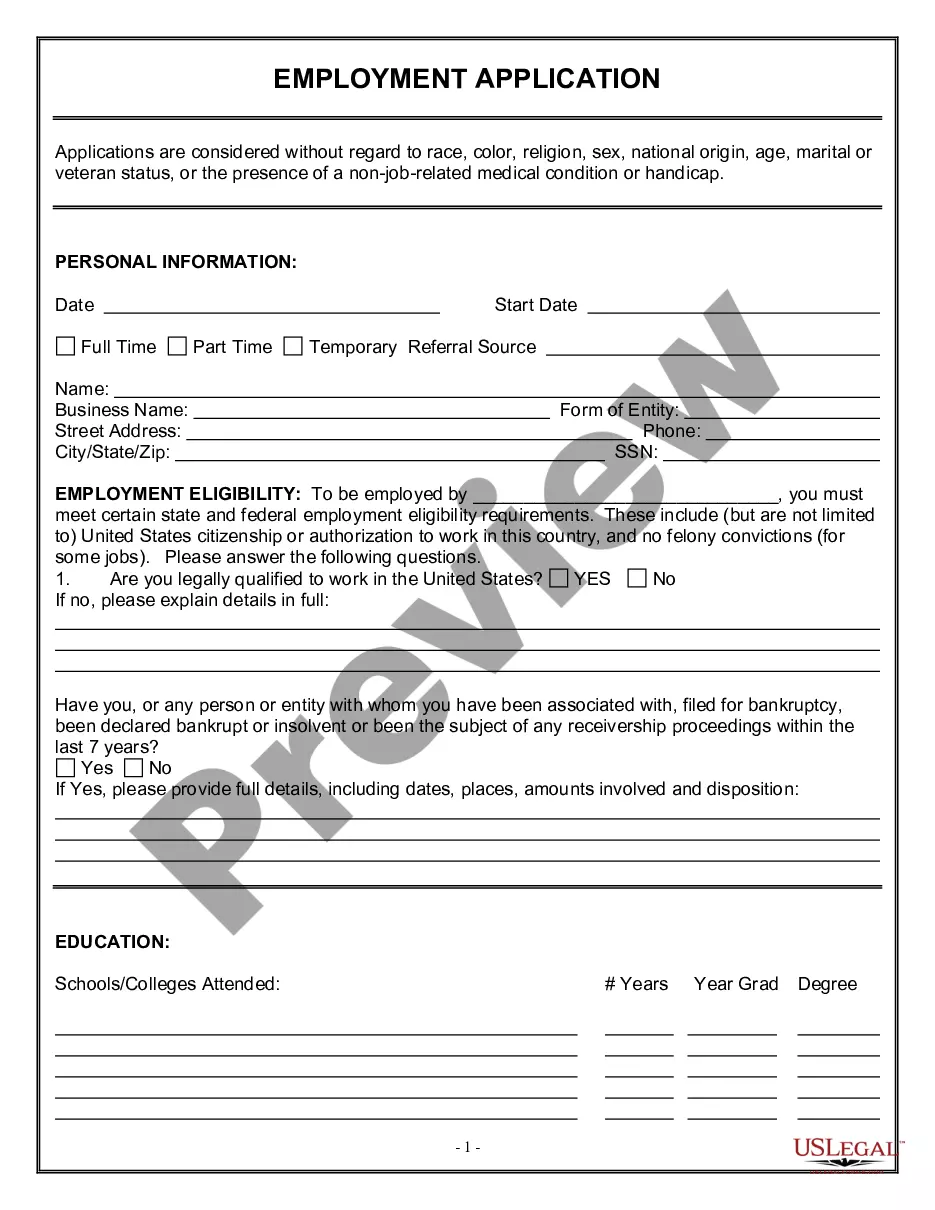

North Carolina Employment Application for Accountant

Description

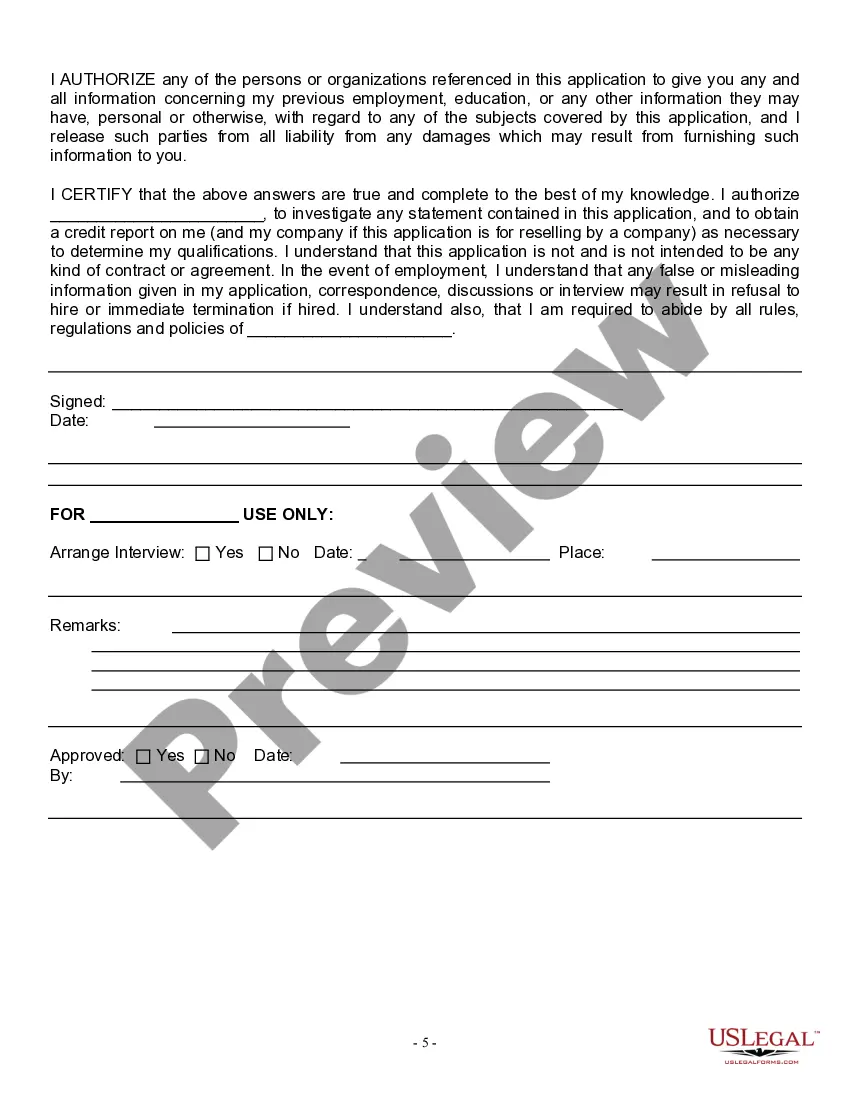

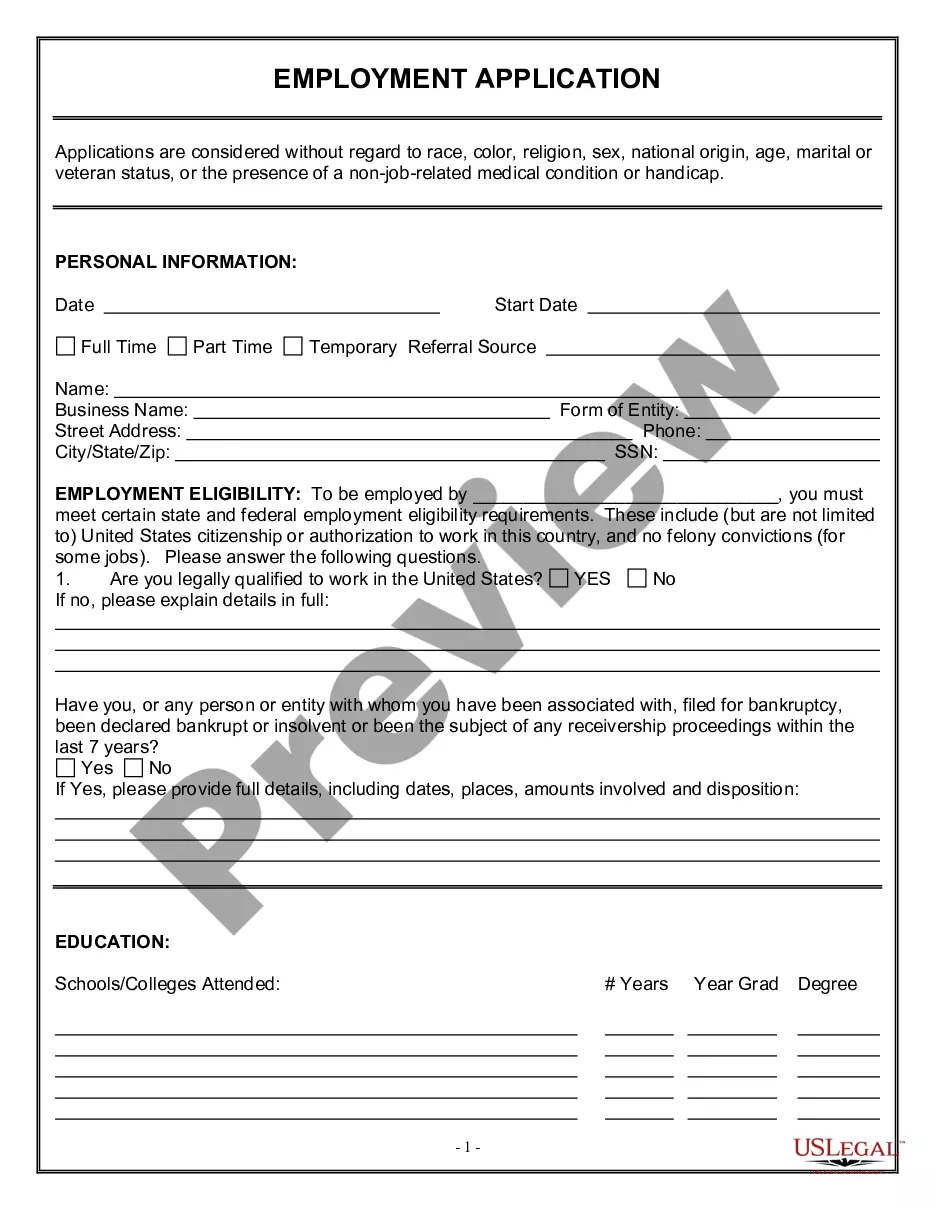

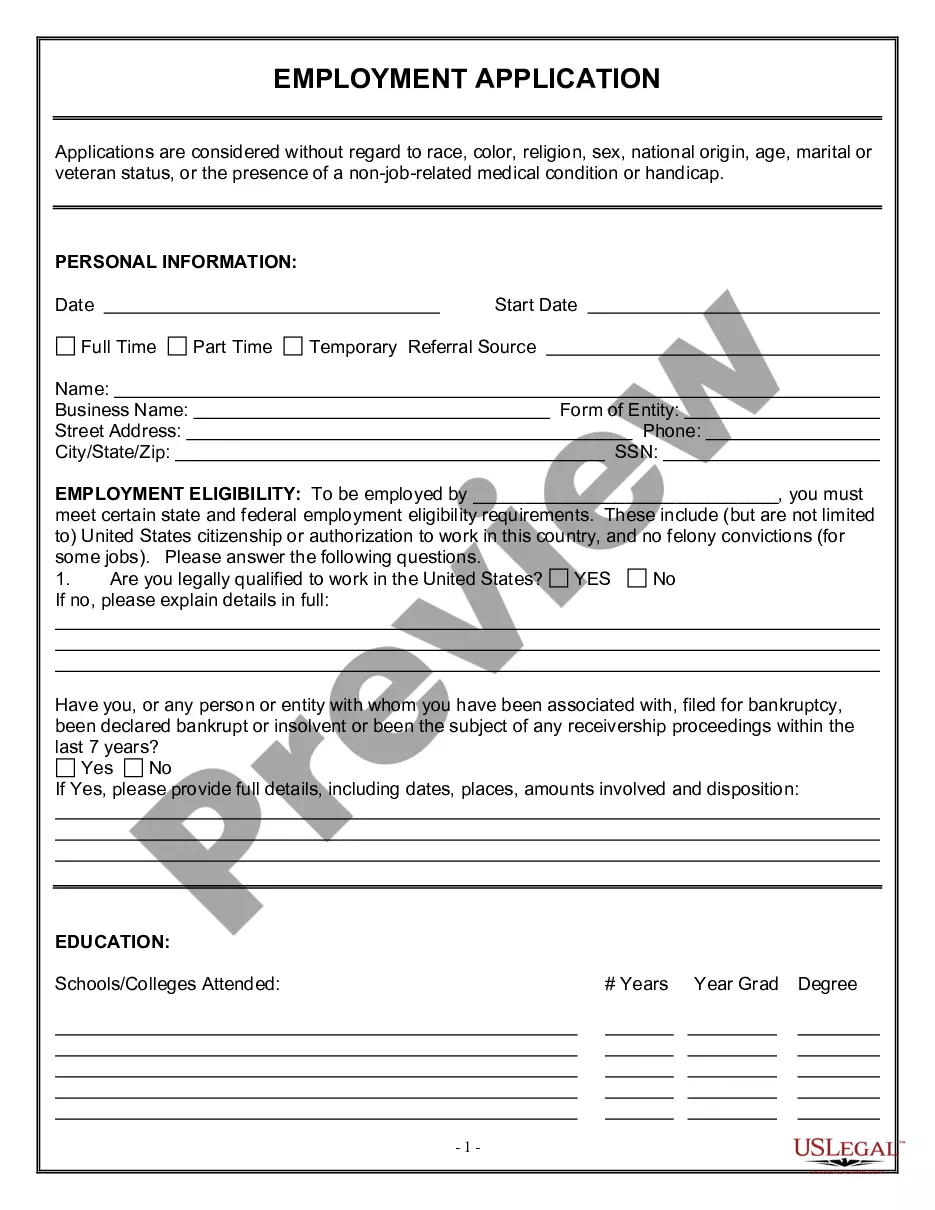

How to fill out Employment Application For Accountant?

You can dedicate time online searching for the valid document template that meets the state and federal standards necessary for you. US Legal Forms provides a wide selection of valid forms that are verified by experts.

It is easy to download or print the North Carolina Employment Application for Accountant from our platform.

If you possess a US Legal Forms account, you can Log In and then click the Download button. Afterwards, you can complete, edit, print, or sign the North Carolina Employment Application for Accountant. Each(valid) document template you acquire is yours permanently.

