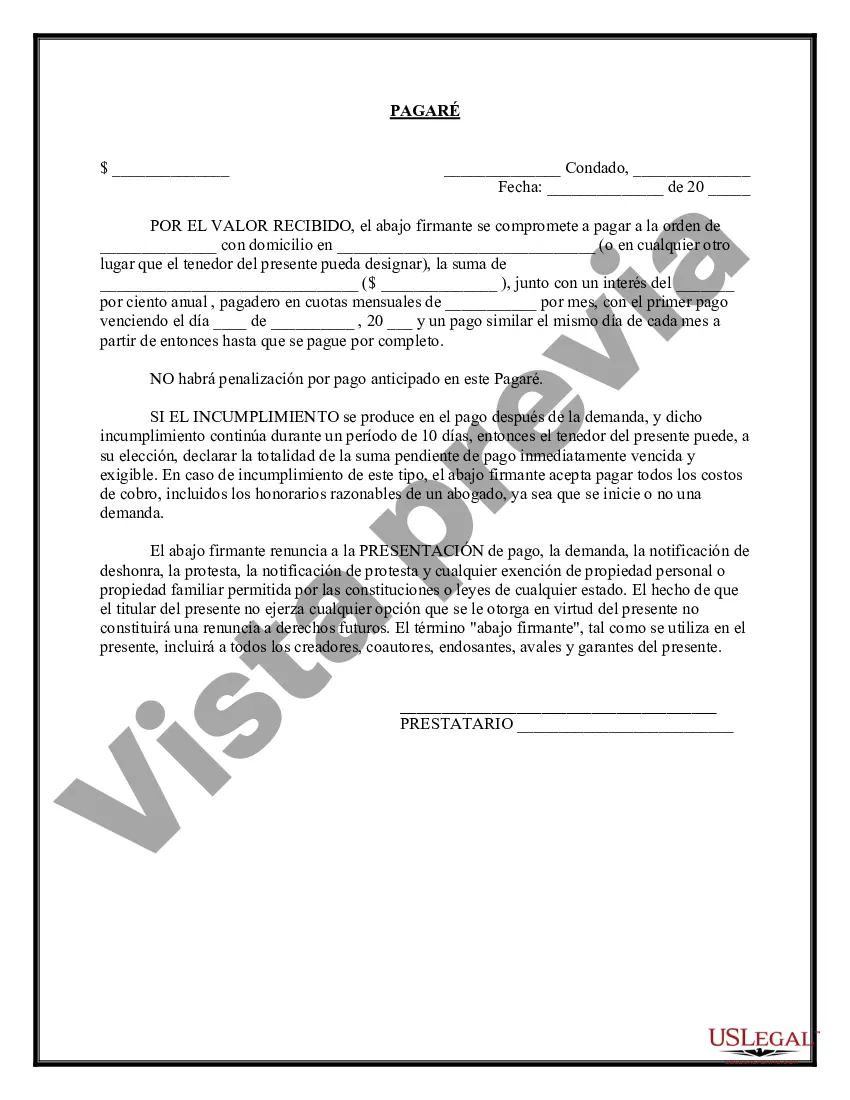

A North Carolina Promissory Note with Installment Payments is a legal document that establishes a written agreement between a lender and a borrower regarding a loan. This type of promissory note outlines the terms and conditions surrounding the loan, including the repayment schedule and the specifics of how the borrower will make payments in installments. In North Carolina, there are various types of Promissory Notes with Installment Payments depending on the purpose and details of the loan. Some notable types include: 1. Real Estate Promissory Note with Installment Payments: This type of promissory note is specifically used for financing real estate transactions. It provides details about the property, its value, and the agreed-upon installment payments required from the borrower to repay the loan. 2. Personal Loan Promissory Note with Installment Payments: This is a common type of promissory note used when individuals lend money to family members or friends. It outlines the terms of the personal loan, such as interest rates, payment amounts, and the agreed-upon schedule for installment payments. 3. Business Promissory Note with Installment Payments: This type of promissory note is utilized when a business lends money to another business entity or an individual. It defines the business relationship and specifies the repayment terms, including the installment amounts and the frequency of payments. Some crucial elements that should be included in a North Carolina Promissory Note with Installment Payments are the names and contact information of both parties involved, the loan amount, the interest rate charged, the repayment schedule, late payment penalties, and any collateral assets used to secure the loan. Lenders and borrowers should also consider including clauses that protect their rights and interests, such as acceleration clauses (allowing the lender to demand full repayment if certain conditions are not met) and default clauses (outlining the consequences of a borrower's failure to repay the loan). It is crucial to consult with legal professionals or use trusted online resources to ensure the Promissory Note complies with North Carolina's specific laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out North Carolina Pagaré Con Pagos A Plazos?

Are you currently in a position in which you will need files for possibly business or individual uses nearly every working day? There are a lot of lawful file templates accessible on the Internet, but getting ones you can depend on isn`t effortless. US Legal Forms offers thousands of develop templates, much like the North Carolina Promissory Note with Installment Payments, which can be created to fulfill state and federal demands.

When you are currently informed about US Legal Forms internet site and also have your account, simply log in. Following that, you may acquire the North Carolina Promissory Note with Installment Payments design.

Unless you come with an accounts and need to begin using US Legal Forms, adopt these measures:

- Discover the develop you need and make sure it is for the proper area/county.

- Make use of the Review key to examine the form.

- See the information to actually have chosen the proper develop.

- In the event the develop isn`t what you are looking for, use the Lookup area to get the develop that suits you and demands.

- If you find the proper develop, simply click Purchase now.

- Choose the pricing prepare you want, complete the necessary information and facts to create your money, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Choose a convenient paper format and acquire your duplicate.

Discover every one of the file templates you have bought in the My Forms menu. You can aquire a more duplicate of North Carolina Promissory Note with Installment Payments at any time, if possible. Just go through the necessary develop to acquire or print out the file design.

Use US Legal Forms, one of the most extensive variety of lawful kinds, to conserve efforts and stay away from faults. The service offers skillfully made lawful file templates which can be used for a selection of uses. Make your account on US Legal Forms and initiate generating your daily life a little easier.