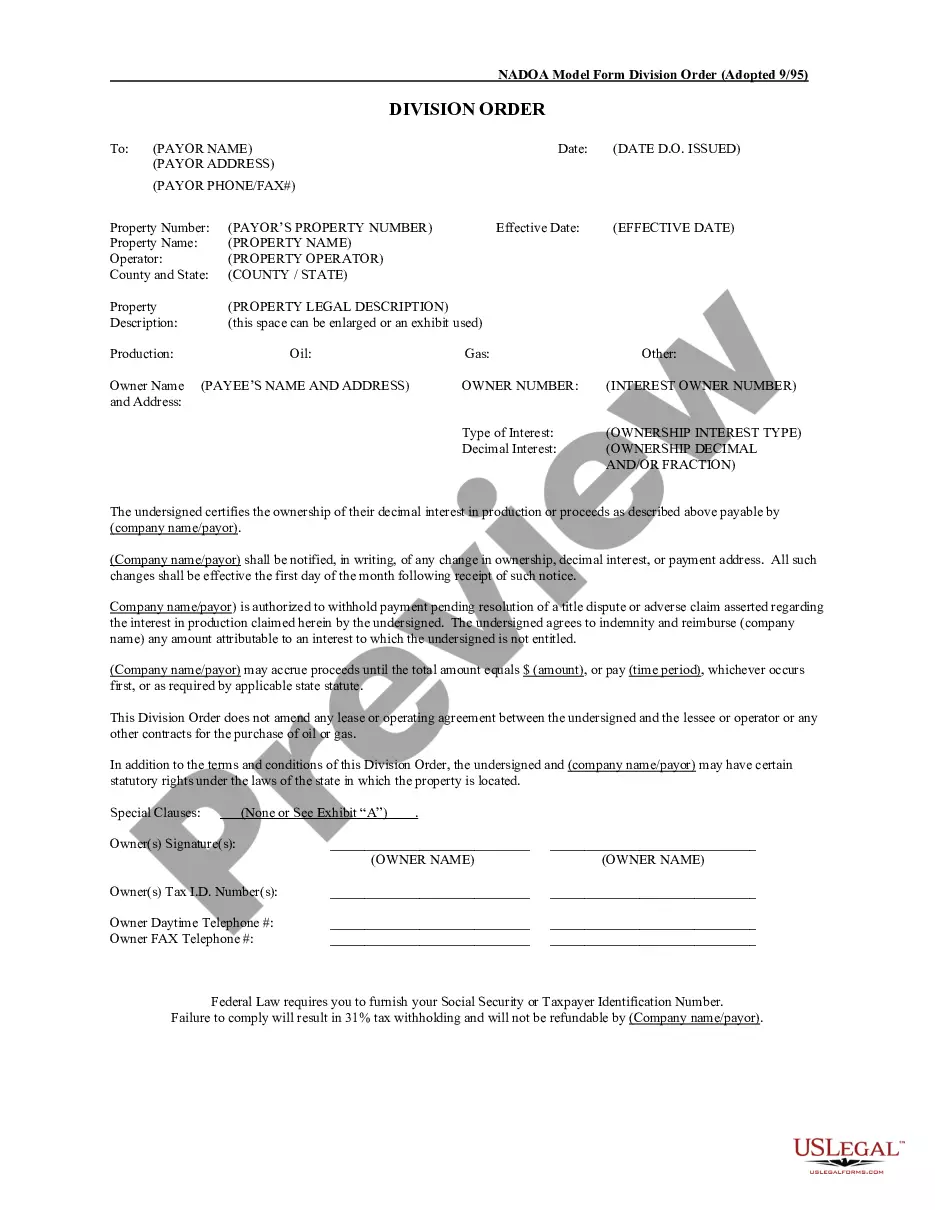

Montana Counterpart Execution

Description

How to fill out Counterpart Execution?

You can commit hours online attempting to find the authorized record format which fits the federal and state needs you want. US Legal Forms offers a large number of authorized types which are examined by professionals. You can easily obtain or produce the Montana Counterpart Execution from our services.

If you already possess a US Legal Forms account, you may log in and then click the Acquire option. After that, you may total, modify, produce, or indication the Montana Counterpart Execution. Every single authorized record format you acquire is yours permanently. To get one more backup of any bought form, go to the My Forms tab and then click the related option.

Should you use the US Legal Forms site for the first time, follow the easy directions under:

- Very first, make certain you have selected the right record format for that county/city of your choice. Browse the form information to make sure you have selected the appropriate form. If accessible, use the Review option to check throughout the record format as well.

- In order to discover one more edition in the form, use the Lookup area to obtain the format that meets your needs and needs.

- Once you have located the format you need, simply click Get now to continue.

- Find the prices program you need, enter your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal account to cover the authorized form.

- Find the formatting in the record and obtain it to your system.

- Make modifications to your record if required. You can total, modify and indication and produce Montana Counterpart Execution.

Acquire and produce a large number of record layouts using the US Legal Forms Internet site, that offers the largest assortment of authorized types. Use specialist and condition-specific layouts to take on your organization or person requirements.

Form popularity

FAQ

SELLER must complete section marked "SELLER COMPLETES IN INK" SELLER must sign (where it says "ALL OWNERS MUST SIGN" ) and have the Title NOTARIZED. If the vehicle is 9 years old or newer, the ACKNOWLEDGEMENT OF MILEAGE DISCLOSURE must be filled out. The BUYER must sign and print name in the section marked "BUYER" Title Paperwork Instructions - Flathead County mt.gov ? motor-vehicles ? TitlePaperwor... mt.gov ? motor-vehicles ? TitlePaperwor...

Related Content. An approach to executing a document that is intended to have legal effect between two or more parties, that involves each party signing a separate (but identical) copy of the document and then exchanging their signed document for the one that has been signed by the other party. Execution in counterparts - Practical Law - Thomson Reuters Practical Law ? ... Practical Law ? ...

Using a counterparts clause clarifies that: ? multiple copies of the same agreement or deed, known as counterparts, may be executed by the parties ? each signed copy will be treated as an original ? together the counterparts will comprise a single legal instrument. Counterparts boilerplate clause - PwC Australia pwc.com.au ? investing-in-infrastructure ? ii... pwc.com.au ? investing-in-infrastructure ? ii...

This Amendment may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute but one and the same agreement. Execution in Counterparts Contract Clause Examples justia.com ? execution-in-counterpart justia.com ? execution-in-counterpart

Answer: Executing a contract in counterparts is a very common practice that simply means that each party signs their own separate duplicate copy of the agreement rather than signing together on the same page of the same document. Q&A #101 ? What does it mean to sign a contract in counterparts? se4nonprofits.com ? blog ? qa-101-what-do... se4nonprofits.com ? blog ? qa-101-what-do...