The North Carolina Stock Sale and Purchase Agreement refers to a legally binding document that governs the sale and purchase of a corporation and all it's stock by the purchaser. This agreement plays a crucial role in facilitating the seamless transfer of ownership and protects the interests of both the buyer and seller involved in the transaction. In a North Carolina Stock Sale and Purchase Agreement, several key elements are typically included to ensure clarity and transparency throughout the process. These elements may include: 1. Parties Involved: The agreement clearly identifies the parties involved in the transaction, namely the purchaser and the seller. It may also involve additional stakeholders like shareholders or board members. 2. Purchase Price: The agreement states the agreed-upon purchase price for the corporation and the stock. This price is typically negotiated between the buyer and seller and may include provisions for adjustments based on factors such as working capital or debt. 3. Assets and Liabilities: The agreement outlines the assets and liabilities being transferred as part of the sale. This includes a comprehensive list of tangible and intangible assets, inventory, real estate, intellectual property, contracts, and any outstanding debts or liabilities. 4. Representations and Warranties: Both the buyer and seller typically provide representations and warranties relating to the corporation being sold. These statements affirm the accuracy and completeness of financial records, legal compliance, and any other relevant aspects. They serve to protect both parties in case of any misrepresentations or undisclosed information. 5. Conditions Precedent: The agreement may specify conditions that must be met before the sale can be finalized. These conditions can vary depending on the specifics of the transaction, such as obtaining necessary approvals from regulatory bodies or shareholders. 6. Indemnification and Limitation of Liability: Provisions for indemnification determine the extent to which the seller will compensate the buyer for any losses or claims arising from pre-closing liabilities. The agreement may also include limitations on the seller's liability to protect them from certain risks after the sale is completed. Different types of Stock Sale and Purchase Agreements categorized under North Carolina law can include variations such as: 1. Asset Purchase Agreement: In this type of agreement, the buyer acquires specific assets and liabilities of the corporation rather than purchasing the entire entity. This approach allows the buyer to tailor the acquisition to their specific needs, excluding certain unwanted assets or liabilities. 2. Stock Purchase Agreement: This agreement involves the purchase of all the shares of the corporation, granting the buyer ownership and control over the entire entity. Unlike the asset purchase agreement, the buyer assumes both the assets and liabilities of the corporation. Ultimately, the North Carolina Stock Sale and Purchase Agreement provides a legally binding framework that governs the sale of a corporation and its stock. By addressing crucial aspects such as purchase price, assets and liabilities, representations and warranties, conditions precedent, indemnification, and the limitations of liability, this agreement safeguards the rights and interests of both the buyer and the seller involved in the transaction.

