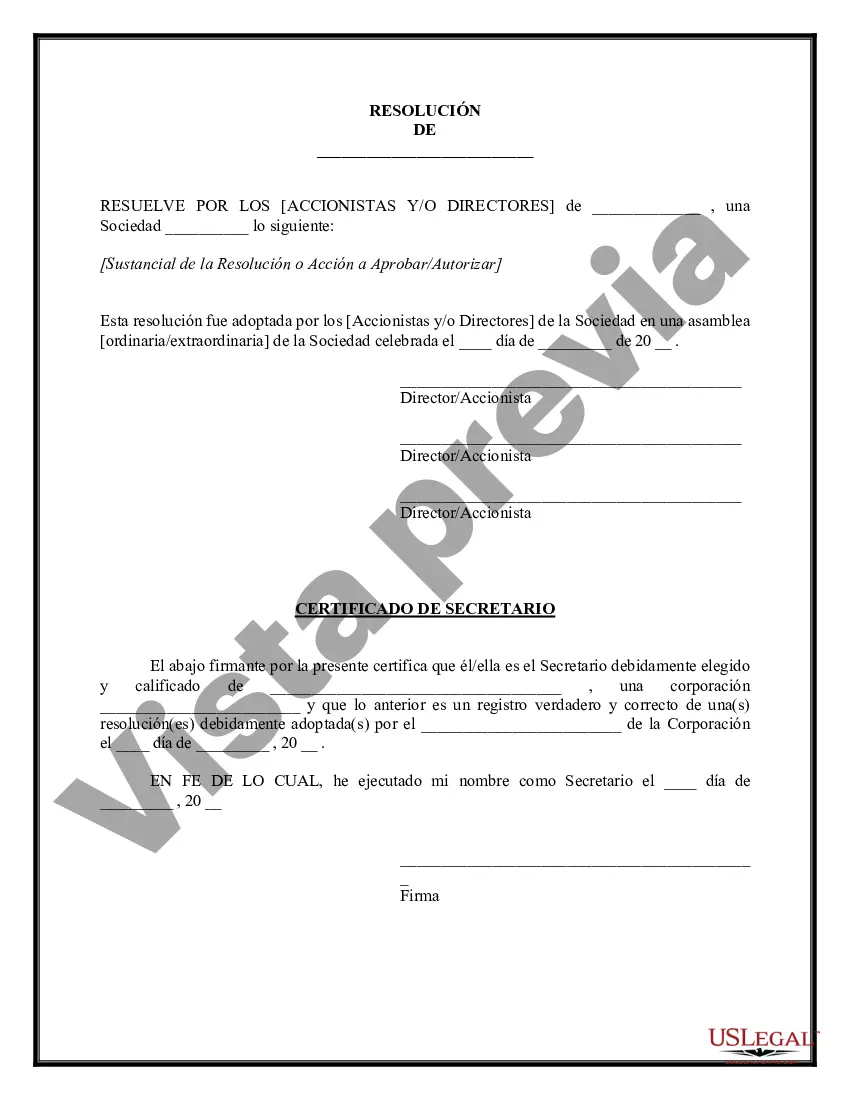

A North Carolina Corporate Resolution for PPP Loan refers to a legal document that outlines the decisions made by a corporation's board of directors or members authorizing the corporation to apply for and accept a Paycheck Protection Program (PPP) loan. This resolution serves as evidence that the corporation has given its consent and grants the necessary authority to obtain the loan. The resolution typically includes various key components. Firstly, it identifies the corporation's name, its address, and the date of the resolution's adoption. It may also mention the names of the corporation's officers, directors, or members in attendance during the resolution's approval. Furthermore, it may state the meeting's purpose, which in this case, is to authorize the corporation's participation in the PPP loan program. The North Carolina Corporate Resolution for PPP Loan should indicate the specific loan amount the corporation plans to apply for. It should emphasize the purpose of the loan, such as maintaining employee payroll or covering essential business expenses during the COVID-19 pandemic. The resolution should also highlight the loan repayment terms, including interest rates and any associated conditions. Additionally, the resolution may address other important matters related to the loan, such as signing and submitting loan application forms, providing necessary financial information, and designating authorized personnel responsible for handling loan-related matters on behalf of the corporation. It is crucial to note that there might not be different types of North Carolina Corporate Resolutions for PPP loans. However, the specific content and format may vary based on the corporation's structure (e.g., whether it is a corporation, limited liability company, partnership, etc.) and any unique requirements set by the North Carolina Department of Commerce or the Small Business Administration (SBA). Overall, the North Carolina Corporate Resolution for PPP Loan is a formal document that demonstrates a corporation's approval and commitment to obtaining a PPP loan to support its workforce and sustain business operations during periods of economic uncertainty.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Resolución Corporativa de Préstamo PPP - Corporate Resolution for PPP Loan

Description

How to fill out North Carolina Resolución Corporativa De Préstamo PPP?

US Legal Forms - one of the biggest libraries of lawful types in America - offers a wide range of lawful document themes it is possible to obtain or print out. Using the website, you can find a large number of types for enterprise and person uses, sorted by types, claims, or keywords.You can find the most recent types of types much like the North Carolina Corporate Resolution for PPP Loan within minutes.

If you currently have a registration, log in and obtain North Carolina Corporate Resolution for PPP Loan through the US Legal Forms collection. The Down load option will show up on every type you look at. You have accessibility to all earlier delivered electronically types inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, listed here are basic recommendations to help you get started:

- Be sure to have picked the right type to your metropolis/region. Click the Review option to check the form`s content. Read the type information to actually have selected the proper type.

- In the event the type doesn`t suit your specifications, use the Lookup field towards the top of the monitor to discover the one who does.

- In case you are pleased with the form, validate your option by simply clicking the Get now option. Then, opt for the prices program you prefer and give your credentials to sign up for the accounts.

- Method the deal. Make use of your Visa or Mastercard or PayPal accounts to complete the deal.

- Choose the format and obtain the form on your own device.

- Make adjustments. Load, change and print out and signal the delivered electronically North Carolina Corporate Resolution for PPP Loan.

Every single format you put into your money does not have an expiry particular date and is your own forever. So, if you want to obtain or print out one more copy, just go to the My Forms area and then click in the type you need.

Obtain access to the North Carolina Corporate Resolution for PPP Loan with US Legal Forms, by far the most considerable collection of lawful document themes. Use a large number of skilled and state-particular themes that meet your business or person requirements and specifications.