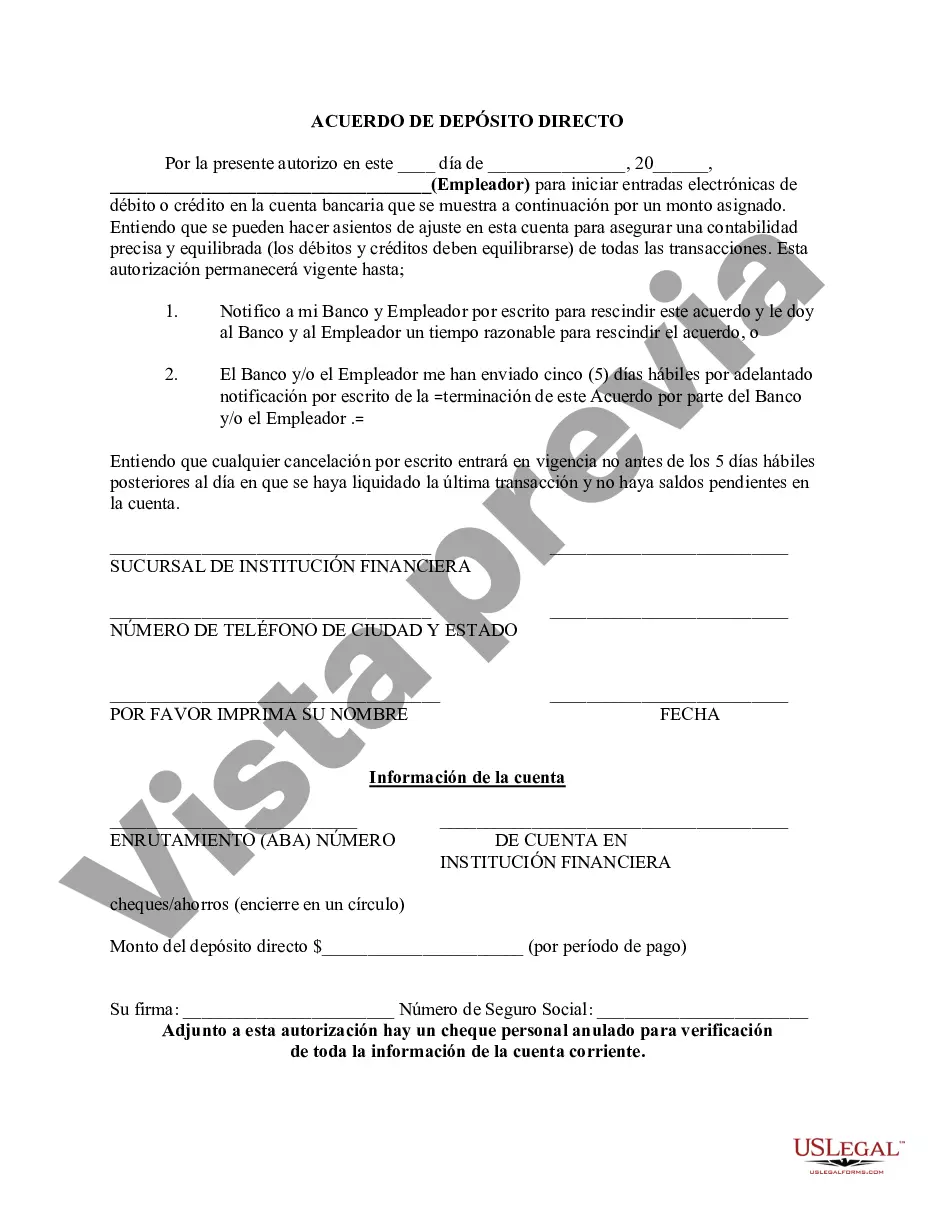

The North Carolina Direct Deposit Form for Employer is a document that allows employers in the state of North Carolina to set up direct deposit for their employees. Direct deposit is a convenient and efficient way for employees to receive their paychecks directly into their bank accounts, eliminating the need for physical checks or cash. This form is typically used when an employee is hired or when they want to change their current direct deposit information. It requires the employee to provide their personal and banking details, such as their full name, Social Security number, address, and bank account information. The employer will also need to fill in their own information, including the company name, address, and contact details. Some key information included in the North Carolina Direct Deposit Form for Employer includes the employee's financial institution name, routing number, and account number. This information is essential for the accurate and secure transfer of funds from the employer to the employee's bank account. It is important to ensure the form is filled out accurately to prevent any delays or errors in processing direct deposits. Employees must provide clear and legible information to avoid any confusion or incorrect transfers. Employers should carefully verify the information provided by the employee before submitting the form to their payroll department or bank. Different types of North Carolina Direct Deposit Forms for Employer may include variations based on the specific requirements of different employers or banking institutions. However, the core information required will generally remain the same — employee and employer details, banking information, and relevant signatures. Overall, the North Carolina Direct Deposit Form for Employer streamlines the payment process, offering employees a more secure and efficient way to receive their wages. It eliminates the need for paper checks, reduces the risk of lost or stolen payments, and ensures timely access to funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Formulario de depósito directo para el empleador - Direct Deposit Form for Employer

Description

How to fill out North Carolina Formulario De Depósito Directo Para El Empleador?

You might take time on the web searching for the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers a vast number of legal documents that are reviewed by experts.

You can conveniently obtain or print the North Carolina Direct Deposit Form for Employer from their services.

If available, utilize the Review button to also preview the document template.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the North Carolina Direct Deposit Form for Employer.

- Every legal document template you obtain is yours perpetually.

- To acquire another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for your preferred county/area.

- Review the form summary to confirm you have chosen the correct form.

Form popularity

FAQ