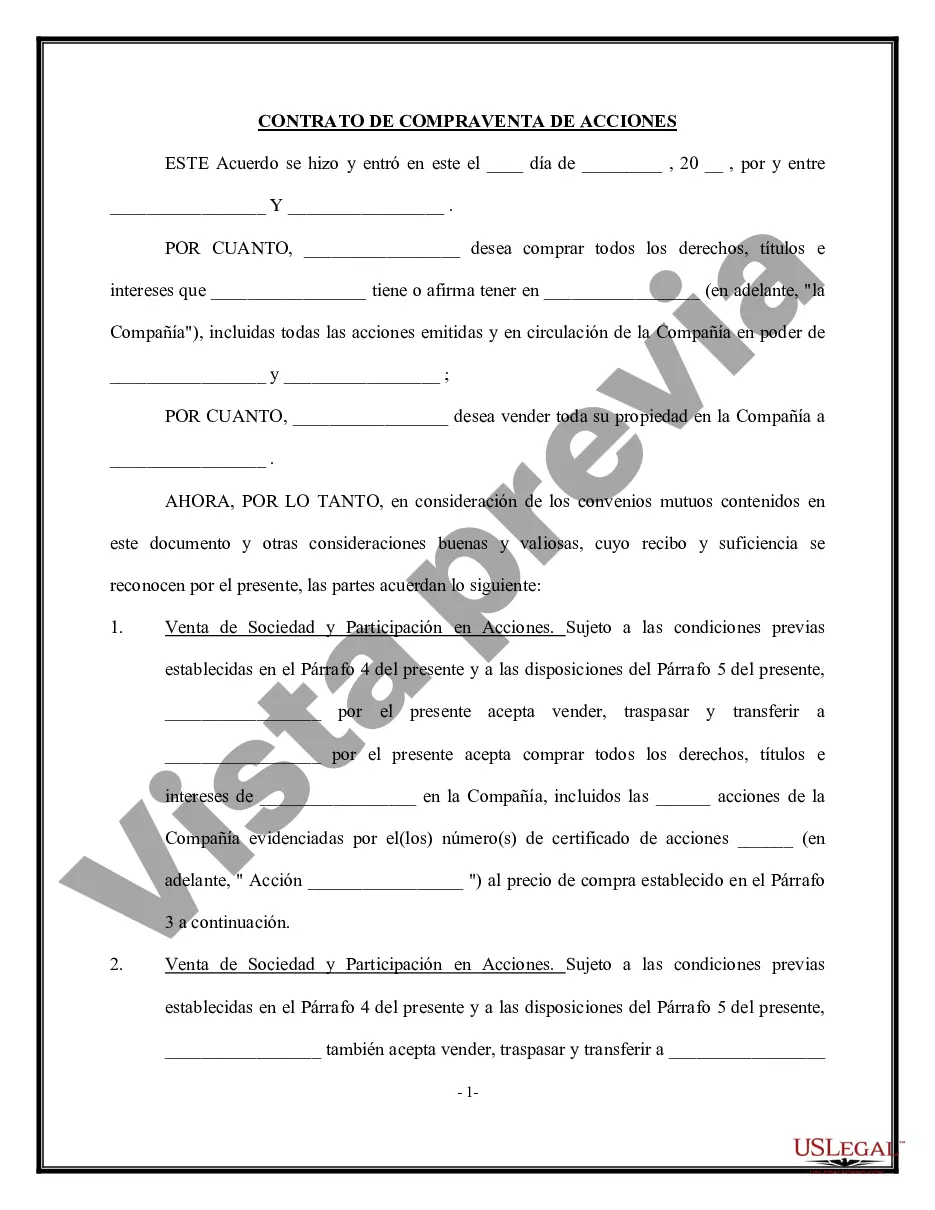

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Acuerdo de compra y venta de acciones - Venta de la Corporación y todas las acciones al Comprador - Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out North Carolina Acuerdo De Compra Y Venta De Acciones - Venta De La Corporación Y Todas Las Acciones Al Comprador?

You can devote time on the Internet looking for the authorized record template that meets the federal and state requirements you need. US Legal Forms supplies a huge number of authorized forms which are evaluated by experts. It is simple to acquire or printing the North Carolina Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser from our services.

If you currently have a US Legal Forms bank account, you are able to log in and click the Down load option. Afterward, you are able to full, change, printing, or indication the North Carolina Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser. Every authorized record template you get is your own permanently. To acquire another version of any purchased develop, check out the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website initially, adhere to the straightforward guidelines listed below:

- Initial, ensure that you have chosen the best record template to the state/area of your choosing. Browse the develop explanation to make sure you have picked the correct develop. If accessible, utilize the Preview option to check from the record template at the same time.

- If you wish to get another version of your develop, utilize the Search area to get the template that suits you and requirements.

- After you have located the template you need, click on Purchase now to proceed.

- Find the costs plan you need, type in your qualifications, and sign up for your account on US Legal Forms.

- Complete the deal. You can utilize your bank card or PayPal bank account to purchase the authorized develop.

- Find the file format of your record and acquire it to the product.

- Make modifications to the record if required. You can full, change and indication and printing North Carolina Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser.

Down load and printing a huge number of record templates using the US Legal Forms website, which provides the largest variety of authorized forms. Use professional and express-distinct templates to take on your company or individual needs.