Complete the transaction. You can use your credit card or PayPal account to pay for the valid form. Choose the format of the document and download it to your device. Make changes to your document if needed. You can complete, edit, sign, and print the North Carolina Employment Application for Accountant. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of the received form, visit the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice. Review the form description to confirm you have chosen the appropriate form.

- If available, use the Review button to go through the document template as well.

- If you want to find another version of the form, use the Lookup field to locate the template that suits your needs and requirements.

- Once you have found the template you need, click Get now to continue.

- Select the pricing plan you require, provide your details, and create an account on US Legal Forms.

Form popularity

FAQ

Steps to Become a CPA in North CarolinaComplete 150 semester hours of college-level education in accounting.Accumulate the required hours of experience.Apply for and pass the Uniform CPA Examination.Take an approved accountancy law course.Apply for a license.Receive a license.

This will take around 3-6 weeks to receive after you've paid. Once you've received your NTS, you will have a validation period that imposes a time limit on when you must take the exam sections you paid for when you received your ATT.

North Carolina (NC) CPA Exam RequirementsMinimum Degree Required: Baccalaureate.Minimum of 30 semester hours in accounting; may count 1 bus.Applicants must receive the BA degree within 120 days after the Board approves the Exam application.Need 150 hours to be granted license but do not need 150 to sit for exam.

North Carolina CPA license requirements In order to become licensed in North Carolina, you must meet the requirement of 150 semester hours of coursework. North Carolina requires all CPA candidates to complete a designated amount of work experience in the field of accounting.

There are six main steps to complete in order to earn a CPA license in North Carolina.Complete 150 semester hours of college-level education in accounting.Accumulate the required hours of experience.Apply for and pass the Uniform CPA Examination.Take an approved accountancy law course.Apply for a license.More items...

Before taking the CPA Exam in North Carolina, you must meet a set of education requirements. First, you need a bachelor's degree or higher from a regionally accredited college or university. You must also have 120 semester hours, including a concentration in accounting, and 24 semester hours of coursework.

Colorado Requirements Overview: With no requirement to be a US Citizen, a resident of CO, or a certain age, it makes Colorado one of the easiest states to sit for the CPA exam and become licensed.

Mail application and documentation to: NC State Board of CPA Examiners, P.O. Box 12827, Raleigh, NC 27605.

Approval & Processing of Applications It takes about 10 business days for the Board to approve and process an initial Exam application and about 5 business days for the Board to approve and process a re-Examination application. However, the approval and processing time may be longer.