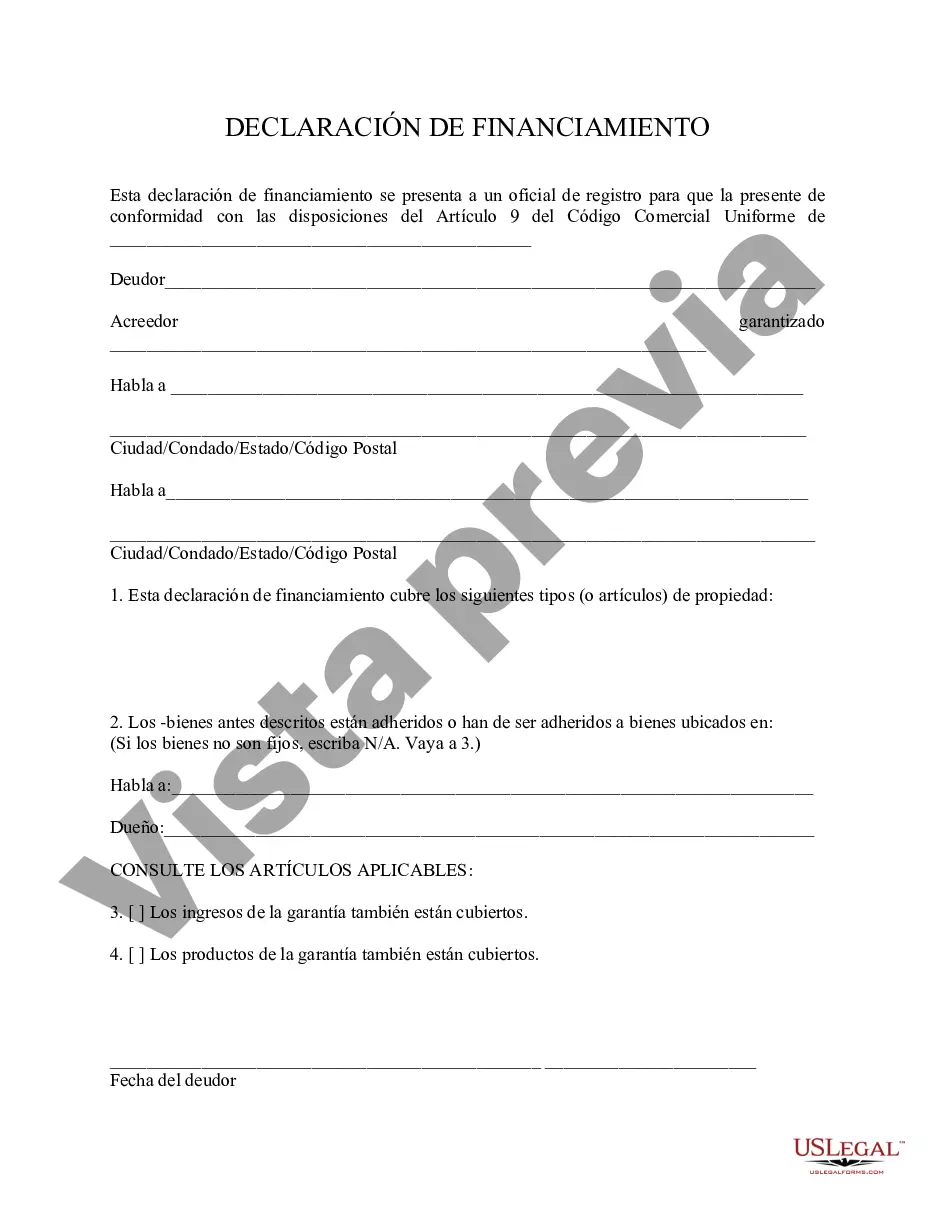

A North Carolina Financing Statement is an official document filed with the North Carolina Secretary of State's office that provides notice to the public that a secured party has a security interest in specific collateral owned by a debtor. This statement is a crucial part of the Uniform Commercial Code (UCC) system, which governs commercial transactions in the United States. The North Carolina Financing Statement serves as a public record, allowing third parties to determine the rights and priorities of secured parties in relation to specific collateral. It is an essential tool for lenders, creditors, and businesses engaged in secured transactions. Keywords: North Carolina Financing Statement, UCC system, secured party, security interest, collateral, third parties, lenders, creditors, businesses, secured transactions. Types of North Carolina Financing Statements: 1. Original Financing Statement: This is the initial filing made by a secured party to establish their security interest in a debtor's collateral. It typically includes necessary information such as the debtor's name and address, secured party's name and address, description of the collateral, and any additional information required by the Secretary of State. 2. Amendment Financing Statement: An amendment financing statement is filed to modify or correct information on a previously filed financing statement. This could include changes to the debtor's name or address, the secured party's information, or alterations to the description of collateral. 3. Continuation Financing Statement: A continuation financing statement is filed to extend the effectiveness of the original financing statement beyond its expiration date. In North Carolina, a financing statement is generally effective for five years from the date of filing. By filing a continuation statement before the expiration, the secured party ensures that their security interest remains in force. 4. Termination Financing Statement: Upon the satisfaction or termination of a secured debt, the secured party files a termination financing statement to formally release their security interest in the collateral. This serves as public notice that the debtor is no longer obligated to the secured party. Keywords: Original Financing Statement, Amendment Financing Statement, Continuation Financing Statement, Termination Financing Statement, debtor, secured party, collateral, Secretary of State, filing, UCC system. Understanding the North Carolina Financing Statement and its various types is essential for lenders, creditors, and businesses engaged in secured transactions within the state. By ensuring accurate and timely filings, parties can protect their interests and avoid potential conflicts or disputes related to their security interests in collateral.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Carolina Declaración de Financiamiento - Financing Statement

Description

How to fill out North Carolina Declaración De Financiamiento?

Are you currently in the position in which you require papers for sometimes company or individual functions virtually every time? There are tons of lawful file web templates available on the Internet, but finding types you can depend on isn`t effortless. US Legal Forms delivers a large number of develop web templates, just like the North Carolina Financing Statement, which are composed to fulfill federal and state demands.

In case you are currently knowledgeable about US Legal Forms internet site and also have your account, simply log in. Afterward, it is possible to acquire the North Carolina Financing Statement template.

Unless you provide an profile and want to begin to use US Legal Forms, follow these steps:

- Discover the develop you will need and make sure it is for your appropriate area/state.

- Make use of the Review key to review the form.

- See the explanation to actually have selected the proper develop.

- When the develop isn`t what you are seeking, take advantage of the Research industry to get the develop that suits you and demands.

- Once you discover the appropriate develop, click on Buy now.

- Pick the prices prepare you desire, fill in the specified info to create your money, and purchase the order utilizing your PayPal or charge card.

- Select a practical file structure and acquire your backup.

Discover all of the file web templates you might have purchased in the My Forms menus. You can get a additional backup of North Carolina Financing Statement whenever, if needed. Just click on the essential develop to acquire or produce the file template.

Use US Legal Forms, the most substantial selection of lawful varieties, to conserve time as well as avoid blunders. The service delivers appropriately created lawful file web templates which you can use for a variety of functions. Make your account on US Legal Forms and initiate generating your daily life easier.