A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account. Commonly, an employer requesting authorization will require a voided check to ensure that the account is valid.

How to set up direct deposit for your paycheckAsk for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF).Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.More items...

How to Set Up Direct DepositFill out the direct deposit form.Include your account information.Deposit amount.Attach a voided check or deposit slip.Submit the form.

An employer can make the payment of wages by direct deposit as a condition of employment without violating the Wage and Hour Act. If direct deposit is the only option offered the employee, the employees must be able to choose their own financial institution.

No employer can require an employee to use direct deposit at a specific bank. Employers aren't allowed to charge employees a fee based on payment method. Employees must have access to their pay stubs.

States that Allow Required Direct DepositIndiana, Kansas, Minnesota, Missouri, South Carolina, Texas, Virginia, Washington, and West Virginia allow employers to require direct deposit.

The Electronic Fund Transfer Act (EFTA), also known as federal Regulation E, permits employers to make direct deposit mandatory, as long as the employee is able to choose the bank that his or her wages will be deposited into. Alternatively, employers can choose the bank that employees must use for direct deposit.

How to Set Up Direct DepositGet a direct deposit form from your employer.Fill in account information.Confirm the deposit amount.Attach a voided check or deposit slip, if required.Submit the form.

North Carolina labor laws allow an employer to pay wages by direct deposit so long as the wages are deposited into an institution whose deposits are insured by the federal government or into a financial institution selected by the employee.

Each employee needs to provide the following information: bank name, account type, account number and routing number. Some states also require employees to sign a consent form before their employer can switch them to direct deposit.

Interesting Questions

More info

Download the Portable Document Format, a file formats software that provides quick link file access. For a copy, call, option 3 before pressing the button on the front page. For additional questions contact us: Email Pinellas County Department of Finance & Human Services Attn. Financial Aid & Scholarships. 12001 J.F. Young Parkway N, Ste 150 Tampa, FL 33614 Toll-free: Fax: Pinellas County Department of Finance & Human Services 12001 J.F. Young Parkway N, Ste 150 Tampa, FL 33614 Toll-free: Florida Dept of Agriculture — Division of Farm & Wildlife Pinellas County Department of Agriculture 1099 S. Pinellas St., Suite 600 Bradenton, FL 34230 Toll-free: For additional questions contact us: Email Pinellas County Dept of Finance & Human Services Attn. Financial Aid & Scholarships. 12001 J.F. Young Parkway N, Ste 150 Tampa, FL 33614 Toll-free: Fax: Pinellas County Department of Finance & Human Services 12001 J.F.