A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

The North Carolina Guaranty of Collection of Promissory Note is a legally binding agreement that serves as a guarantee or assurance for the collection of a promissory note. It ensures that in the event of default or non-payment by the borrower, the guarantor will step in and fulfill the obligations outlined in the promissory note. This type of agreement is commonly used in North Carolina to protect lenders and ensure the repayment of loans. The Guaranty of Collection is a crucial tool for lenders, as it provides an added layer of security and decreases the risk associated with lending money. There are certain variations or types of the North Carolina Guaranty of Collection of Promissory Note that can be customized based on specific requirements. Some common types include: 1. Unconditional Guaranty: This type of guaranty imposes an absolute obligation on the guarantor to pay the lender in the event of default by the borrower. It is the most comprehensive form of guaranty. 2. Conditional Guaranty: Unlike an unconditional guaranty, a conditional guaranty is contingent upon certain triggers or conditions. The guarantor is only obligated to make payment if the specified conditions are met, such as the borrower's bankruptcy or insolvency. 3. Limited Guaranty: In a limited guaranty, the guarantor agrees to be responsible for a portion of the outstanding debt rather than the entire amount. This could be a fixed sum or a percentage of the total loan. 4. Continuing Guaranty: Also known as an open-ended guaranty, a continuing guaranty covers all present and future obligations of the borrower to the lender. It remains in effect until terminated or revoked by the guarantor. 5. Joint and Several guaranties: In this type of guaranty, multiple guarantors are held individually and collectively liable for the borrower's debt. The lender can thus pursue any single guarantor for the full amount owed. It is important to note that the specific terms and conditions of the North Carolina Guaranty of Collection of Promissory Note may vary depending on the parties involved, the nature of the loan, and the lender's preferences. It is always recommended seeking legal advice and ensure compliance with North Carolina state laws to accurately draft and execute this agreement.The North Carolina Guaranty of Collection of Promissory Note is a legally binding agreement that serves as a guarantee or assurance for the collection of a promissory note. It ensures that in the event of default or non-payment by the borrower, the guarantor will step in and fulfill the obligations outlined in the promissory note. This type of agreement is commonly used in North Carolina to protect lenders and ensure the repayment of loans. The Guaranty of Collection is a crucial tool for lenders, as it provides an added layer of security and decreases the risk associated with lending money. There are certain variations or types of the North Carolina Guaranty of Collection of Promissory Note that can be customized based on specific requirements. Some common types include: 1. Unconditional Guaranty: This type of guaranty imposes an absolute obligation on the guarantor to pay the lender in the event of default by the borrower. It is the most comprehensive form of guaranty. 2. Conditional Guaranty: Unlike an unconditional guaranty, a conditional guaranty is contingent upon certain triggers or conditions. The guarantor is only obligated to make payment if the specified conditions are met, such as the borrower's bankruptcy or insolvency. 3. Limited Guaranty: In a limited guaranty, the guarantor agrees to be responsible for a portion of the outstanding debt rather than the entire amount. This could be a fixed sum or a percentage of the total loan. 4. Continuing Guaranty: Also known as an open-ended guaranty, a continuing guaranty covers all present and future obligations of the borrower to the lender. It remains in effect until terminated or revoked by the guarantor. 5. Joint and Several guaranties: In this type of guaranty, multiple guarantors are held individually and collectively liable for the borrower's debt. The lender can thus pursue any single guarantor for the full amount owed. It is important to note that the specific terms and conditions of the North Carolina Guaranty of Collection of Promissory Note may vary depending on the parties involved, the nature of the loan, and the lender's preferences. It is always recommended seeking legal advice and ensure compliance with North Carolina state laws to accurately draft and execute this agreement.

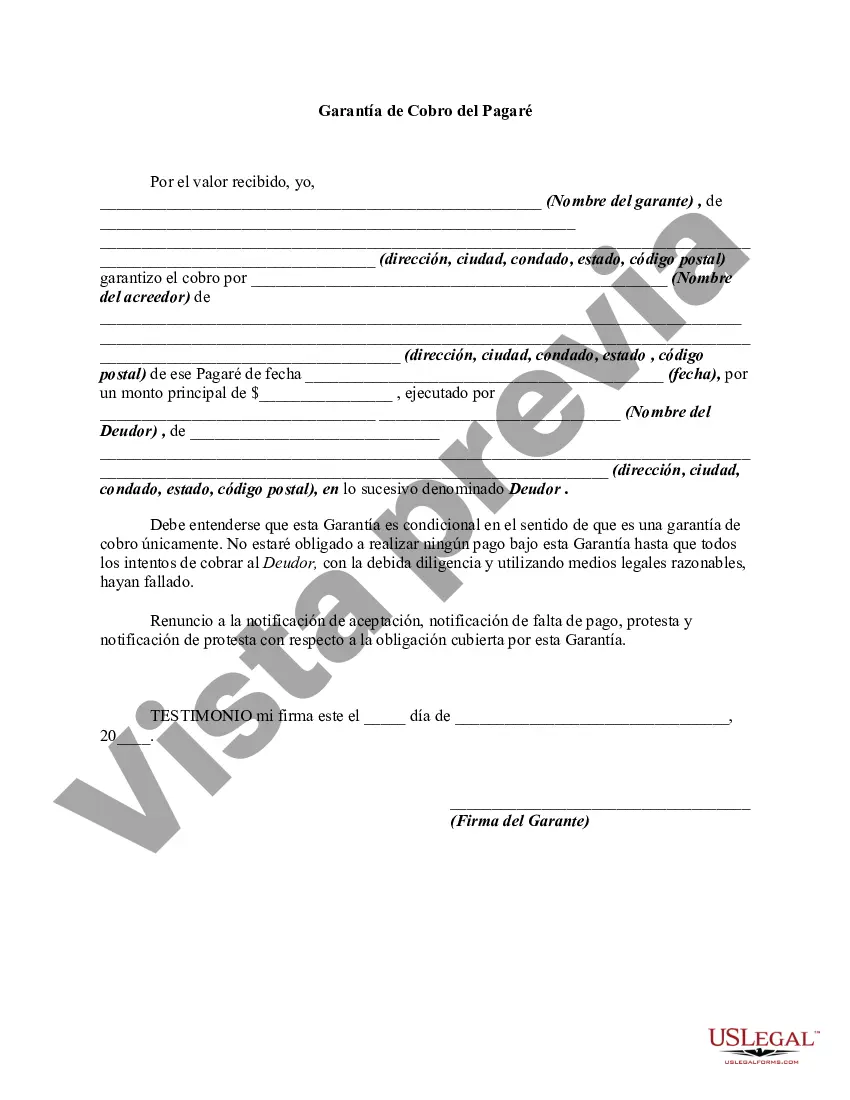

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.