In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

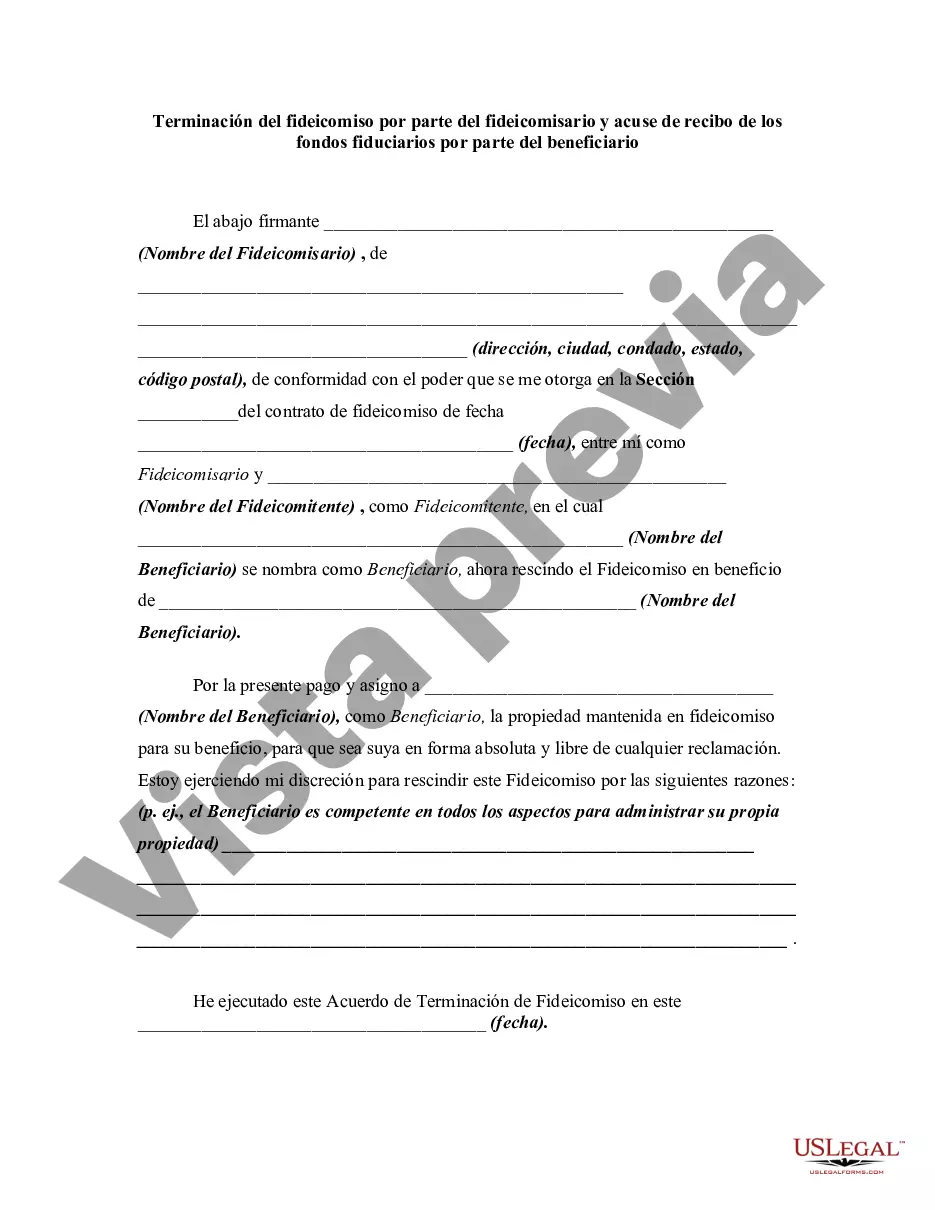

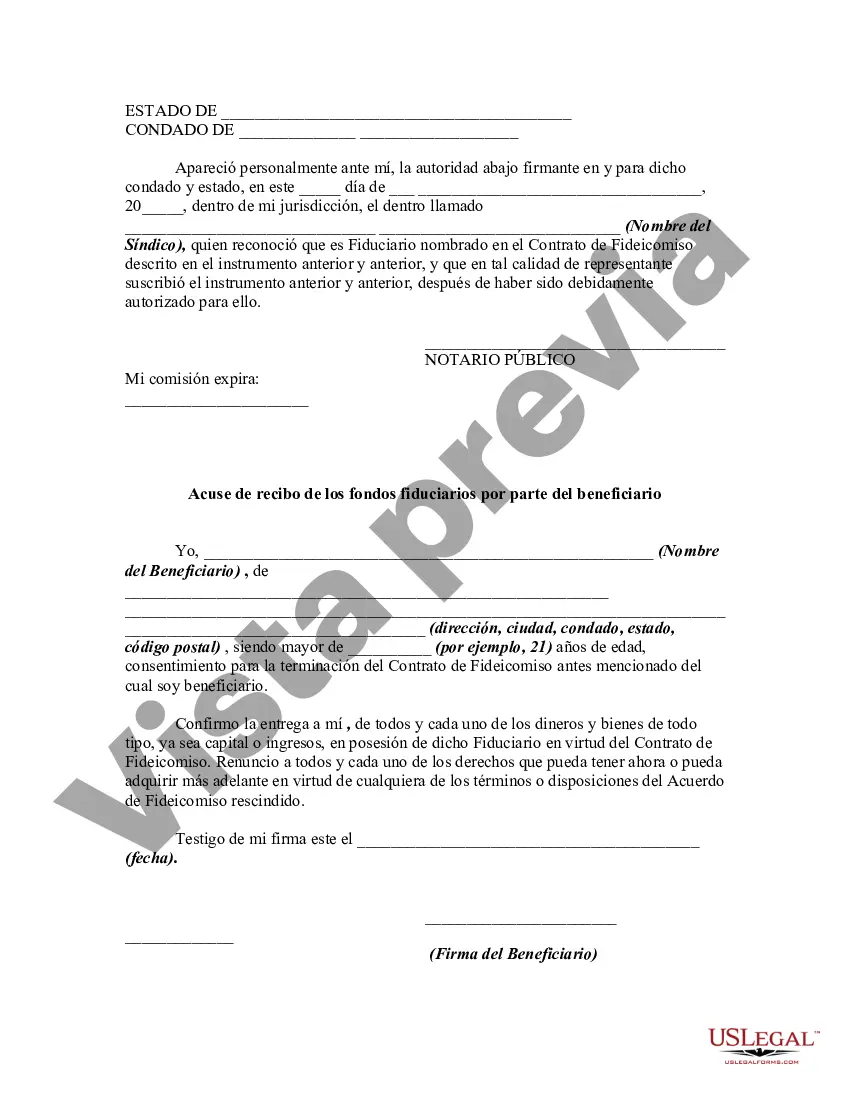

North Carolina Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary In North Carolina, the Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary refers to the legal process by which a trustee formally concludes a trust and distributes the trust assets to the designated beneficiary. This termination process typically occurs upon reaching the trust's specified end date, achievement of the trust's purpose, or fulfillment of the conditions stated in the trust agreement. There are several types of Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary in North Carolina, including but not limited to: 1. Irrevocable Trust Termination: This type of termination occurs when an irrevocable trust, which cannot be altered or revoked by the settler (trust creator) after its creation, reaches its predetermined end date, or when the trust's purpose has been fulfilled. In such cases, the trustee must distribute the trust assets to the beneficiary and obtain an official acknowledgment of receipt from them. 2. Revocable Trust Termination: Unlike irrevocable trusts, revocable trusts can be modified or revoked by the settler during their lifetime. When a revocable trust is terminated, the trustee follows the instructions provided by the settler and distributes the trust assets accordingly. Similar to an irrevocable trust termination, an acknowledgment of receipt is obtained from the beneficiary. 3. Charitable Trust Termination: Charitable trusts are established for charitable purposes and often entail specific conditions for termination, such as the achievement of a particular goal or the occurrence of a specified event. When the trustee determines that the trust's objective has been met or can no longer be fulfilled, they initiate the termination process, distribute the remaining assets to the designated charitable organization, and obtain an acknowledgment from the beneficiary, which in this case, might be the charitable organization itself. 4. Testamentary Trust Termination: A testamentary trust arises from a will and takes effect upon the death of the testator. Once the trust's purpose has been fulfilled or the specified conditions have been met, the trustee terminates the trust, disburses the trust assets to the beneficiaries, and acquires acknowledgment of receipt. Regardless of the type of trust termination, the trustee must fulfill their fiduciary duty, acting in the best interest of the beneficiaries, and adhere to North Carolina trust laws and regulations. The acknowledgment of receipt serves as evidence that the beneficiary (or beneficiaries) has received the trust funds and releases the trustee from further liabilities concerning the trust. It is crucial to consult an experienced attorney or legal professional specializing in trusts and estates in North Carolina to ensure compliance with all necessary legal procedures and to accurately draft the Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary documents