North Carolina Sample Letter for Erroneous Information on Credit Report

Description

How to fill out Sample Letter For Erroneous Information On Credit Report?

Finding the correct legitimate document template can be quite a challenge.

Certainly, there are numerous templates available online, but how can you acquire the valid form you desire.

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the North Carolina Sample Letter for Incorrect Information on Credit Report, that can be utilized for business and personal purposes.

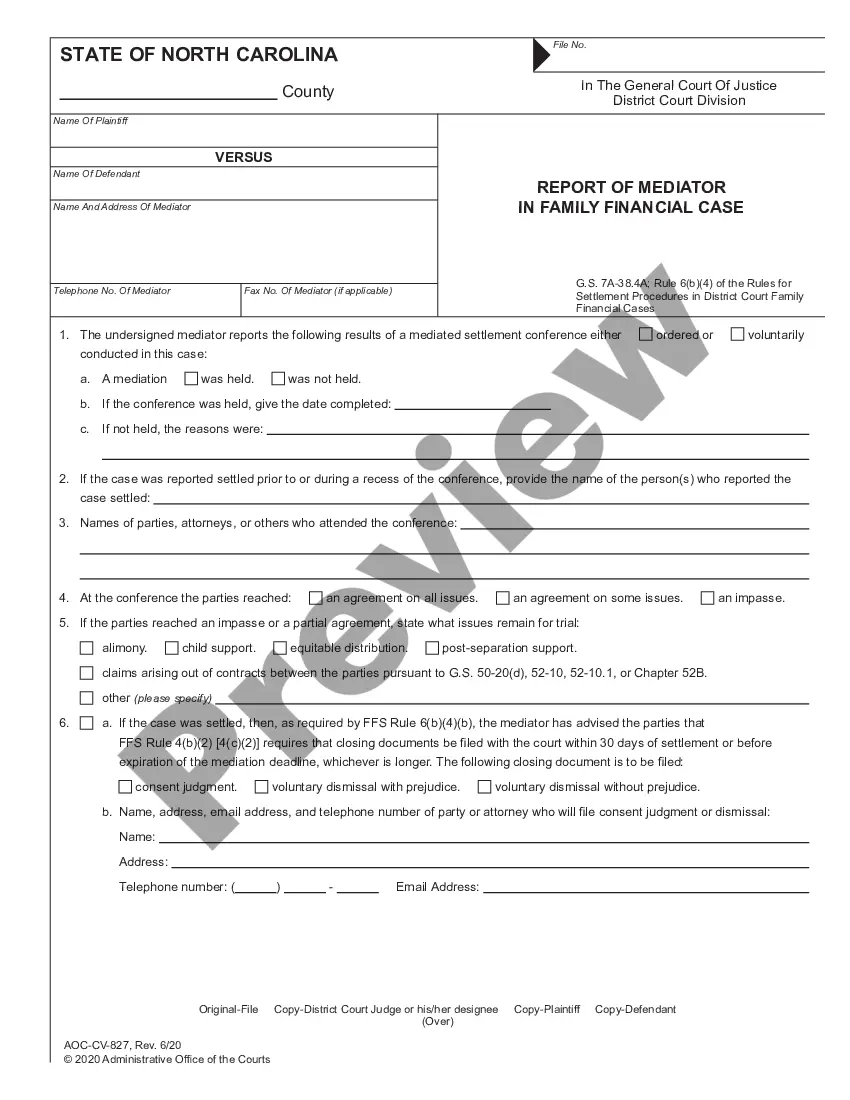

First, ensure you have selected the correct form for your city/region. You can preview the form using the Review button and read the form description to confirm this is suitable for you.

- All the forms are reviewed by experts and comply with federal and state regulations.

- If you are currently a member, Log In to your account and click the Acquire button to get the North Carolina Sample Letter for Incorrect Information on Credit Report.

- Use your account to browse the legal templates you've previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

To remove an incorrect collection from your credit report, begin by identifying the collection agency associated with the item. Dispute the collection by sending them a North Carolina Sample Letter for Erroneous Information on Credit Report, along with any proof that supports your claim. It is crucial to follow up on your dispute and ensure the collection agency responds appropriately. Keeping detailed records of your communications will support your case.

A 609 letter is a type of correspondence you can use to request validation of debt from creditors. You can draft this letter by stating your rights under the Fair Credit Reporting Act. Utilize a North Carolina Sample Letter for Erroneous Information on Credit Report to ensure you maintain a formal tone and include necessary details. This method can help you seek clarification on accounts listed on your credit report.

To remove incorrect information from your credit report, you should start by reviewing your report for inaccuracies. Gather supporting documentation and then write a North Carolina Sample Letter for Erroneous Information on Credit Report to dispute the errors. Send this letter to the credit bureau along with your evidence for a prompt investigation. Monitor your report to ensure the errors are corrected.

The 609 letter can be an effective tool in disputing inaccuracies on your credit report, as it invokes your rights under the Fair Credit Reporting Act. However, the success of this letter hinges on the accuracy of the information you provide. To enhance your dispute, you may want to consider the North Carolina Sample Letter for Erroneous Information on Credit Report, as it offers a more direct approach to addressing and rectifying errors found in your report. Utilizing the right resources can greatly improve your chances of a favorable outcome.

If you find false information on your credit report, act swiftly to dispute it. Begin by collecting any evidence that supports your claim and then contact the credit reporting agency. Using the North Carolina Sample Letter for Erroneous Information on Credit Report will help you craft a clear and persuasive dispute. This letter not only outlines the inaccuracies but also emphasizes your rights to correct your credit report.

To correct a mistake on your credit report, start by reviewing your credit report thoroughly. Identify the inaccuracies and gather supporting documents that prove the errors. You can then submit a dispute to the credit reporting agency, using the North Carolina Sample Letter for Erroneous Information on Credit Report to outline your case effectively. This letter streamlines the process and ensures the agency addresses your concerns promptly.

An example of a consumer statement may include a brief explanation of why you believe a specific entry in your credit report is inaccurate. This statement allows you to add your perspective to the report, which can benefit future creditors reviewing your file. When drafting such a statement, consider using a North Carolina Sample Letter for Erroneous Information on Credit Report to structure your thoughts clearly and effectively.

A 623 letter refers to a correspondence sent to a creditor under Section 623 of the Fair Credit Reporting Act. It allows consumers to dispute any erroneous information reported by creditors to credit agencies. This letter is essential for consumers seeking to clarify discrepancies, and a North Carolina Sample Letter for Erroneous Information on Credit Report provides a solid framework for creating your own.

A 623 letter example typically includes a request for verification of information that appears on your credit report. This letter should reference the Fair Credit Reporting Act, allowing you to seek clarification on any disputed debts. Using a North Carolina Sample Letter for Erroneous Information on Credit Report can assist you in crafting a clear and professional inquiry.

To remove erroneous information from your credit report, start by identifying the inaccuracies you want to dispute. Write a dispute letter following the guidelines of a North Carolina Sample Letter for Erroneous Information on Credit Report, detailing the errors and including supporting documents. Submit this letter to the credit reporting agency and monitor your credit report for corrections.