North Carolina Pledge of Shares of Stock

Description

How to fill out Pledge Of Shares Of Stock?

If you wish to fulfill, obtain, or print legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the website's straightforward and effective search tool to locate the documents you require.

A range of templates for business and individual purposes are categorized by type and state, or keywords.

Step 4. After finding the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the North Carolina Pledge of Shares of Stock with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to acquire the North Carolina Pledge of Shares of Stock.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct region/state.

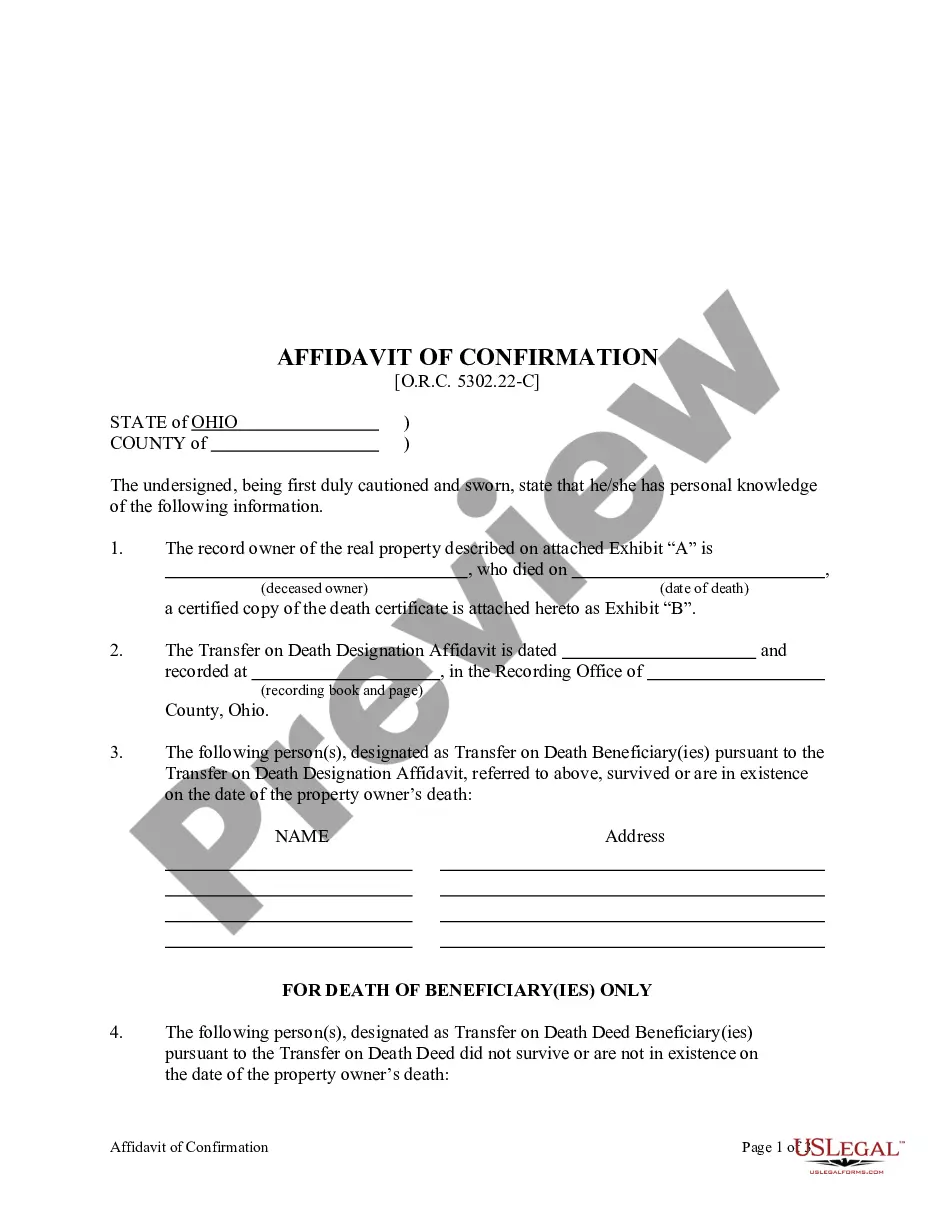

- Step 2. Use the Preview option to view the form's content. Be sure to check the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

If you do not pledge your shares, you retain complete ownership and the freedom to manage your investments without any limitations. However, you may lose opportunities to leverage your stocks for loans or credit. Evaluating whether a pledge is right for you can lead to more informed financial decisions.

To pledge your shares, you will typically need to provide ownership documentation and complete specific forms required by your brokerage. These documents should outline the details of the North Carolina Pledge of Shares of Stock transaction. Utilizing uslegalforms can help ensure that all required paperwork is correctly prepared and submitted.

The duration for which you can keep your shares pledged depends on the terms set by your financial institution. Generally, you can maintain your pledge as long as necessary, but you should regularly review the agreement to ensure it meets your needs. The North Carolina Pledge of Shares of Stock provides flexibility, allowing you to release your shares when conditions are favorable.

If you decide against pledging your shares in Angel One, you will have full control over your stock holdings. However, you may forgo certain financial advantages available through the North Carolina Pledge of Shares of Stock. It's wise to evaluate your current financial needs and the potential benefits of pledging.

While pledging shares is not mandatory, it can be beneficial for securing loans or obtaining better financing terms. The North Carolina Pledge of Shares of Stock allows you to leverage your investments without selling them. Consider your financial goals and consult with experts to determine if a pledge aligns with your strategy.

Yes, typically, you will still receive dividends for shares that are pledged. When you pledge your shares in a North Carolina Pledge of Shares of Stock, you maintain ownership rights. However, it’s important to read the terms set by your brokerage, as conditions can vary based on the agreement.

Pledging your shares involves submitting a request to your brokerage or financial institution to use your shares as collateral. You will need to fill out specific forms that detail the type and amount of shares being pledged. Many users find that platforms like uslegalforms can guide you through the North Carolina Pledge of Shares of Stock process, ensuring all your documents are in order.

The process for pledging shares usually starts with selecting the shares you want to pledge and drafting a pledge agreement. Once the agreement is signed, you may need to notify your stockbroker or the relevant authority. Familiarity with the North Carolina Pledge of Shares of Stock will facilitate this process significantly.

When you pledge your shares, you give the lender a claim on those shares if you cannot meet your repayment obligations. This arrangement can help you secure funding but also entails risks, as creditors can take ownership of your shares. Understanding the nuances of the North Carolina Pledge of Shares of Stock is crucial to making this decision.

Pledging shares online typically requires you to log into the financial institution's website and fill out a pledge agreement. Be prepared to provide details regarding the shares and your ownership. Platforms like US Legal Forms offer valuable resources to help you with the North Carolina Pledge of Shares of Stock.