specific to the type of trust being terminated.North Carolina Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary In North Carolina, the Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary refers to the legal process by which a trustee formally concludes a trust and distributes the trust assets to the designated beneficiary. This termination process typically occurs upon reaching the trust's specified end date, achievement of the trust's purpose, or fulfillment of the conditions stated in the trust agreement. There are several types of Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary in North Carolina, including but not limited to: 1. Irrevocable Trust Termination: This type of termination occurs when an irrevocable trust, which cannot be altered or revoked by the settler (trust creator) after its creation, reaches its predetermined end date, or when the trust's purpose has been fulfilled. In such cases, the trustee must distribute the trust assets to the beneficiary and obtain an official acknowledgment of receipt from them. 2. Revocable Trust Termination: Unlike irrevocable trusts, revocable trusts can be modified or revoked by the settler during their lifetime. When a revocable trust is terminated, the trustee follows the instructions provided by the settler and distributes the trust assets accordingly. Similar to an irrevocable trust termination, an acknowledgment of receipt is obtained from the beneficiary. 3. Charitable Trust Termination: Charitable trusts are established for charitable purposes and often entail specific conditions for termination, such as the achievement of a particular goal or the occurrence of a specified event. When the trustee determines that the trust's objective has been met or can no longer be fulfilled, they initiate the termination process, distribute the remaining assets to the designated charitable organization, and obtain an acknowledgment from the beneficiary, which in this case, might be the charitable organization itself. 4. Testamentary Trust Termination: A testamentary trust arises from a will and takes effect upon the death of the testator. Once the trust's purpose has been fulfilled or the specified conditions have been met, the trustee terminates the trust, disburses the trust assets to the beneficiaries, and acquires acknowledgment of receipt. Regardless of the type of trust termination, the trustee must fulfill their fiduciary duty, acting in the best interest of the beneficiaries, and adhere to North Carolina trust laws and regulations. The acknowledgment of receipt serves as evidence that the beneficiary (or beneficiaries) has received the trust funds and releases the trustee from further liabilities concerning the trust. It is crucial to consult an experienced attorney or legal professional specializing in trusts and estates in North Carolina to ensure compliance with all necessary legal procedures and to accurately draft the Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary documents specific to the type of trust being terminated.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.