to complete the purchase.

- Step 6. Find the format from the legitimate form and download it on your system.

- Step 7. Full, change and printing or signal the Montana Demand for a Shareholders Meeting.

Every legitimate file design you get is your own for a long time. You have acces to every single form you acquired in your acccount. Click the My Forms portion and choose a form to printing or download once again.

Compete and download, and printing the Montana Demand for a Shareholders Meeting with US Legal Forms. There are many professional and express-certain varieties you can utilize for your personal business or personal demands.