Montana Stop Annuity Request is a legal process by which an individual in the state of Montana can terminate or halt an annuity contract. An annuity is a financial product commonly used for retirement planning, wherein the annuitant receives periodic payments from an insurance company in exchange for a lump sum or regular premium payments. However, circumstances may arise where an individual needs to stop or surrender their annuity contract, leading to the Montana Stop Annuity Request. There are several types of Montana Stop Annuity Requests that an individual may consider based on their unique situation. These include: 1. Complete Annuity Surrender: This type of request involves terminating the annuity contract entirely, resulting in the annuitant giving up all future rights to receive payments from the insurance company. The surrender value, i.e., the fair market value of the annuity at the time of surrender, is typically paid out to the annuitant. 2. Partial Annuity Surrender: In some cases, an annuitant may only need to withdraw a portion of their annuity's value. The annuitant can request a partial surrender, wherein they receive a specific amount of money while leaving the rest of the annuity intact. 3. Annuity Withdrawal: Instead of surrendering the entire contract, an annuitant may choose to request periodic withdrawals from their annuity. These allow them to access a specific amount of money at regular intervals, helping meet their financial needs while keeping the annuity in force. 4. Annuitization Modifications: An annuity contract often allows annuitants to change the payment schedule or modify the payout options. By submitting a Montana Stop Annuity Request, an annuitant can make adjustments such as switching from a fixed annuity to a variable annuity or altering the frequency and duration of payments. 5. Beneficiary Change: An annuitant may also choose to modify the beneficiary designation of their annuity contract through a Stop Annuity Request. This change ensures that the designated individual(s) will receive the remaining annuity balance upon the annuitant's death. When submitting a Montana Stop Annuity Request, it is important to follow the proper procedures as outlined by the insurance company that issued the annuity contract. Typically, a written request must be sent to the insurance company's customer service department, including specific details such as the annuitant's name, contract number, and desired changes. Consulting with a financial advisor or an attorney specializing in annuities can help navigate the complexities of this process and ensure a successful outcome.

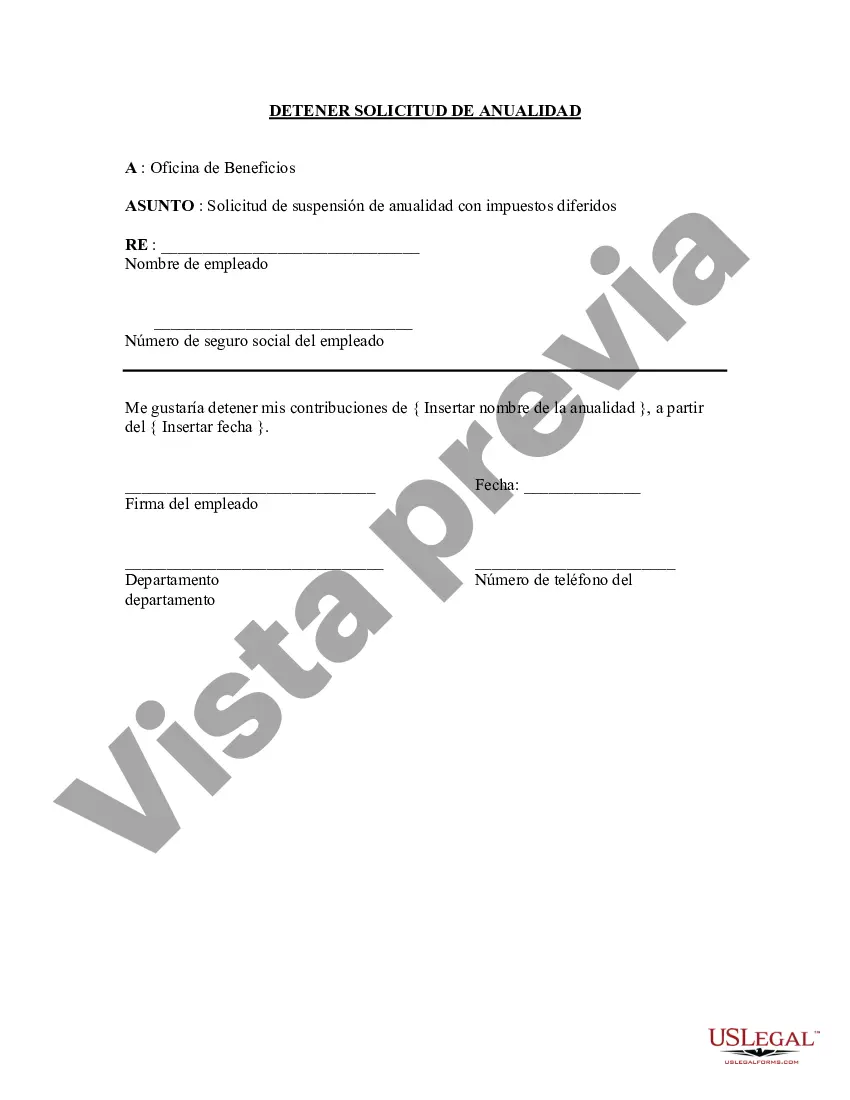

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montana Detener solicitud de anualidad - Stop Annuity Request

Description

How to fill out Montana Detener Solicitud De Anualidad?

US Legal Forms - one of several largest libraries of legitimate forms in the USA - delivers an array of legitimate file web templates you can download or produce. Utilizing the site, you will get a huge number of forms for business and personal reasons, sorted by groups, suggests, or key phrases.You can find the most recent models of forms much like the Montana Stop Annuity Request within minutes.

If you currently have a monthly subscription, log in and download Montana Stop Annuity Request in the US Legal Forms library. The Download option can look on each type you perspective. You have accessibility to all previously delivered electronically forms in the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, here are easy recommendations to help you started off:

- Ensure you have picked the correct type to your area/county. Click the Review option to check the form`s content material. See the type explanation to ensure that you have chosen the right type.

- In case the type does not match your specifications, make use of the Look for industry near the top of the display screen to find the one that does.

- Should you be satisfied with the shape, confirm your option by visiting the Buy now option. Then, pick the costs program you favor and provide your credentials to sign up for the accounts.

- Procedure the financial transaction. Use your charge card or PayPal accounts to finish the financial transaction.

- Pick the file format and download the shape on the product.

- Make changes. Fill up, modify and produce and indication the delivered electronically Montana Stop Annuity Request.

Each template you included with your account does not have an expiry particular date and is your own forever. So, if you would like download or produce yet another version, just proceed to the My Forms area and click in the type you need.

Gain access to the Montana Stop Annuity Request with US Legal Forms, probably the most comprehensive library of legitimate file web templates. Use a huge number of skilled and state-certain web templates that fulfill your organization or personal requires and specifications.